The price of Bitcoin was trading in the red at the time of writing. The price action signaled that the buyers are exhausted and that the sellers could drag it lower in the short term. It was trading at 43,563 far above today's low of 42,625. In the short term, it could only test and retest the immediate upside obstacles before dropping again.

BTC/USD registered a 3.15% growth from 42,625 today's low to 43,969 daily high. In the last 24 hours, Bitcoin is down by 3.61% but it is up by 9.40% in the last 7 days.

BTC/USD further growth invalidated

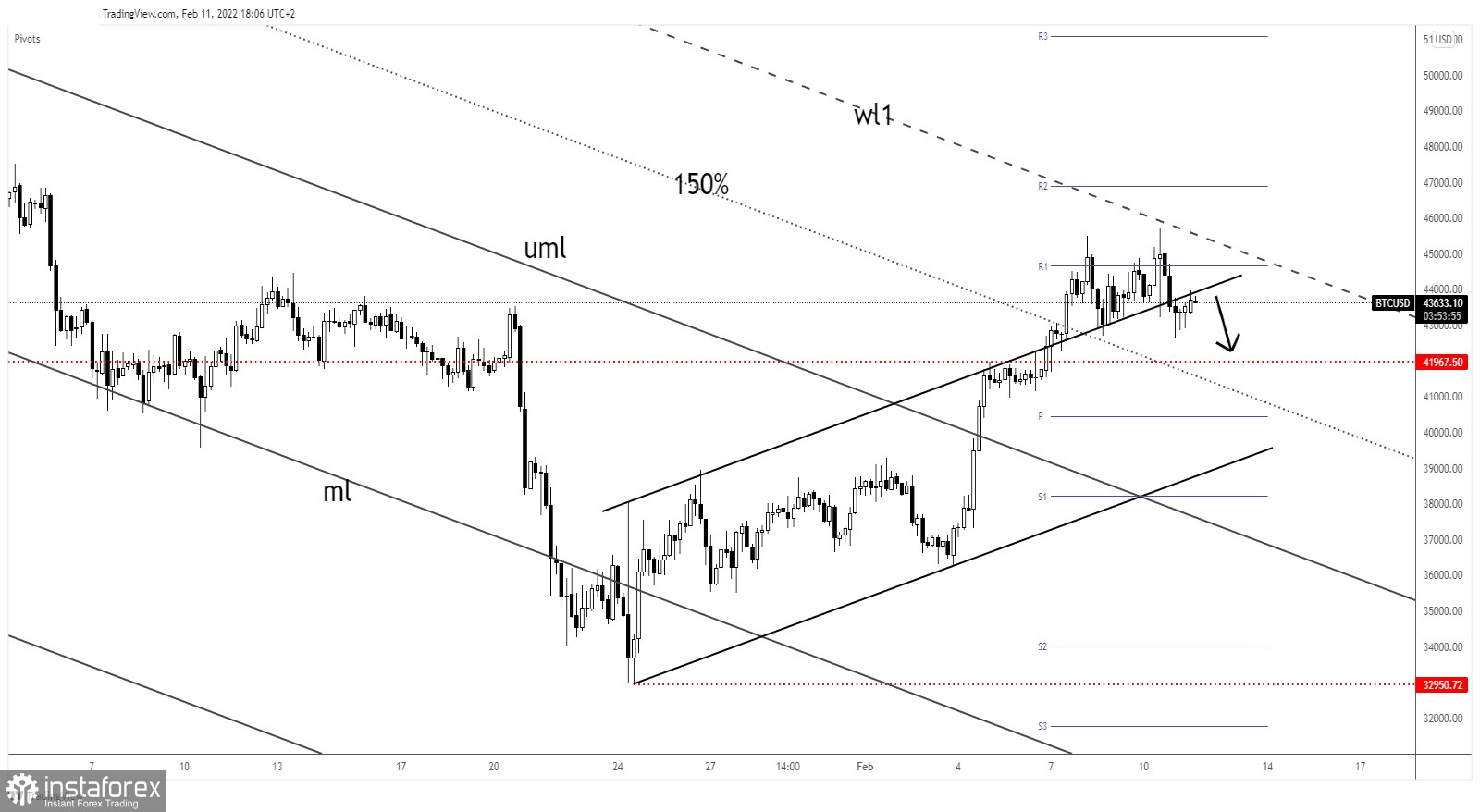

Technically, the pair retested the channel's upside line. As long as it stays below it, the rate could come back down. 43,000 psychological level stands as an immediate downside obstacle. As you can see on the H4 chart, the price found resistance at the first warning line (WL1) of the descending pitchfork.

Its false breakout above the weekly R1 (44,656.31) signaled that the buyers are exhausted. It could come back to test and retest the 41,967 downside obstacle and the 150% Fibonacci line.

BTC/USD outlook

In the short term, the bias is bearish after dropping below the up channel's upside line. After its massive growth, a temporary decline is natural. A temporary drop could bring new buying opportunities.

Moving sideways and making a valid breakout above the warning line (wl1) could activate an upside continuation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română