As a rule, every first Friday of a new month, the US Department of Employment publishes data on the labor market for the previous month. Last Friday was no exception.

Thus, on October 2, it became known that in the United States, the unemployment rate was 7.9%, with a forecast of 8.2% and the previous indicator of 8.4%. This is quite a positive moment, which shows that unemployment in the US is declining at a faster pace than economists expect. However, the number of jobs created in non-agricultural sectors of the American economy was below the consensus forecast of 850,000 and amounted to 661,000 new vacancies. As for the average hourly wage, its growth was 0.1% in September, which is worse than the forecast of 0.2%. To sum up, we see that data on the US labor market once again turned out to be mixed, and market participants had to choose a priority between significantly reduced unemployment and weaker than expected Nonfarm Payrolls and wage growth.

Now about the current topic of COVID-19, which continues to have a significant impact on market sentiment, and therefore on the course of trading. Let's start with Europe, where the most alarming situation with the daily number of infections still remains in Spain, France, the Czech Republic and Slovakia. In Spain, sanitary restrictions have been tightened, especially for the country's capital, Madrid. From today, Paris is declared the most dangerous zone, which is bad news for the residents of the French capital, as well as the owners of bars, restaurants and gyms, which were hit hardest by the newly introduced restrictions. Some people are already ready to close their business, which leaves people without means of subsistence. A difficult situation remains in Marseille. In European countries, where the COVID-19 pandemic is experiencing the largest outbreaks and the most severe restrictions are being imposed, there are protests and criticism of the authorities, who are accused of inaction and inability to cope with the crisis.

If you look at the situation in the world, the daily increase in infected people fluctuates around 2 million people, and the leader in the number of daily infections is India, where the daily increase in cases is 70-80 thousand people. However, the main news, as it usually happens, came from the United States. As it became known, among those infected with the coronavirus was the President of the United States of America, Donald Trump, who will spend some time in the clinic according to his doctors. It is reported that the American leader's illness is mild. Trump feels a little tired, but does not lose a positive mood. This news literally blew up the Internet. However, knowing the reputation of the 45th US President, I would not rule out that this is an election maneuver, as a result of which, Donald Trump is trying to score points in his favor in the election race with his opponent Joe Biden. Although you shouldn't joke about such things, and most likely, the US President actually caught the coronavirus.

If you look at the economic calendar, then from the entire flow of macroeconomic information, the main event of the current week can certainly be considered the minutes of the last meeting of the US Federal Open Market Committee (FOMC), which will be published on Wednesday, October 7. And now it's time to move on to the technical picture of the main currency pair of the Forex market.

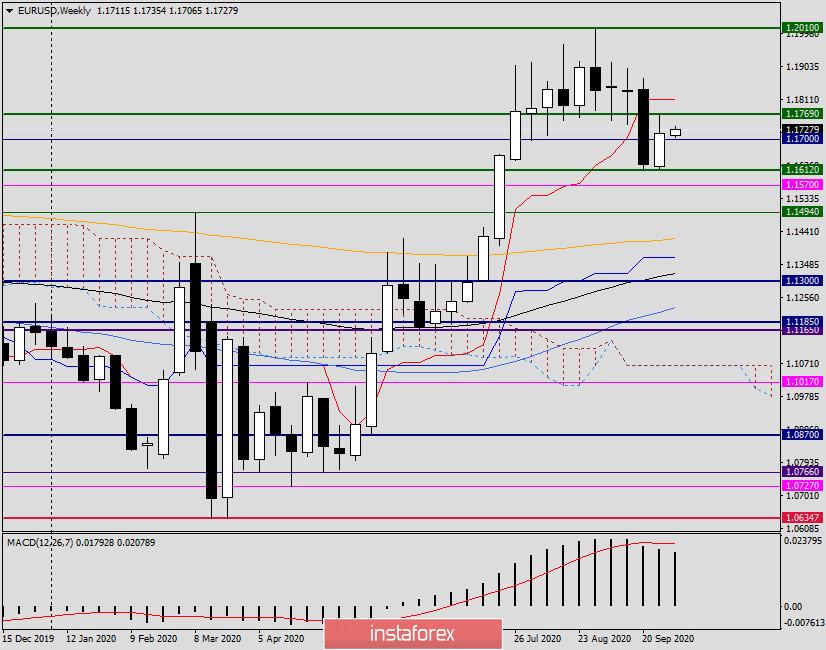

Weekly

Following the results of last week's trading, the EUR/USD currency pair rose, ending the session at 1.1715. Thus, the most important level of 1.1700 is currently falsely broken. This probability was assumed in previous reviews of the euro/dollar, in which it was expected that the pair would return to 1.1700 and circle around this significant mark. At the same time, strong support is observed near 1.1612/14 (the lows of the last 2 weeks), and resistance is indicated directly below the strong technical level of 1.1770. The bullish scenario will continue to be implemented if the previous highs are updated. With this development of trading, the next target of the euro bulls will be the Tenkan line of the Ichimoku indicator, which runs at 1.1811. If the rate increase players manage to solve this problem and close the current five-day trading above Tenkan, the chances of the pair's subsequent growth will significantly increase. Bears on the instrument need to return the quote below 1.1700, and at the same time break through the support at 1.1612. The closing of the week under another very important and significant mark of 1.1600 will further strengthen the position of sellers.

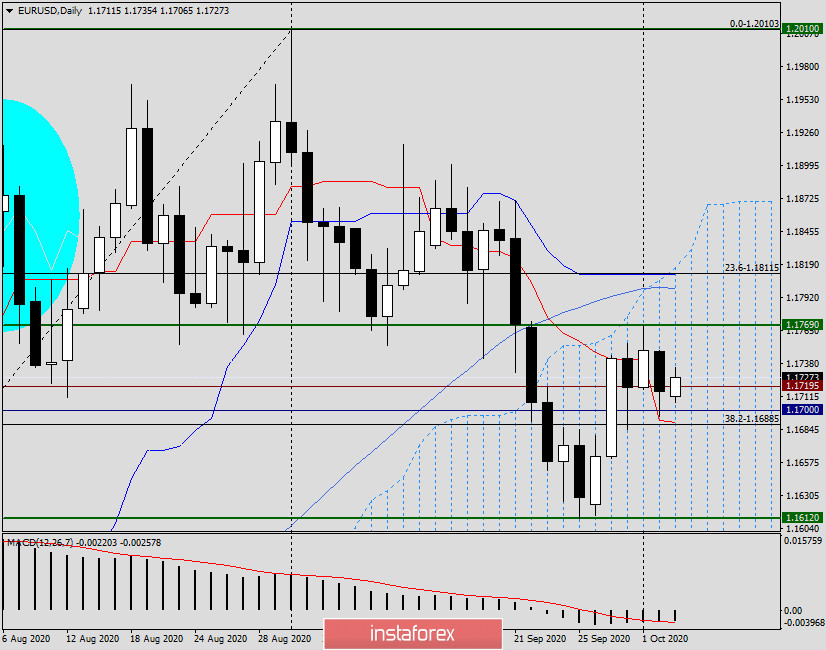

Daily

As you can see, on Friday, investors played back labor reports from the States in favor of the US dollar. Although, since the numbers are ambiguous, things could have been different. I assume that Friday's strengthening of the US currency took place as part of a correction to its previous decline, as well as against the background of profit-taking before the weekend.

If the Tenkan line is designed to play the role of resistance on the weekly chart, then on the daily timeframe it supports the quote and limits its further decline. It is also worth noting that the euro/dollar is trading within the Ichimoku cloud. It is characteristic that the upper border of the cloud and the 50 simple moving average are located near 1.1811, that is, exactly where the weekly Tenkan line runs. This factor only emphasizes the strength and significance of this mark and once again forces us to admit that only its true breakdown will indicate the seriousness of the players' intentions to increase the rate.

Turning to the trading recommendations, I note that at the moment there is still a probability of successful positioning in both directions. It is better to open purchases after breaking the nearest resistance of 1.1769, on a rollback to the already broken level, with a small target near 1.1811. If it is not possible to break through this mark, and under 1.1769 there will be reversal patterns of candle analysis on four-hour and (or) hourly timeframes, this will be a signal to open short positions. Another option for sales is the breakdown of the level of 1.1690, when on the rollback to which it is worth considering opening sales transactions. If the breakdown of this mark turns out to be unsuccessful and bullish candles appear, it will be time to think about buying the main currency pair. We will look at smaller timeframes in tomorrow's EUR/USD review, but for today, this is all the information.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română