Outlook on October 14:

Analytical overview of major pairs on the H1 TF:

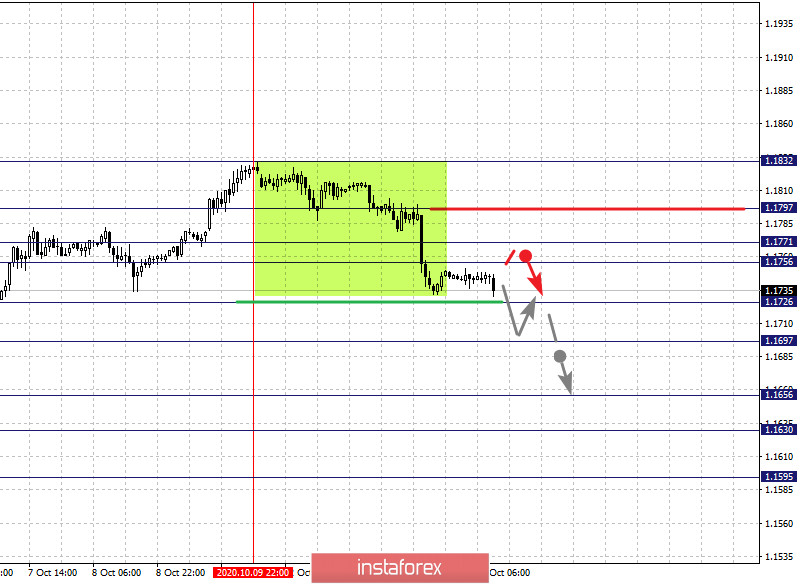

The key levels for the euro/dollar pair on the H1 chart are 1.1797, 1.1771, 1.1756, 1.1726, 1.1697, 1.1656, 1.1630 and 1.1595. The development of the upward trend was cancelled by the price and we are watching the downward pattern from October 9th. The decline is expected to continue after breaking through the level of 1.1726. In this case, the target is 1.1697 and price consolidation is near this level. If the target breaks down, it will lead to the development of a strong decline. In this case, the target is 1.1656, while price consolidation is in the range of 1.1656 - 1.1630. On the other hand, we consider the level of 1.1595 as a potential value for the downward trend. Upon reaching which, we expect an upward pullback.

A short-term growth as well as consolidation is expected in the range of 1.1756 - 1.1771. If the last value breaks down, it will lead to a deep correction. Here, the target is 1.1797, which is the key support for the downward structure.

The main trend is the descending structure from October 9

Trading recommendations:

Buy: 1.1756 Take profit: 1.1770

Buy: 1.1772 Take profit: 1.1796

Sell: 1.1724 Take profit: 1.1698

Sell: 1.1695 Take profit: 1.1658

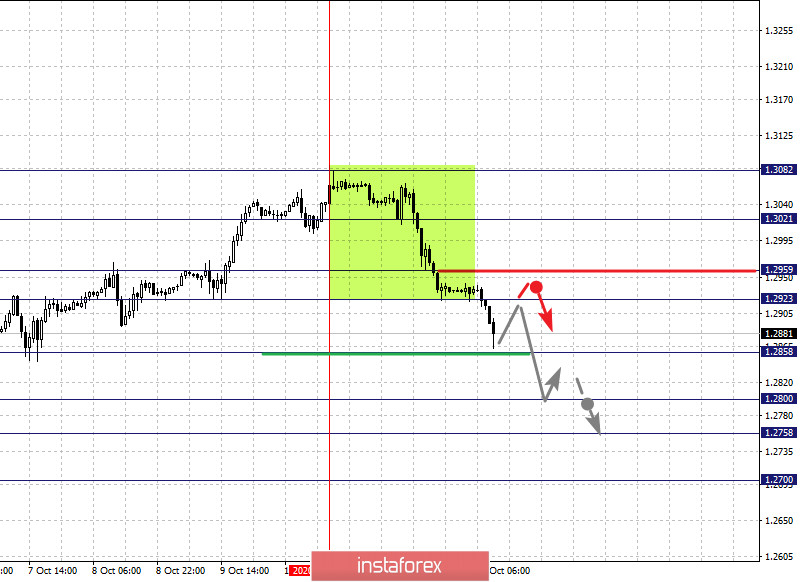

The key levels for the pound/dollar pair are 1.3021, 1.2959, 1.2923, 1.2858, 1.2800, 1.2758 and 1.2700. Here, we are following the formation of the downward trend structure from October 12th. The downward movement is expected to continue after breaking through the level of 1.2858. In this case, the target is 1.2800. On the other hand, there is a short-term decline as well as consolidation in the range of 1.2800 - 1.2758 . For the potential value for the bottom, we have the level of 1.2700. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 1.2923 - 1.2959. If the last value breaks down, it will lead to a deep correction. The potential target here is 1.3020, which is the key support for the downward structure.

The main trend is the formation of a descending structure from October 12

Trading recommendations:

Buy: 1.2923 Take profit: 1.2958

Buy: 1.2961 Take profit: 1.3020

Sell: 1.2856 Take profit: 1.2800

Sell: 1.2798 Take profit: 1.2760

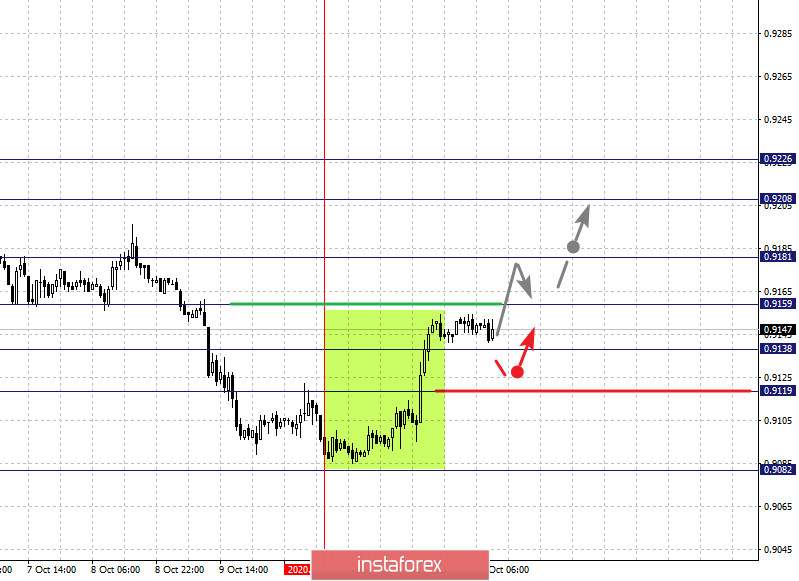

The key levels for the dollar/franc pair are 0.9226, 0.9208, 0.9181, 0.9159, 0.9138, 0.9119 and 0.9082. The upward potential from October 12 is being followed here. Now, the growth of the pair is expected after breaking through the level of 0.9159. In this case, the target is 0.9181. Price consolidation is near this level. If the target breaks down, it will lead to a strong rise. Here, the target is 0.9208. For the potential value for the top, we consider the level of 0.9226. Upon reaching which, we expect a downward pullback.

A short-term decline is possible in the range of 0.9138 - 0.9119, from which a key upward reversal is expected. Here, breaking through the last level will encourage the development of a downward structure. In this case, the potential target is 0.9082.

The main trend is the formation of potential for the top from October 12

Trading recommendations:

Buy : 0.9160 Take profit: 0.9180

Buy : 0.9182 Take profit: 0.9208

Sell: 0.9136 Take profit: 0.9120

Sell: 0.9115 Take profit: 0.9085

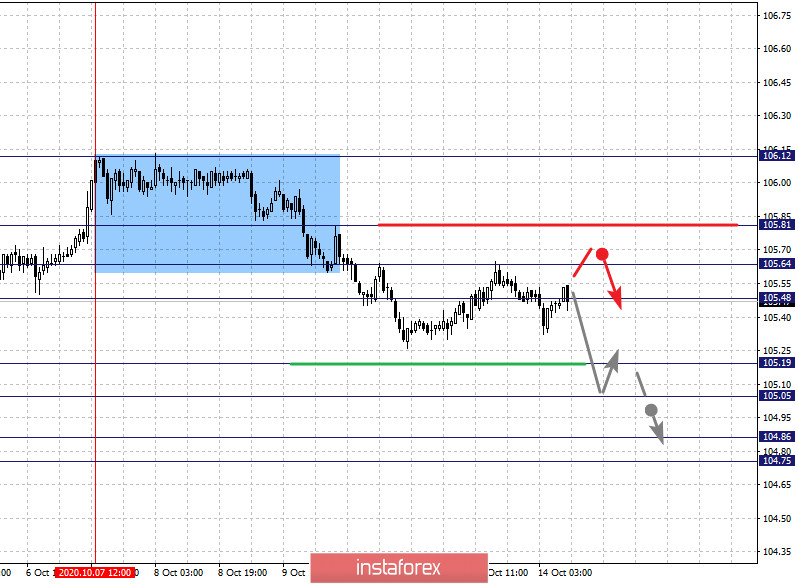

The key levels for the dollar/yen are 105.81, 105.64, 105.48, 105.19, 105.05, 104.86 and 104.75. The development of the top-down structure from October 7 is being followed here. A short-term decline is expected in the range of 105.19 - 105.05. If the last value breaks down, it will lead to a strong movement to the level of 104.86. For the potential value for the bottom, we consider the level 104.75. Upon reaching which, we expect consolidation and upward pullback.

A short-term growth is expected in the range of 105.48 - 105.64. Breaking through the last value will lead to a deep correction. The target here is 105.81, which is the key support for the downward structure.

The main trend is the descending structure from October 7

Trading recommendations:

Buy: 105.48 Take profit: 105.62

Buy : 105.65 Take profit: 105.80

Sell: 105.19 Take profit: 105.06

Sell: 105.03 Take profit: 104.87

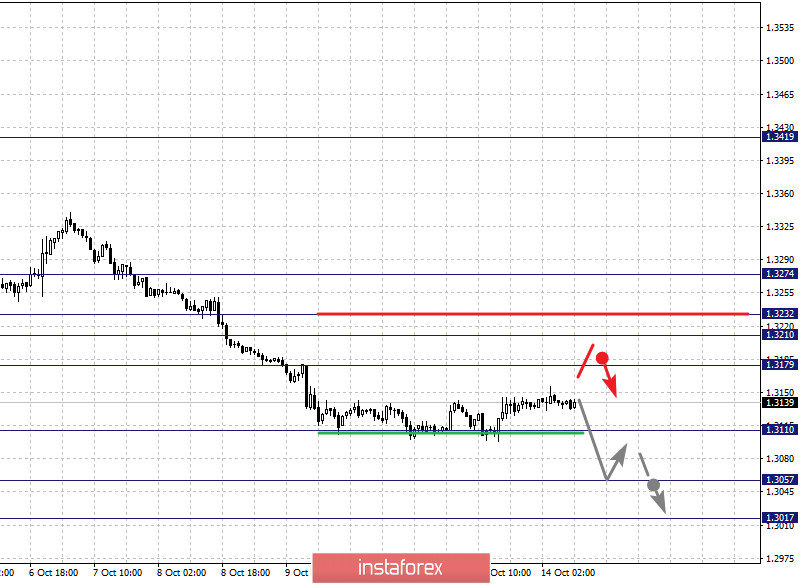

The key levels for the USD/CAD pair are 1.3274, 1.3232, 1.3210, 1.3179, 1.3110, 1.3057 and 1.3017. Here, we are following the development of the downtrend cycle from September 29. The decline is expected to continue after breaking through the level of 1.3110. In this case, the next target is 1.3057. For the potential value for the downward trend, we consider the level of 1.3017. Upon reaching which, consolidation and upward pullback are expected.

On the other hand, correction is expected to end after breaking through the level of 1.3180. The next target is 1.3210. On the other hand, the range of 1.3210 - 1.3232 is the key support for the downward structure and the price passing this level will lead to the formation of initial conditions for the upward cycle. In this case, the first target is 1.3274.

The main trend is the descending structure from September 29

Trading recommendations:

Buy: 1.3180 Take profit: 1.3210

Buy : 1.3233 Take profit: 1.3274

Sell: 1.3110 Take profit: 1.3060

Sell: 1.3055 Take profit: 1.3017

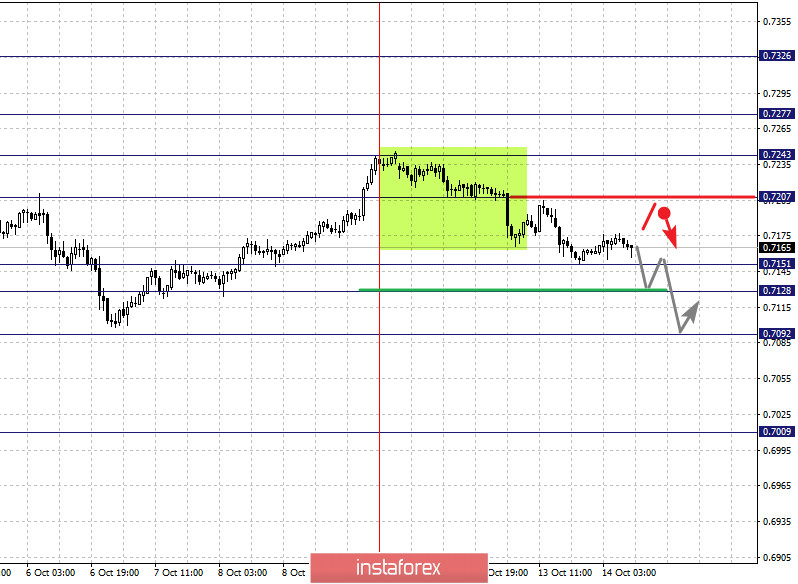

The key levels for the AUD/USD pair are 0.7326, 0.7277, 0.7243, 0.7207, 0.7151, 0.7128 and 0.7092. Now, we are following the upward structure from September 25. The growth of the pair is likely to continue after the breakdown of 0.7207. In this case, the first target is 0.7243. Meanwhile, a short-term growth is expected in the range of 0.7243 - 0.7277. For the potential value for the top, we consider the level of 0.7326. Upon reaching which, we expect a downward pullback.

The main support for the upward trend is the range of 0.7151 - 0.7128 and the price passing this level will encourage the formation of initial conditions for a downward cycle. Here, the first potential target is 0.7092.

The main trend is the upward structure from September 25, the correction stage

Trading recommendations:

Buy: 0.7208 Take profit: 0.7241

Buy: 0.7245 Take profit: 0.7275

Sell : 0.7151 Take profit : 0.7128

Sell: 0.7126 Take profit: 0.7092

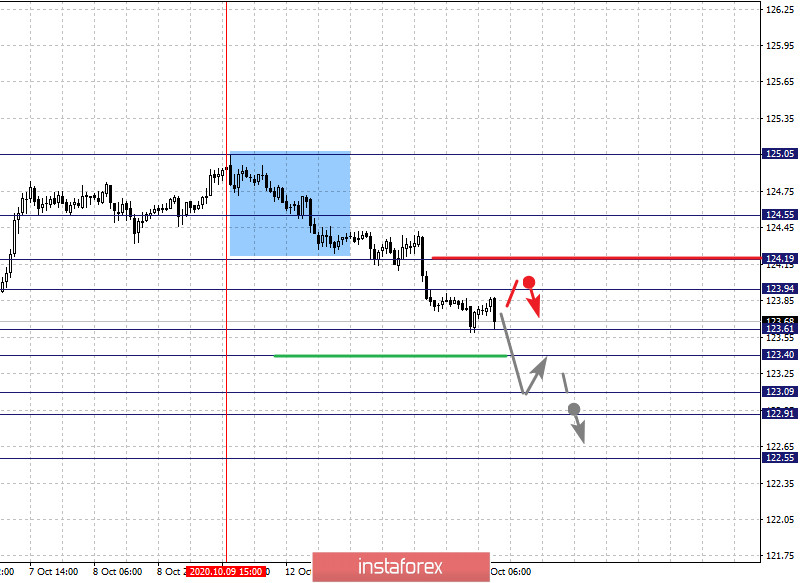

The key levels for the euro/yen pair are 124.55, 124.19, 123.94, 123.61, 123.40, 123.09, 122.91 and 122.55. Here, we are following the formation of the descending structure from October 9. Moreover, a short-term decline is expected in the range of 123.61 - 123.40. In case of breakdown of the last value, it will lead to a strong decline. Here, the target is 123.09 and there is consolidation in the range of 123.09 - 122.91. For the potential value for the bottom, we consider the level of 122.55. Upon reaching which, we expect an upward pullback.

A short-term growth is possible in the range of 123.94 - 124.19, If the last value breaks down, it will lead to a deep correction. The target here is 124.55, which is a key support for the downward structure on October 9.

The main trend is the descending structure from October 9

Trading recommendations:

Buy: 124.95 Take profit: 124.17

Buy: 124.22 Take profit: 124.55

Sell: 123.60 Take profit: 123.40

Sell: 123.38 Take profit: 123.10

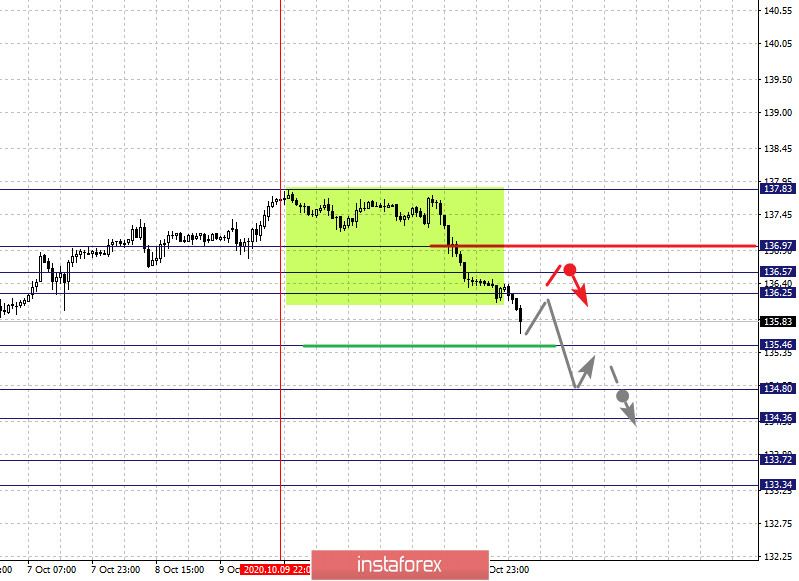

The key levels for the pound/yen pair are 137.83, 136.97, 136.57, 136.25, 135.46, 134.80, 134.36, 133.72 and 133.34. The formation of the descending structure from October 9 is being followed here. Now, the decline is expected to continue after breaking through the level of 135.46. In this case, the target is 134.80. On the other hand, there is short-term decline as well as consolidation in the range of 134.80 - 134.36. In case of breakdown of the last value, it will lead to a strong decline. Here, the target is 133.72. For the potential value for the bottom, we consider the level of 133.34. Upon reaching which, we expect consolidation and upward pullback.

A short-term growth is expected in the range of 136.25 - 136.57. If the last value breaks down, it will lead to a deep correction. Here, the target is 136.97, which is a key support for the bottom and its breakdown will encourage the formation of an upward structure. In this case, the potential target is 137.83.

The main trend is the formation of a descending structure from October 9

Trading recommendations:

Buy: 136.25 Take profit: 136.57

Buy: 136.58 Take profit: 136.95

Sell: 135.44 Take profit: 134.85

Sell: 134.80 Take profit: 134.40

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română