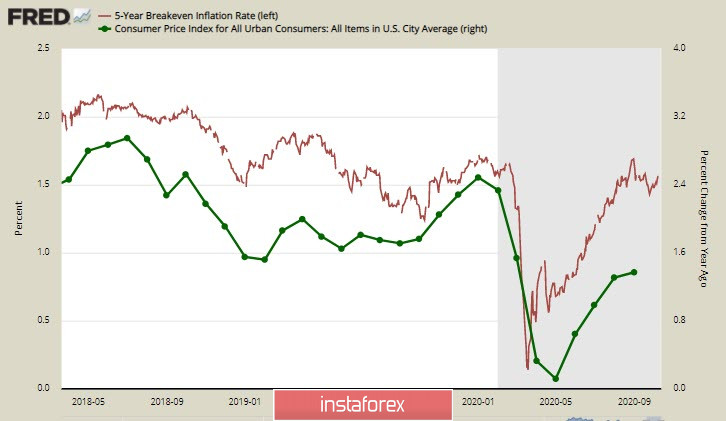

September's US inflation report was slightly worse than expected, which led to a high demand for defensive assets. Inflation rose from 1.3% to 1.4% y/y, which was in line with expectations, but the root value remained at 1.7% y/y, which indicates a slowdown in consumer demand growth.

The Johnson Redbook Index survey of retail trade as of October 9 also shows a slowdown in demand, with a monthly growth of 1.2% against 2.1% a month earlier.

Interestingly, the yield on TIPS' inflation-protected bonds has returned to a likely level, even though official inflation is significantly lower. This gap indicates the potential for rising inflation – businesses are waiting for consumer demand to grow and are focusing on a higher price level than what is officially reached at the moment.

Here, we can see that the dollar has good growth potential. Indices of economic optimism are growing, NFIB in September showed 104 against 100.2 a month earlier, which exceeded the forecast. Meanwhile, the IBD/TIPP index also rose by 55.2p in October against 45p in September.

However, it is difficult to say whether this growth will be recovered before the US elections, but there is no doubt that there is a significant potential. The dollar has a good starting position against most competitors, despite clear problems in the US economy.

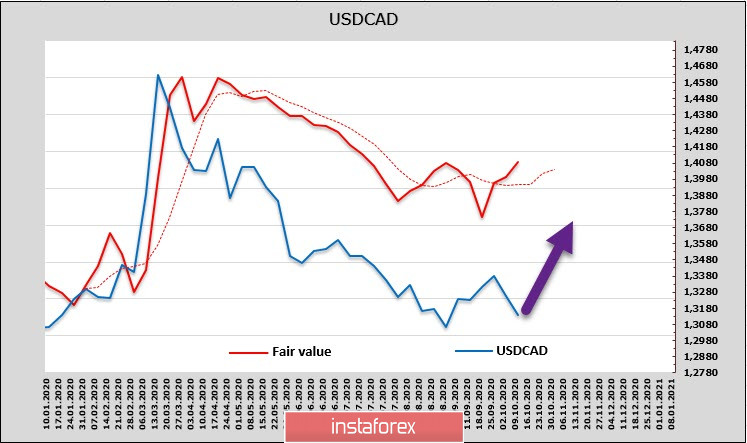

USD/CAD

The Canadian dollar strengthened last week due to an unexpectedly good labor market report, but this factor has already been recovered, and there are no new ones that can support the CAD so far. Canada has already recovered about 75% of the jobs lost in Q1, compared to 50% or slightly more in the US, which is a good indicator, but at the same time it indicates that this resource has already been used up and there is less room for employment growth.

An additional factor that contributed to this pair's decline should be considered the reaction to the change in the pre-election situation in the US, but this is a general factor that pushed up all risky assets for a while.

In turn, oil prices remain stable and nothing can take them out of range – neither storms, nor the threat of a consumption decline, based on the forecast of BP.

The growth of the Canadian currency is also due to the historically strong correlation with the US stock market. Among the major world currencies, this relationship is the strongest for the CAD. If US stock indexes rose at the end of the week, then in view of lack of agreement in Congress to expand the stimulus package, the US stock market declined again. Thus, the pressure on CAD may rise again.

Last week's net short position of CAD remained practically unchanged at -1.356 billion, but the estimated price goes up, which gives reason to expect the development of a bullish trend.

Today, ADP's private sector employment report will be published, but it is unlikely to affect the quotes so much. On the other hand, we expect the formation of the local bottom to be completed. Here, we consider buying from the current levels with the goal of updating the high of 1.3420. The nearest resistances are 1.3240/60 and 1.3340.

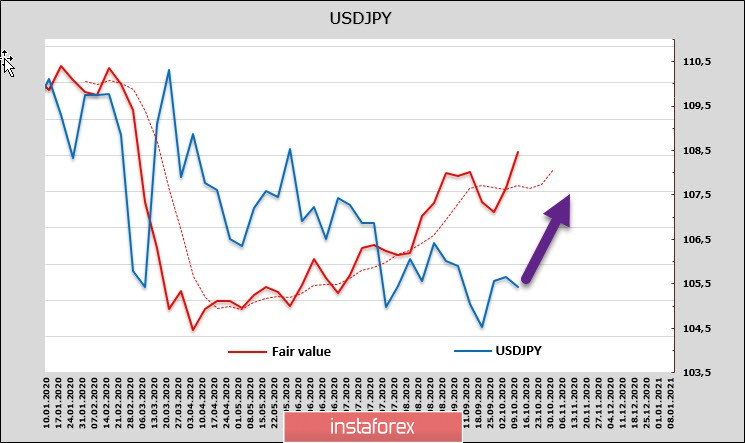

USD/JPY

Japan's economic recovery remains slow. August's engineering products orders rose by only 0.2%, and the annual decline was -15.2%. In turn, industrial production declined by -13.8% y/y, which is worse than July and indicates a clear recovery slowdown of the real sector.

Meanwhile, the net bullish advantage in the yen is still significant, amounting to 2.497 billion. However, the trend is clearly reversing, the weekly decline of 0.435 billion is almost a fifth of the total position, and the analysis of financial flows allows this pair to grow.

The low recovery rate directly affects the demand for raw materials, while the yen sales and dollar purchases by exporters remain relatively low, which hinders the growth of USD/JPY. Nevertheless, we expect growth to the resistance zone 106/90/107/10, a breakout of which will be logical and increase the chances of getting out of the range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română