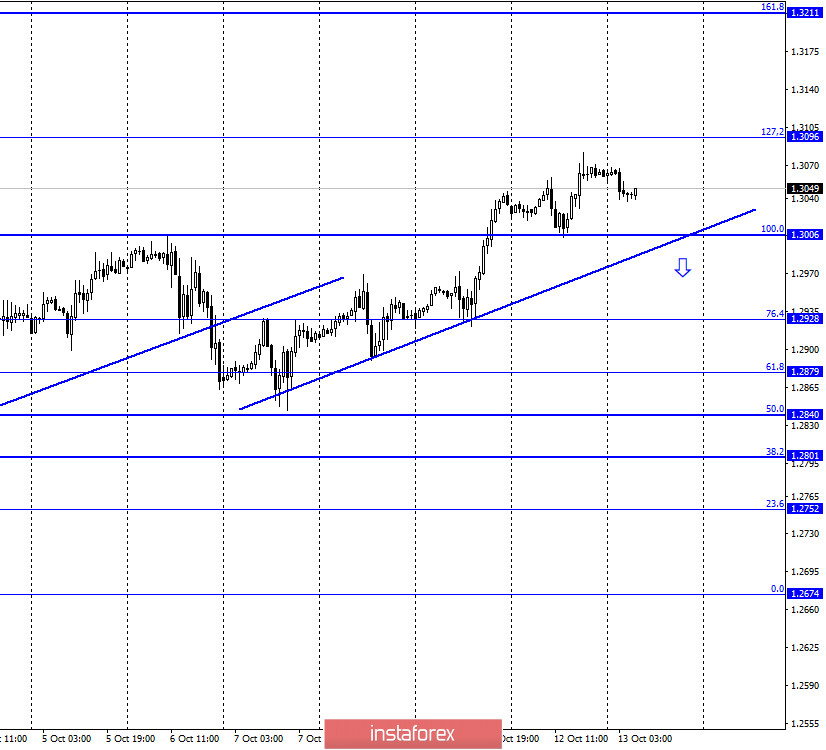

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair quotes resumed the growth process in the direction of the corrective level of 127.2% (1.3096), having consolidated above the corrective level of 100.0% (1.3006). Thus, the mood of traders is still characterized as "bullish". Despite the fact that the British pound continues to show growth in recent days and even weeks, no one will argue with the fact that for this currency, the number one topic remains Brexit and the relationship between the UK and the EU after Brexit. It is also unlikely that anyone will argue with the judgment that so far the parties can not agree on a trade deal and the chances that they will reach an agreement in the next month are extremely small. However, there are many chances that relations between them will be damaged because of the bill "on the internal market of Great Britain", which may come into force if a free trade agreement can not be reached. So personally, it is quite surprising to see that the pound continues to show growth. There may be several explanations for this. First, traders continue to believe in success in the negotiations between Brussels and London (although there are no signals about this). Second, traders do not want to believe the rumors and pay attention to them. When it is known for sure that the negotiations have finally failed, then new sales of the British will follow. And until that time, traders are more interested in elections in the United States. Thanks to this, it is the US dollar that continues to fall.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation above the Fibo level of 38.2% (1.3010), which allows traders to expect continued growth in the direction of the next corrective level of 23.6% (1.3191). The rising trend line on the hourly chart is also important. In general, the pair took a big step to break out of the range between the levels of 1.2720 and 1.3010, in which it was trading for quite a long time.

GBP/USD – Daily.

On the daily chart, the pair's quotes have consolidated above the corrective level of 76.4% (1.3016), which now allows us to expect continued growth in the direction of the next corrective level of 100.0% (1.3513).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

Bank of England Governor Andrew Bailey gave a speech in the UK on Monday, saying that letters were sent to British banks asking if they were ready to work with zero rates and negative rates. Thus, the Central Bank of England continues to prepare its banking and financial systems for another easing of monetary policy. At the very least, confidence is growing that the Central Bank will lower the rate again in the coming months.

The economic calendar for the US and the UK:

US - consumer price index (12:30 GMT).

US - consumer price index excluding food and energy prices (12:30 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (14:00 GMT).

On October 13, the US calendar contains inflation reports for September, and in the UK there will be another speech by the Governor of the Bank of England, Andrew Bailey. By the way, traders also do not react to his speeches, as well as to Brexit and negotiations between the EU and Britain.

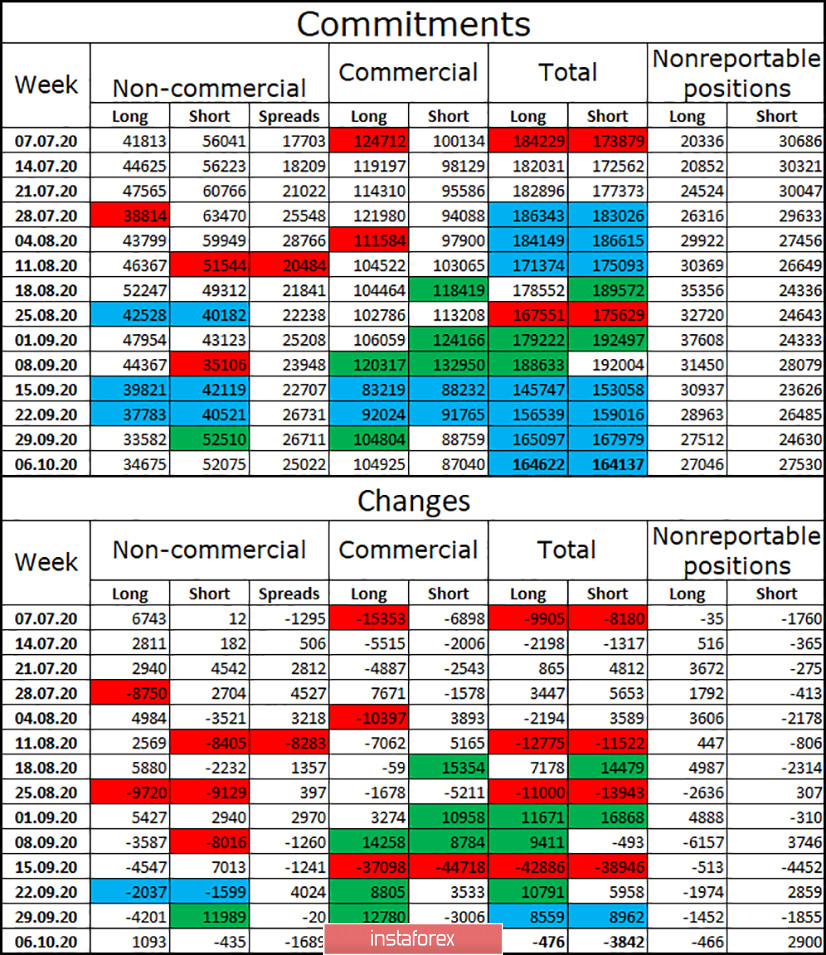

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that there were no changes during the reporting week. The "Non-commercial" category of traders opened only a thousand long contracts and closed 435 short contracts. Thus, the changes are minimal and do not allow us to draw any long-term conclusions. In total, speculators continue to hold a larger number of short contracts, which indicates their belief in the fall of the British dollar. And it is in the last two weeks that the number of these contracts has grown significantly. In general, the market is almost a perfect balance. The COT report shows that a total of 164,622 long contracts and 164,137 short contracts are open.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend buying the GBP/USD pair with a target of 1.3096, as it was fixed above the corrective level of 100.0% (1.3006) on the hourly chart. I recommend selling the British dollar if the closing is performed under the ascending trend line on the hourly chart with the targets of 1.2879 and 1.2840.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română