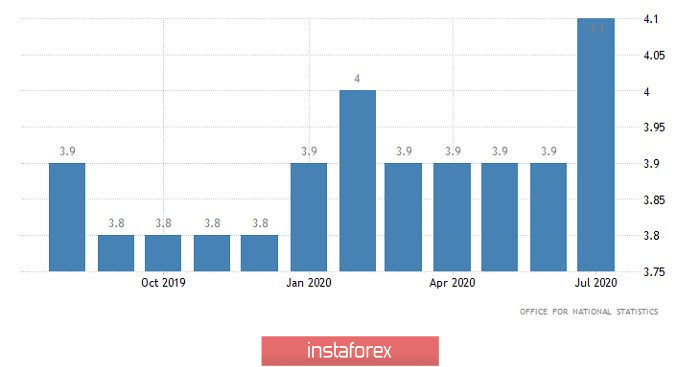

The market unexpectedly stood still yesterday. We will not observe anything like this today. At least the pound will begin to move in the morning. The reason for this will be the data on the labor market. The fact is that you can talk as much as you like about the lack of measures to support the economy in the United States, but unemployment is going down there. However, it is growing in the UK and may increase from 4.1% to 4.2%. So the situation is clearly not in favor of the pound.

Unemployment rate (UK):

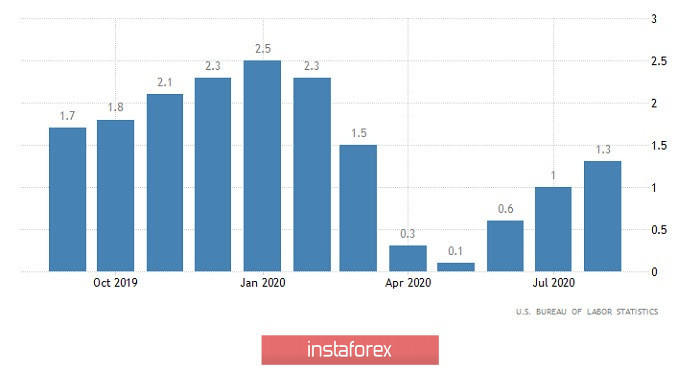

But the most important event not only of today, but of the entire week, is the release of US inflation data, where it is expected to grow from 1.3% to 1.5%. Investors are very fond of rising inflation. Especially if it is approaching the target levels of the monetary authorities. Indeed, in the worst case, this means that the Federal Reserve will not take any steps to soften the parameters of monetary policy. Of course, in theory, the rise in inflation may even make the Fed think about raising interest rates. But clearly not in the current conditions. Nevertheless, against the background of the expansion of stimulating measures in the form of various programs of quantitative easing by the Bank of England or the European Central Bank, the Fed's firmness looks like a tightening of monetary policy. So the inflation data can provoke a noticeable increase in interest in the dollar.

Inflation (United States):

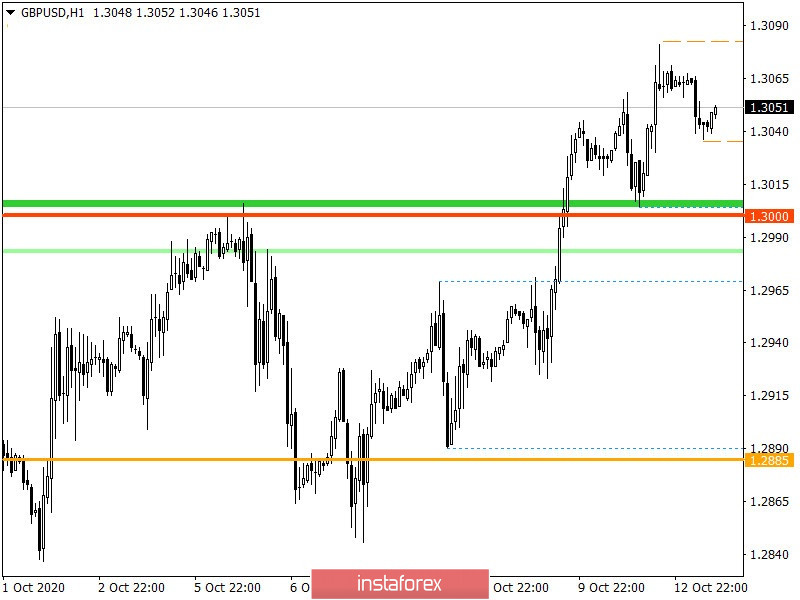

The GBPUSD pair continues to settle above the psychological level of 1.3000, which complicates the process of a downward development due to the shift in market ticks. The leverage for sharp price changes is still speculative excitement, which is considered volatile, which means that focusing the price above the psychological level may be a local manifestation in the market.

If we proceed from the quote's current location, we can see that the highest value at the moment is the coordinate of 1.3081, where there was a slight pullback, followed by stagnation.

Regarding volatility, a high coefficient of speculative transactions is still recorded, which leads to market surges and a confident increase in volatility.

Considering the trading chart in general terms, the daily period, we can see a corrective move from the local low of 1.2674, which, with the current changes, can be re-qualified into a recovery process relative to the decline in September.

We can assume that due to speculative excitement there is a risk of chaotic jumps, where special attention is paid to the coordinates 1.3036 and 1.3081, since getting the price to settle outside the derived values can lead to local acceleration.

Specifying all of the above into trading signals:

- We consider long positions after getting the price to settle above 1.3081, towards 1.3120-1.3150.

- We consider short positions after getting the price to settle below 1.3036, towards 1.3000-1.2950.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments on the hourly and daily periods indicate a buy signal by getting the price to settle above 1.3000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română