Crypto Industry News:

Crypto asset management company Valkyrie will begin trading ETFs with exposure to Bitcoin mining companies on the Nasdaq exchange starting Tuesday.

A spokesman for Valkyrie said the company's ETF will be available on the Nasdaq exchange under the WGMI designation. According to a request filed with the Securities and Exchange Commission on January 26, the investment vehicle will not offer direct exposure to Bitcoin, but at least 80% of its net assets will come from the securities of companies that "derive at least 50% of their revenues or profits." mining BTC or provide mining hardware or software. The report further states that Valkyrie will invest up to 20% of the ETF's net assets in companies with "a significant portion of their net assets" in Bitcoin.

Valkyrie's offer is similar to the ETF owned by Digital Asset Mining proposed by VanEck in December. The company said it plans to invest 80% of its total assets in the securities of cryptocurrency mining companies, and the SEC is expected to either decide on the fund or extend the deadline to February 14.

In October, Valkyrie became one of the first asset management companies to offer indirect exposure to cryptocurrencies through cash settled contracts when it launched the ETF Bitcoin Strategy. The fund is currently traded on the Nasdaq for $17.01, up more than 20% from Thursday's decline to $14.12.

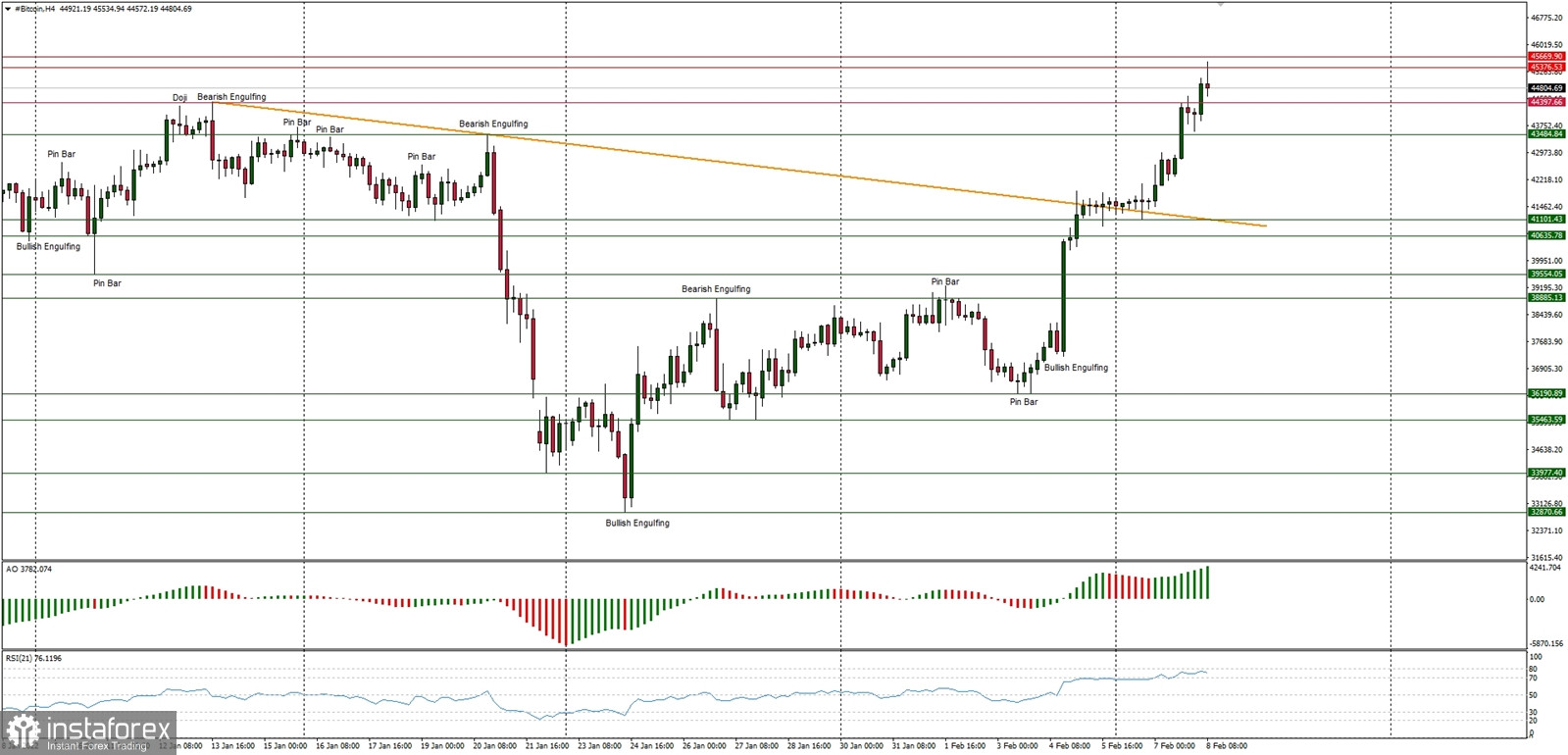

Technical Market Outlook

The BTC/USD pair has made a new swing high at the level of $45,535. The next target for bulls is seen at the level of $46,673 (38% Fibonacci retracement level).The bulls are in control of the market on the lower time frames as the momentum is strong and positive on the daily time frame chart as well, so the market is bouncing from the extremely oversold conditions. The nearest technical support is seen at $44,397 and $43,484.

Weekly Pivot Points:

WR3 - $50,386

WR2 - $46,257

WR1 - $44,577

Weekly Pivot - $40,396

WS1 - $38,765

WS2 - $34,482

WS3 - $32,499

Trading Outlook:

The market is bouncing after over the 80% retracement made since the ATH at the level of $68,998 was made. The level of $44,442 is the next key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română