Latest macroeconomic reports indicate an improvement in the US economy, which suggests a stronger GDP recovery in the 4th quarter of 2020. Against this background, demand for the euro has climbed up, as traders are again gradually starting to give preference to risky assets.

However, despite the good performance, many companies are likely to operate below their normal capacity, thereby limiting the rate of recovery. The long-term damage of the coronavirus pandemic will still be unclear, especially since high unemployment for the next 2-3 years will limit the growth potential of the economy.

In that regard, yesterday, Chicago Fed president Charles Evans said that he expects GDP to recover to pre-crisis levels by the end of 2021, and then reach full recovery only by 2023 (unemployment rate at 4% and inflation at 2%). According to him, a lot depends on further fiscal stimulus, which, until now, the US has been dragging on.

As for Europe, ministers held a meeting yesterday, during which Eurogroup president, Paschal Donoghue, presented his work program for the near future. It focuses on three main components, namely the economy, financial issues and the euro exchange rate. Donoghue said that the group's main goal is to support the recovery and growth of the eurozone, as well as to avoid the risk that the coronavirus crisis will lead to an increase in economic imbalances. He pledged to work intensively in strengthening the banking union, which will allow the financial sector to better support the economy by properly redistributing and managing financial risks.

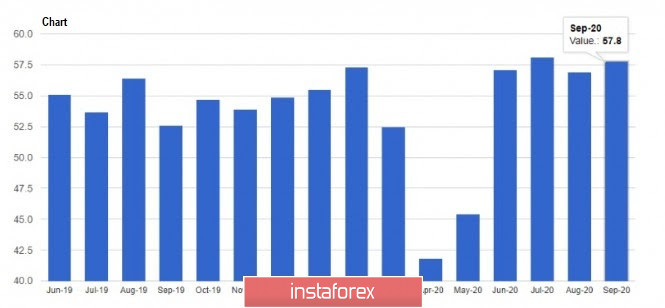

Going back to statistics, the latest report on US service PMI rose from 56.9 points to 57.8 points, which indicates an increase in activity in the service sector.

The Employment Trends Index also continued to grow in September, thanks to the persistent rise of jobs in the United States. The Conference Board reported that the index is at 54.80 points, up from its 53.30 value a month earlier.

On the topic of exchange rates, demand for risky assets, particularly the euro, will depend on how the bulls hold in the area of the 18th figure. A breakout above the range will lead to a strong bullish move towards the highs of 1.1840 and 1.1870, while a breakout below will return the pair to the level of 1.1750, and then to a quote of 1.1700 or 1.1655.

AUD/USD

The Australian dollar remained trading in a flat market, not minding the recent decision of the Reserve Bank of Australia to leave its monetary policy unchanged. The key interest rate will remain at 0.25%, and the target level of yield on 3-year government bonds at 0.25%.

Soon though, the RBA said that they will resort to softer monetary policy, as it would be necessary to maintain the state of the labor market and continue economic recovery.

With regards to the AUD/USD pair, a breakout above the resistance level of 0.7200 will result in a strong bullish move towards 0.7265 and 0.7350, but if the pressure on the Aussie returns, a decline towards 0.7070 and 0.7000 could occur.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română