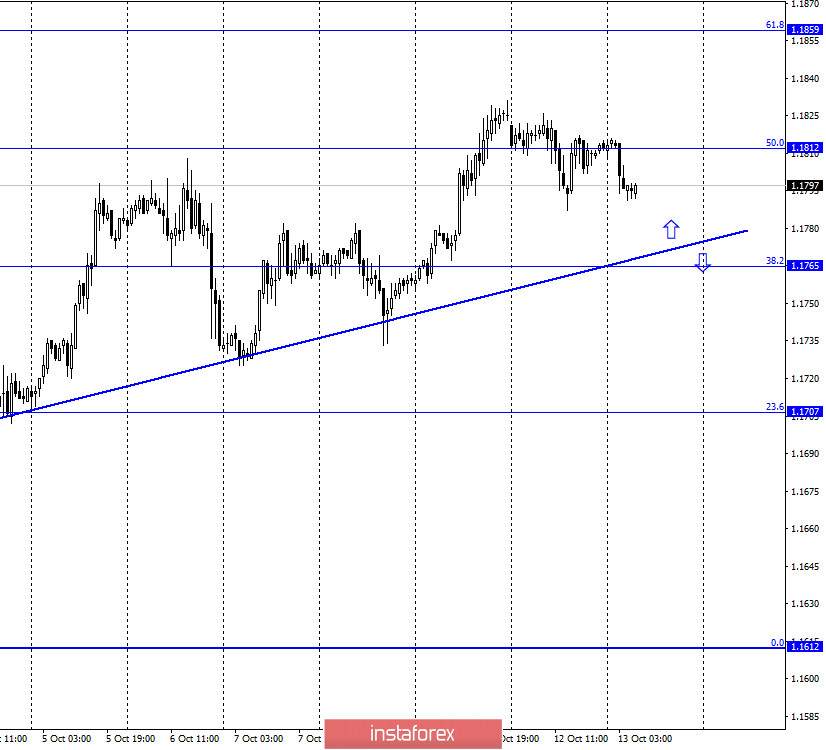

EUR/USD – 1H.

On October 12, the EUR/USD pair performed a reversal in favor of the US currency and began the process of falling in the direction of the corrective level of 8.2%3 (1.1765) and the upward trend line, which still retains the "bullish" mood of traders. Thus, the pair's rebound from this line will work in favor of the EU currency and resume the growth process in the direction of the corrective level of 61.8% (1.1859). The information background for the EUR/USD pair on Monday was rather poor. European Central Bank President Christine Lagarde made a speech, however, she did not address monetary policy or economic issues in her speech this time. Thus, her performance was not interesting for traders. However, from America, information that the Democrats and Republicans could not agree on a new package of assistance to the economy were again received. However, this time the Republicans' offer was already $ 1.8 trillion, which is not much less than the Democrats' offer of $ 2.2 trillion. The parties may still agree on this package before the presidential election, which could support the demand for the US dollar. Also, before the election, there will be two more rounds of debates between Donald Trump, whose ratings continue to fall according to several major TV companies and publications. Most likely, the second round, scheduled for October 15, will be canceled due to Trump's coronavirus illness. However, the third (October 22) should take place.

EUR/USD – 4H.

On a 4-hour chart, the graphic picture remains very boring. The pair's quotes have returned to the side corridor and continue to trade inside it. A rebound was made from the lower border of this corridor, as well as from the corrective level of 127.2% (1.1729), thus, the growth of the pair's quotes has a good chance of continuing in the direction of the upper line of the side corridor. The activity of traders has decreased in recent days.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed an increase to the corrective level of 261.8% (1.1825). The pair's rebound from this level will allow us to expect a reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 200.0% (1.1566). Closing above it will increase the chances of growth in the direction of the Fibo level of 323.6% (1.2084).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 12, in the European Union and America, the calendars of economic events were empty. Christine Lagarde's speech was "off-topic", thus, it did not affect the euro/dollar pair in any way.

News calendar for the United States and the European Union:

EU - ZEW business sentiment index (09:00 GMT).

US - consumer price index (12:30 GMT).

US - consumer price index excluding food and energy prices (12:30 GMT).

On October 13, the European Union is planning an index of business sentiment, and in the United States - inflation. The second indicator will be more important for traders.

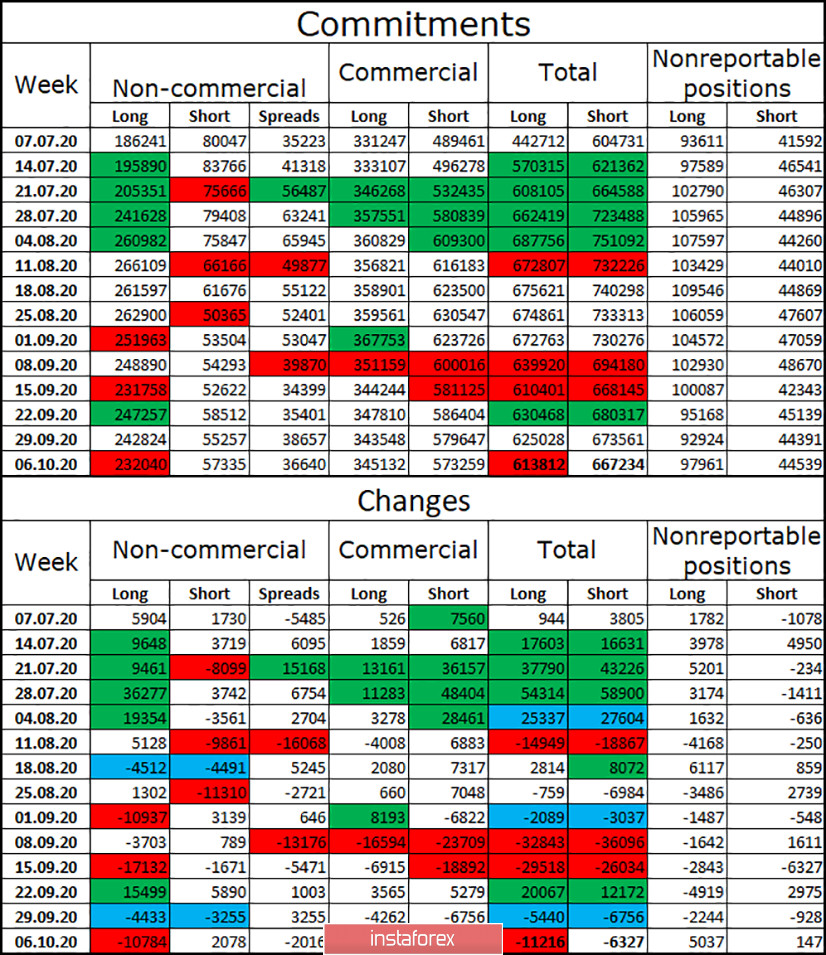

COT (Commitments of Traders) report:

The latest COT report was quite informative. The most significant and important category of "Non-commercial" traders continues to get rid of long contracts, closing almost 11 thousand during the reporting week. In addition, about 2 thousand short-contacts were opened, thus, the mood of major players in relation to the European currency has become much more "bearish". However, in general, I can't say that in recent months the major players have started to look in the direction of selling off the euro. Since the beginning of August, the total number of long contracts in the hands of speculators has been decreasing, however, the total number of short contracts is also decreasing. In total, in the hands of Non-commercial, there are four times more long-contracts than short contracts. Thus, I would say that the chances of the continued growth of the European currency are still high.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1707, if the close is made under the trend line on the hourly chart. Buying the pair today is advisable with a target of 1.1859 if a new rebound from the trend line is made.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română