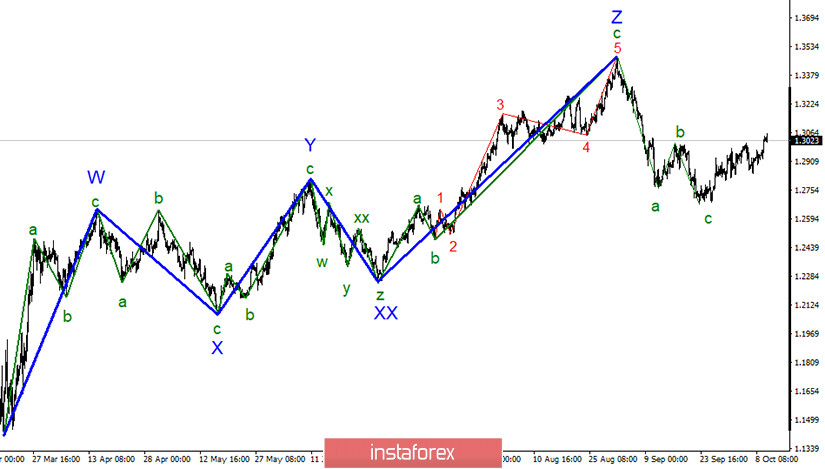

Globally, it is presumed that the formation of a new downward trend section remains. However, it is very likely that everything will end with waves a - b - c. If this is true, then the price increase will continue from the current levels with targets located near the peak of the z wave. A successful attempt to break the high of wave b also indirectly indicates the readiness of the markets to buy this tool.

If we look closely, it is clear that the wave pattern has indeed taken on a three-wave form, which looks quite convincing. A failed attempt to break through the 61.8% Fibonacci level only further assures that the downward set of waves is complete. But the successful attempt to break through the 38.2% level in the end suggests that the markets are quite ready for a new growth of the quotes. This is slightly unusual, given the UK's news background, but the markets are now paying more attention to the news background from the US, which is also unsatisfactory.

Last Friday, it was confirmed that the markets are actively ignoring the UK's news background again. Today, two important reports were released, which did not cause any reaction from the markets, although they should have. The volume of GDP in August grew by only 2.1%, although there was an increase of 6.6% in July, and the forecast was + 4.6%. The same thing goes for the industrial production report. The growth in August amounted to only 0.3 %%, although a growth of 5.2% was recorded a month earlier and the forecast was + 2.5%. Thus, the conclusions can be made almost unclear. The recovery of the British economy is slowing down, which is no longer an assumption, since it is confirmed by official statistics. On such news, the demand for the pound should have declined, but it did not. On the contrary, it added about 100 pips last Friday. Thus, I conclude that the markets are now putting the news background from the US first. If so, then the markets may continue to dislike the US dollar until the election, or at least until the end of October.

However, I also draw your attention to the fact that the picture may change dramatically in a month. Firstly, the news background in the UK is even worse now than the US. Secondly, it is unclear what the market's reaction to the results of the presidential election will be. Thirdly, we don't know when these results will be publicized, since both parties seem to be preparing not for elections, but for courts.

General conclusions and recommendations:

The pound/dollar pair has supposedly completed the formation of the downward trend. A successful attempt to break through the 38.2% level allows us to recommend buying the pair with targets located around 1.3191 and 1.3480, which equates to 23.6% and 0.0% Fibonacci. However, the current news background is such that it can lead to a strong complication of the current wave pattern.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română