Inflation (along with the refinancing rate and the unemployment rate) is a fundamental economic indicator. From the point of view of financial markets, this is almost the most significant factor. However, from the layman's point of view, all this looks a little strange. After all, it is obvious that if prices go up, it is bad. I personally can buy less goods or services when prices go up. Though this is the case, markets, in a strange way, react with optimism to price increases and are extremely dissatisfied when prices go down. Why is this?

To understand inflation is to understand the terminology itself. Inflation means an increase in the aggregate price level in the economy as a whole. What about the lowering of prices? This phenomenon is called deflation. Though they are different, we are dealing with the same phenomenon: a change in the price level. It is just that the growth and decline of prices have different names. From a scientific point of view, this is incorrect, since we miss the phenomenon itself. The term inflation comes from the Latin word inflatio, which literally translates as bloating. Bloating is a form of growth. In other words, we explain the meaning of the word with the same word. Logically, we should define the whole phenomenon, not a particular one-- that change is a change in the price level. It doesn't matter if it's going up or down. This situation is caused by the fact that this definition is relatively new. Regular monitoring of the price level began more or less just over a hundred years ago.

By history's standards, the concept is very new. Interest in this phenomenon was caused by the economic shocks of the first half of the last century, when European countries, after the end of the First World War, faced a catastrophic increase in prices. Accordingly, the term was chosen for the price increase. Later, when prices showed a downward trend, another term was simply coined for this concept. The scale of the price increase was so impressive that the subsequent decline was almost imperceptible. These two terms took root. However, over time, it became clear that you need to look at the phenomenon as a whole. The term consumer price index is being used more and more in scientific terminology. It implies any change in the price level-- both in the direction of growth and decline. This term is much more accurate. If you look closely at what exactly the American and European statistical agencies publish, you can see that they are talking about the consumer price index.

The term still does not answer the question of why, from the point of view of financial markets, price growth is a good thing. Central banks around the world openly say that their main goal is to prevent a slide into deflation. At the same time, they talk about the need for price stability, meaning the inflation rate in the region of 2.0%. In other words, prices should rise. From the point of view of the layman, this is a kind of surrealism. The thing is that in the public consciousness, prices are living its own life. However, this is far from the case. The fact is that the price of any product or service is a reflection of two components: supply and demand. Demand can be expressed through the aggregate desire of many individuals to get a particular product. An offer is nothing more than its physical presence. Accordingly, if the demand increases, but the supply remains unchanged, then the price will increase. Well, if the supply increases, but the demand remains unchanged, the price will go down. In Economics, the price of a commodity is sometimes called the point of equilibrium between supply and demand. You can, of course, easily object, saying that the sellers are completely impudent and groundlessly raise prices.

Let's do a simple thought experiment. For example, we have only one tomato seller and he can set prices randomly. Even if these sellers become two, they can easily agree among themselves and still raise prices. However, as soon as the number of sellers increases, to ten for example, such collusion becomes difficult. Let's say they were able to come to an agreement. There is a high risk that some of them will not be in a hurry to raise their prices along with everyone else. He will do it one or two days later. Let's say that due to circumstance, they are unable to do so. It turns out that all potential buyers at this time will go to buy tomatoes only from him. Other participants in the conspiracy instantly lose their profits; maybe even go broke. It is this risk that prevents full-scale collusion of sellers. This only applies to a market where there are many sellers. When it comes to the economy, more often than not, they talk about the so-called developed countries. These countries all have this problem where there are more or less various antitrust services that are designed to prevent the collusion of sellers.

Based on the given information, the answer to the question of why investors perceive price growth as a positive factor follows. If the price is a reflection of the ratio of demand to supply, then its growth indicates the presence of some unsatisfied demand. Therefore, you can safely invest in increasing the production of goods or services. This leads to both the creation of new jobs and the modernization of production facilities. You must agree that all this is perceived as extremely positive phenomena without any reservations. Moreover, no matter what anyone says, wages almost always grow more than prices. It's just that you can only see this on a few large scale examples. Prices can change constantly-- literally every month-- but salaries usually do not grow so often. For each individual, this happens every three, four, or five years. In the end, this growth not only covers the price increase but also exceeds it. After all, this logically follows from the fact of price growth. If prices go up, workers will demand higher wages so the cost of labor will also go up.

Deflation, or falling prices, is nothing more than a real nightmare. After all, if prices fall, it means that supply exceeds demand. There are a lot of goods and services on the market that no one needs and sellers are forced to reduce their prices in order to somehow sell them. After all, in the production of these very goods and services, funds have been invested that need to be recaptured. Therefore, from the point of view of entrepreneurs, both small and large corporations, the logical step is to reduce the volume of output. What is the point of investing in the release of a product whose price is going down? This will inevitably lead to a reduction in the number of jobs. In other words, people can literally be left without jobs and means of livelihood. Although prices are falling, attaining the money to buy anything will not be easy. Moreover, seeing that the purchasing power of money is growing, all participants in the economic game make a choice in the direction of accumulation, rather than consumption. After all, it is more profitable to keep money rather than spend it. Tomorrow, the same money will be used to more than it originally could. All this leads to a sharp contraction in demand and an even greater drop in prices. This is followed by a full-scale closure of enterprises and mass unemployment. This situation is called a deflationary spiral. This is what happened during the great depression and it took a Herculean effort to get out of this situation. It took more than one year. In the United States, most of all their roads were built at that time. People built them literally for a bowl of soup. That's all they were paid. Prices continued to go down. At the same time, a decline in prices over a long period of time carries another big threat. At some point, demand is squeezed so much that there is nowhere else to go. Then it inevitably starts to grow. But many manufacturers by this time have already reduced output so much that there is a completely opposite situation and demand catastrophically exceeds supply. But if the demand can be regulated by the amount of money, then the supply is much more complicated. In other words, supply is physically unable to keep up with demand. As a result, deflation is abruptly replaced by simply galloping inflation and money is simply devalued. All those who have previously saved them in the hope of buying a yacht instead of a coat are unable to buy matches with them. Entrepreneurs face the same problem, which makes it difficult for them to invest in increasing the output of goods and services.

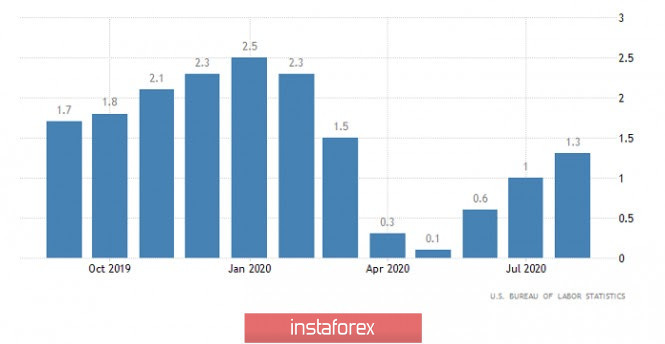

So it should not be surprising that investors are optimistic about today's increase in inflation in the United States from 1.3% to 1.5%. Yes, if these forecasts are confirmed. The US Dollar will get a great incentive to grow. Investments in the American economy will become a little more attractive.

Inflation (United States):

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română