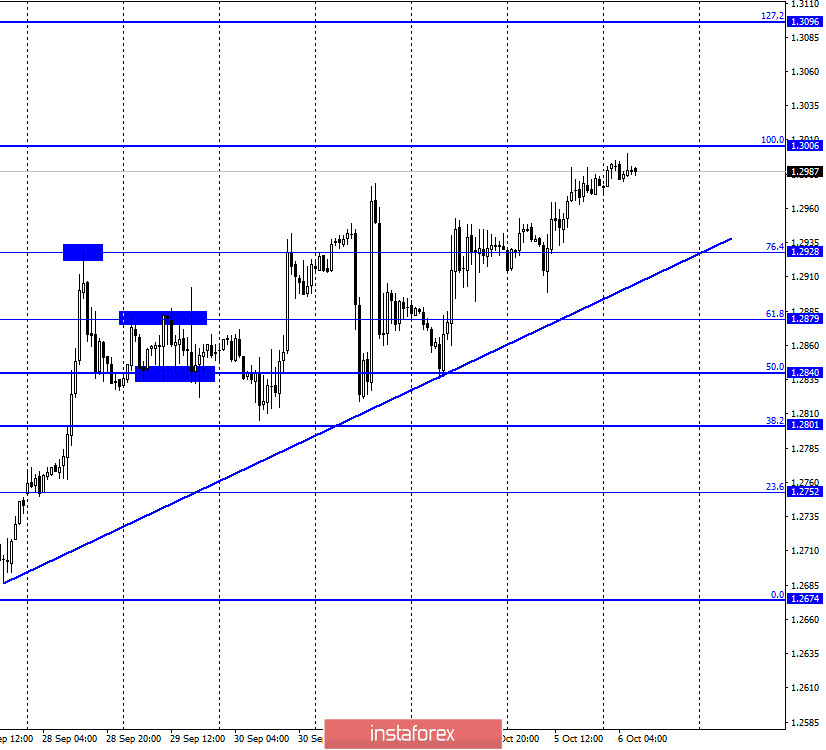

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair quotes continued to grow in the direction of the corrective level of 100.0% (1.3006). The rebound of quotes from this level will allow traders to expect a reversal in favor of the US currency and a slight fall in the direction of the Fibo level of 76.4% (1.2928) and the trend line, which continues to characterize the current mood of traders as "bullish". Closing the pair's rate above 100.0% will increase the probability of further growth towards the next corrective level of 127.2% (1.3096). Meanwhile, in Britain, all the anti-records of COVID-2019 incidence are being broken for three days in a row. On October 5 and 3, 13 thousand diseases were registered, and on October 4 - 23 thousand. For comparison, at the peak of the first wave, no more than 6 thousand diseases were registered per day. Boris Johnson announced a new outbreak a couple of weeks ago, however, yesterday, he said that the British are waiting for a "hard winter", and the virus is likely to continue to spread until spring. The UK government plans the mass vaccination of Britons, however, it will not start until next year. The Prime Minister also urged not to lose common sense and strictly comply with the requirements of quarantine measures. Thus, all negotiations with the European Union and Brexit in the near future may take a back seat, as the epidemic is again in the first place.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair continues to grow in the direction of the corrective level of 38.2% (1.3010), which almost coincides with the level of 100.0% on the hourly chart. Thus, the rebound of quotes from this level will also allow traders to expect a reversal in favor of the US currency and a slight fall in the direction of the Fibo level of 50.0% (1.2867). A consolidation above the level of 38.2% will increase the probability of further growth towards the next corrective level of 23.6% (1.3191).

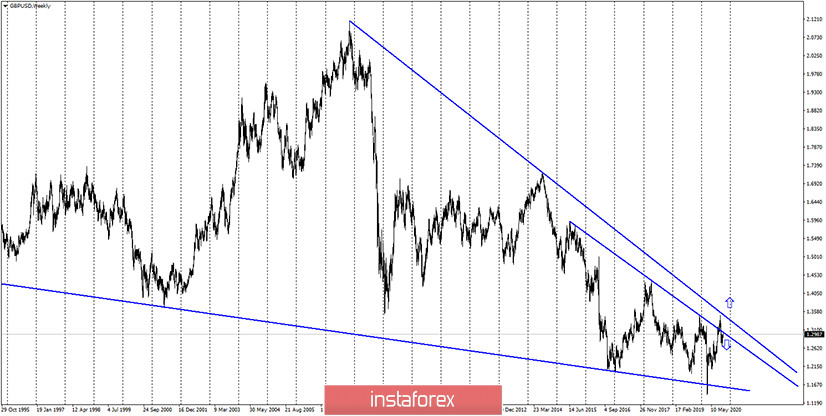

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 61.8% (1.2709) and a reversal in favor of the British currency with the resumption of the growth process in the direction of the corrective level of 76.4% (1.3016) (almost coincides with the nearest levels on the hourly and 4-hour charts). Closing the pair's rate above this level will increase the probability of further growth towards the next level of 100.0% (1.3513).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

On Monday, the UK only had a report on business activity in the service sector, and the member of the Bank of England's MPC, Andy Haldane, did not report anything interesting or important. The British pound continues its heavy growth due to the difficult situation in the US.

News calendar for the US and UK:

UK - PMI for the construction sector (08:30 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (14:40 GMT).

On October 6, Jerome Powell's speech will be of great importance for the pound/dollar pair, as well as any news from the UK regarding the coronavirus, and from the US, regarding Donald Trump and future elections.

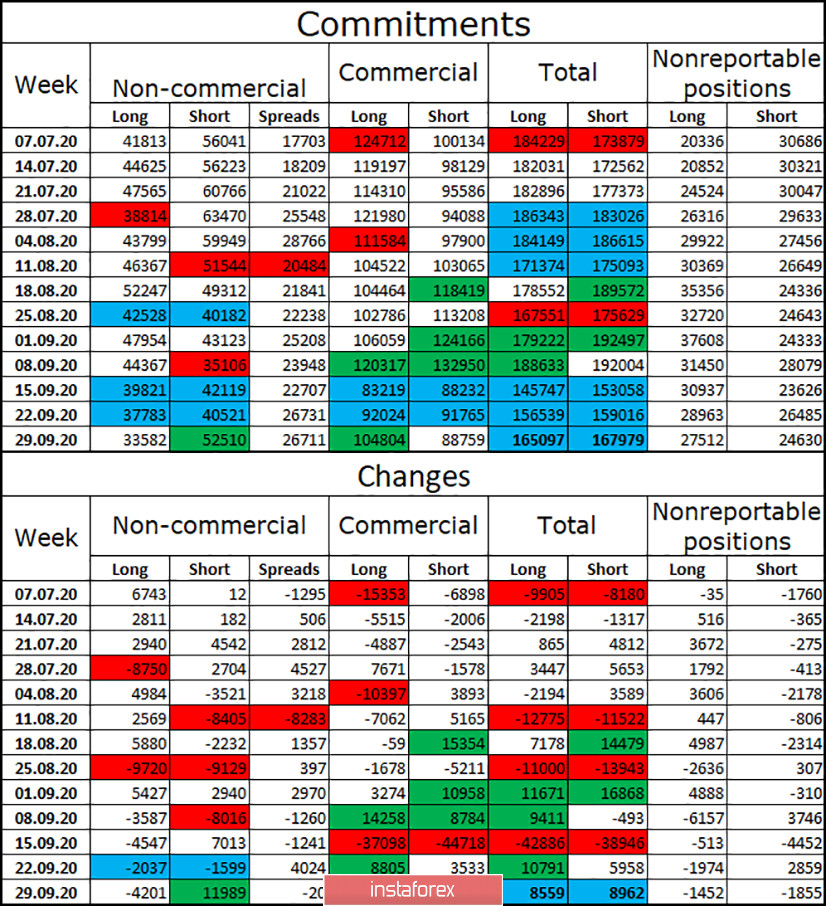

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed a sharp increase in the number of short contracts in the "Non-commercial" category. This means that this group of traders believes that the British pound will continue to fall, although it has been growing in recent days. Now the total number of short contracts focused on the hands of speculators exceeds the total number of long contracts. Thus, we can conclude that major traders are again changing their mood to "bearish". In total, during the reporting week, all categories of traders opened approximately the same number of contracts.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend buying the GBP/USD pair with targets of 1.3096 and 1.3191, if the consolidation is performed over the area of 1.3006-1.3010. Breaking quotes from this area will allow you to open sales with the goal of a trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română