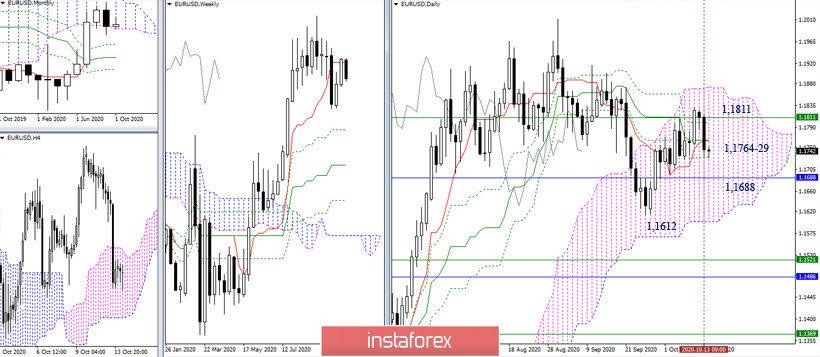

EUR / USD

The resistance of the weekly short-term trend (1.1811) still managed to block the way for the bulls, who are now pushed back to the supports of the daily cross (1.1764-29). In the current situation, it is important for the bears to form and fix a weekly pullback, while consolidating below the lower limit of the monthly cloud (1.1688). Further, it will be important to enter the bearish zone relative to the daily Ichimoku cloud and restore the downward trend (1.1612). In case of failures and inability to implement the set tasks, it will contribute to consolidation and new attempts by the opponent to get support from the weekly short-term (1.1811).

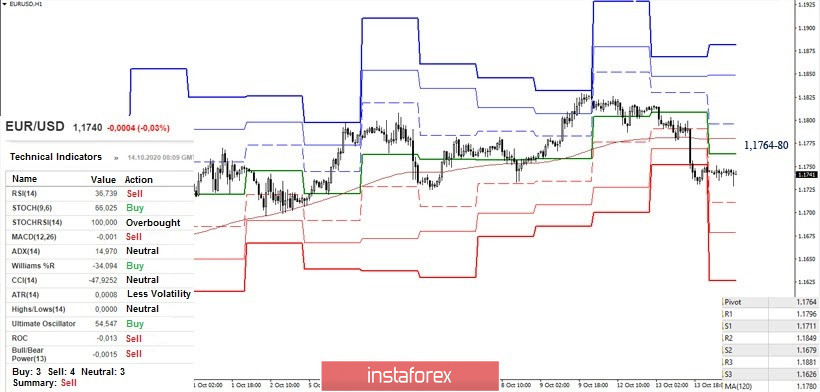

In the smaller time frames, the bears achieved a full advantage. The next downward targets within the day are the support levels of 1.1711 - 1.1679 - 1.1626. On the other hand, the key resistances are located at the level of 1.1764-80 (central pivot level + weekly long-term trend). In case of consolidation above, the bulls will balance out the current gains of the opponent and may consider testing opportunities again with the goal of breaking the weekly short-term (1.1811).

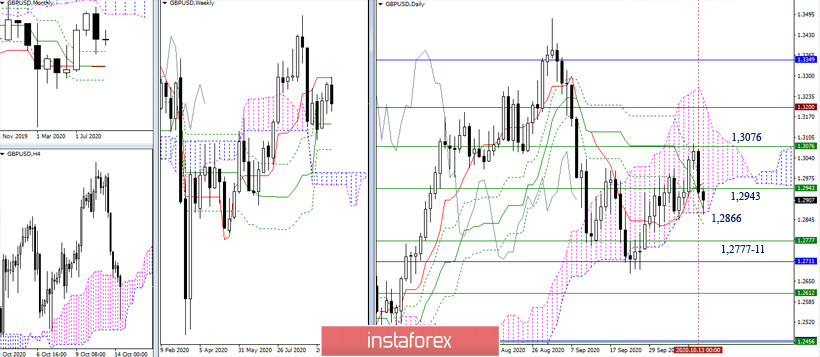

GBP / USD

Reaching the weekly short-term trend (1.3076) caused the daily rebound to be formed. The bears are now testing important limits – the final levels of the daily cross and the lower border of the daily cloud (1.2866). A reliable consolidation below will allow them to make further plans to strengthen their moods. Now, working in the daily cloud and returning support (daily cross + weekly Fibo Kijun 1.2943) will help the bulls to smoothen bearish successes, and then completely re-outline a new attack on the resistance of 1.3076 (weekly Tenkan).

At the moment, the advantage is on the bears' side, who are testing the strength of the first support level (1.2879), and continue further to the next levels located at 1.2827 (S2) and 1.2732 (S3). Today, the key levels of the smaller time frames are joining forces at 1.2974 (center pivot level + weekly long-term trend) and working below which will help maintain bearish plans.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română