It is not known how the epic with the US presidential election will end, however, we must admit that Donald Trump was as important for the oil market as the princes of Saudi Arabia in the 1980s and 1990s. It was said then that a single sneeze from a member of the Royal family could change prices. In 2017-2020, Brent and WTI followed the White House host's Twitter account much more than they did events in the Middle East. His calls for OPEC to stop controlling the market and allow prices to fall have been replaced by pressure on Riyadh during its war with Moscow. Then Trump needed more expensive black gold to save the American oil industry.

Oil is really used to the owner of the White House, thus, it should not be surprising that information about his illness, followed by rapid recovery, led to a roller coaster for Brent and WTI. The market is seriously concerned about Joe Biden's ideas to join the Paris climate agreement, spend $ 2 trillion on clean energy, and others that could create serious difficulties for the country's industry. Moreover, the state of the oil and gas industry already leaves much to be desired: according to Deloitte research, 7 out of 10 jobs lost due to the pandemic will not be restored until the end of 2021.

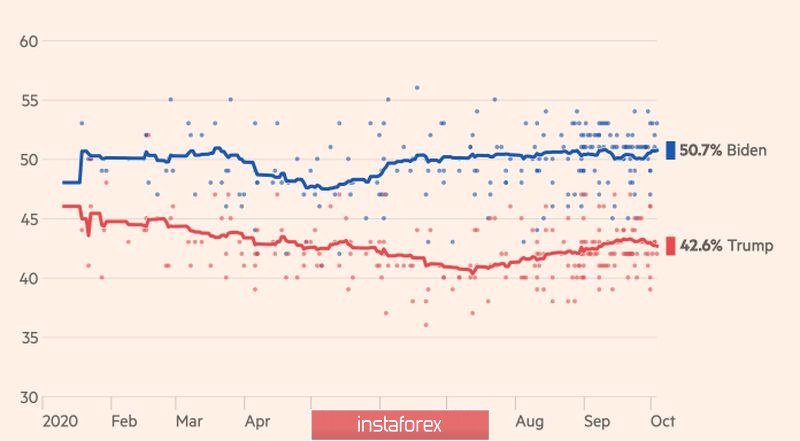

Thus, the growth of Joe Biden's rating is perceived as a reason for selling Brent and WTI, while you need to understand that the reduction in US production is a "bullish" factor for black gold. I do not believe that a Democrat's victory in the election will signal a deep correction, on the contrary, traders will have a great opportunity to buy it on downturns.

The dynamics of the ratings of Joe Biden and Donald Trump

In the meantime, the market continues to be in a state of tug-of-war. Rumors of potential additional fiscal stimulus by Congress are on the side of the bulls; news from Norway, where strikes may reduce the country's production capacity by 330 thousand b/d, which is equivalent to 8% of production; information about Donald Trump's recovery; and the approach of tropical storm Delta to the coast of Louisiana and Florida. According to Weather Tiger, it can reach the power level of the 3rd category on the 5-step Saffir-Simpson scale. The reduction in US production in this region is a bullish factor for Brent and WTI.

"Bears" are armed with the second wave of COVID-19 in Europe and the still tense epidemiological situation in the States, the growing popularity of Joe Biden, and the gradual increase in production from OPEC+. The agreement to reduce production by the cartel and Russia allowed to withdraw oil from April's bottom and stabilized the market for some time. However, as soon as the volume of obligations decreases, the situation will not change for the better for black gold.

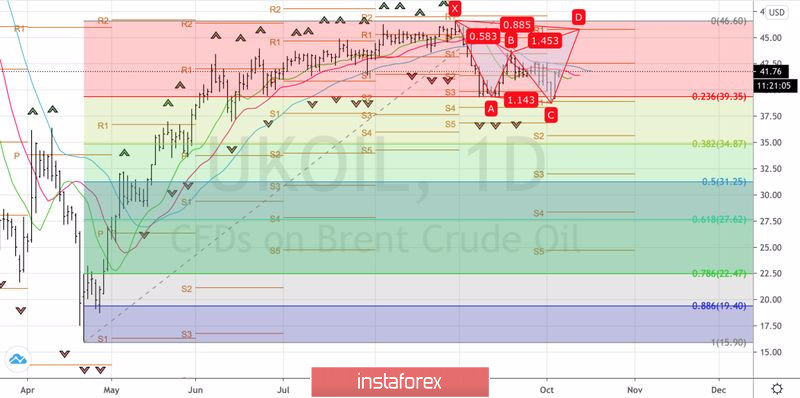

Technically, the "Shark" pattern is forming on the daily chart of the North Sea variety. Breaking through the $ 42.5 and $ 43.3 per barrel resistances will allow it to activate and form long positions on Brent. The target of the upward movement is the level of 88.6% or $ 46 per barrel.

Brent, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română