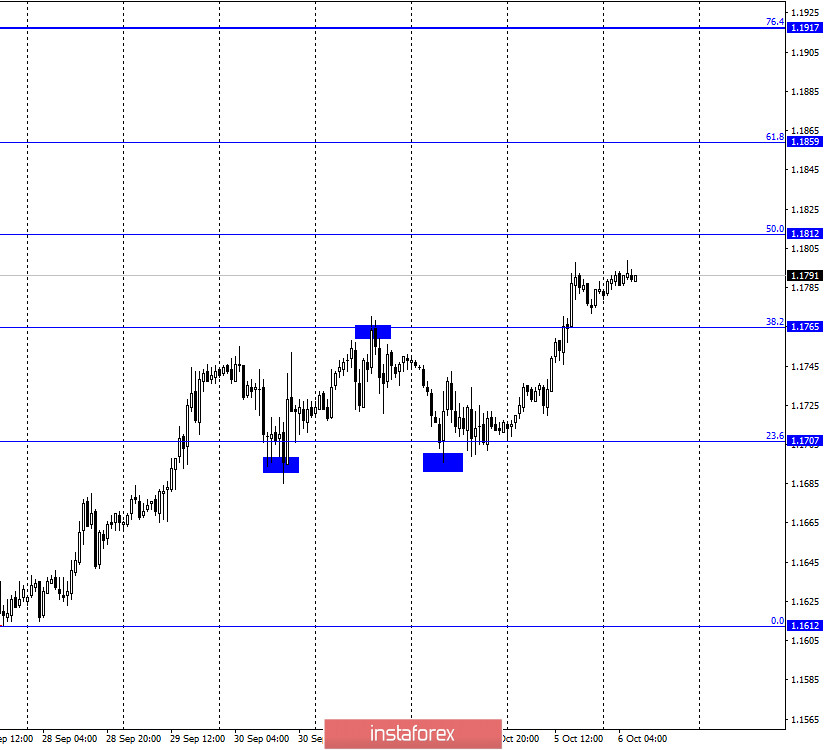

EUR/USD – 1H.

On October 5, the EUR/USD pair resumed the growth process and consolidated above the corrective level of 38.2% (1.1765). Thus, the growth of quotes can now be continued in the direction of the next Fibo level of 50.0% (1.1812). At the same time, US President Donald Trump was released from the hospital tonight and taken by helicopter to the presidential administration (White House), from which he has already managed to shoot a video in which he urged Americans not to be afraid of the coronavirus, and said that he feels good. To be honest, it's all very much like a theatrical production. Donald Trump, who is 74 years old and overweight, suffered the disease in three days? Even if he is not completely cured yet, the attending physician lets him leave the hospital? To be honest, it all looks very strange. Trump also urged not to let the coronavirus dominate. Although how can this be explained to the 200,000 Americans who died from COVID-2019? Perhaps Trump wanted to show that the virus is not as terrible as it is described? However, it turned out badly again. Let me remind you that more than half of Americans believe that Trump regularly misleads when talking about the coronavirus. Simply put, America doesn't trust the president. Also, the president does not believe the dollar, which continues to fall against the European currency.

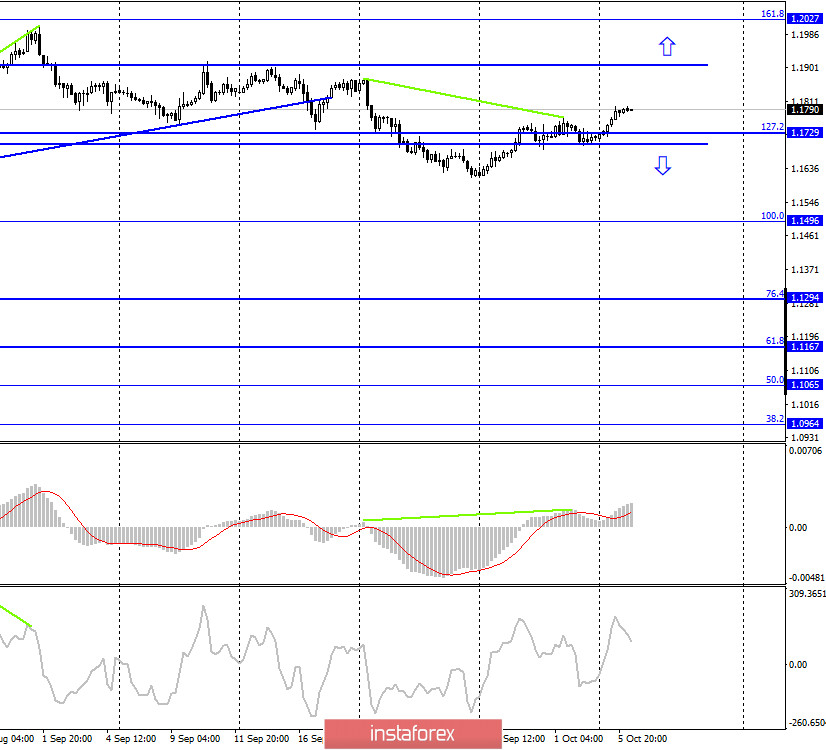

EUR/USD – 4H.

On the 4-hour chart, the graphic picture remains very sad. The pair's quotes returned to the side corridor, where they had been trading for about two months, and several times they fixed above and below the corrective level of 127.2% (1.1729). As a result, the growth process within the corridor resumed in the direction of its upper border. Thus, it is unclear whether the upward trend has resumed, or whether the pair has simply returned to the side corridor.

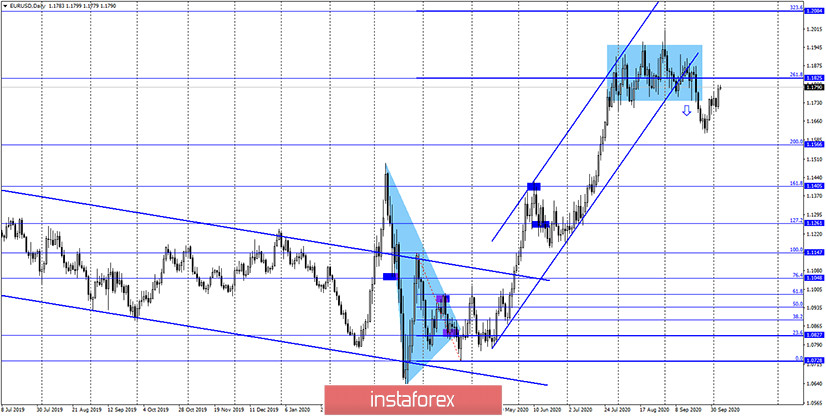

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a sharp reversal in favor of the EU currency and began the process of returning to the weak level of 261.8% (1.1825). However, a drop in prices still looks more likely. Fixing the pair's rate above the level of 261.8% will increase the probability of further growth towards the level of 323.6% (1.2084).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 5, the US and the European Union released indices of business activity in the service sectors, which did not interest traders. Retail sales in the EU turned out to be better than traders expected, however, it is unlikely that this report was the reason for the growth of the euro currency.

News calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (08:35 GMT).

EU – ECB President Christine Lagarde will deliver a speech (13:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (14:40 GMT).

On October 6, Christine Lagarde will give two speeches in the European Union, and Jerome Powell will give a speech in the United States. This is the most important news of the day.

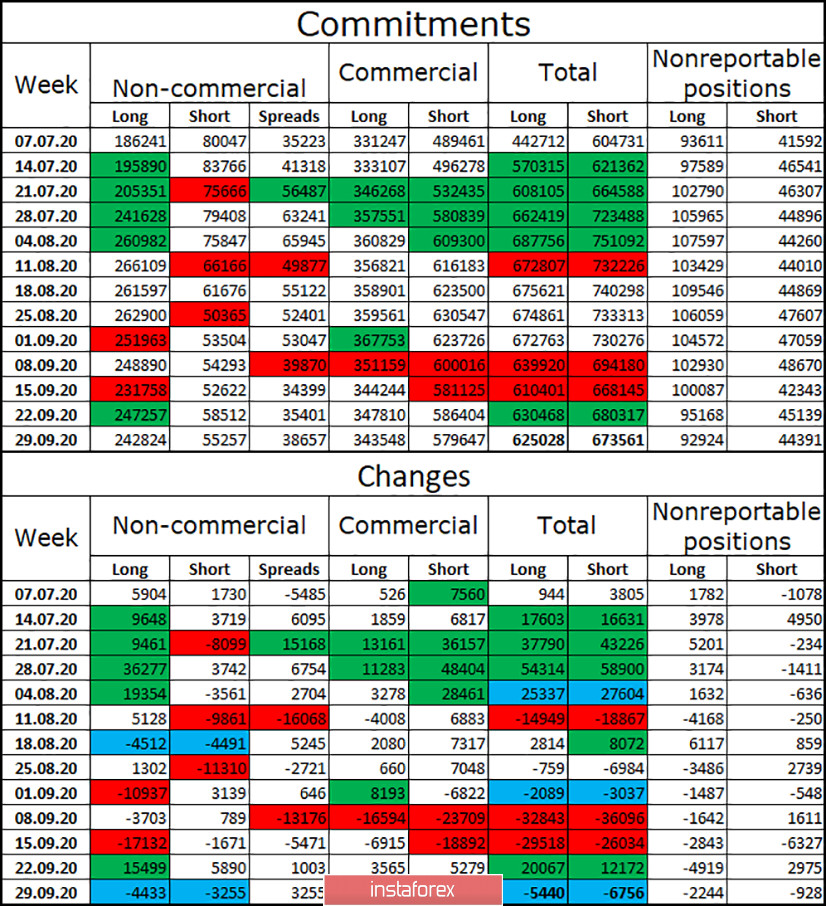

COT (Commitments of Traders) report:

The last COT report was quite boring. During the reporting week, the "Non-commercial" category of traders got rid of both long and short contracts. With approximately equal amounts. Thus, the mood of speculators remained the same. In general, all categories of traders also closed approximately the same number of long and short contracts. Thus, there were really few changes during the reporting week. In general, major traders still have about 5 times more long contracts than short. This means that speculators still believe that the European currency will continue to grow. But how long will their faith last?

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1707, if the close is made under the level of 38.2% (1.1765) on the hourly chart. I recommend buying the pair today with targets of 1.1812 and 1.1859, as the closing was made over 38.2% (1.1765).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română