In general, all macroeconomic statistics published on Friday indicated an inevitable rise in the dollar and so, the euro's weakening is quite logical. What's interesting is why the pound was growing? It grew solely for one single reason – Brexit. Another round of negotiations ended in nothing again, so Boris Johnson personally entered the matter, announcing on Friday that he would personally negotiate with Ursula von der Leyen. At the same time, the British Prime Minister has appointed meetings for Saturday. In view of this, the pound immediately rose. After all, Boris Johnson is an internationally renowned negotiator. In general, everyone believed that such a talented diplomat would immediately resolve all issues, however, he could only agree to extend the negotiations for another month. Although he promised quite recently that either an agreement would be reached before October 15, or Great Britain would leave the European Union without any trade agreements that only Brussels needed.

In short, we managed to let another month pass with groundless hopes for the pound, and for the entire British economy. In the last few years, the pound has only lived hoping for a miracle and Boris Johnson is not the first to try to make a fairy tale come true. Unfortunately, there are no wizards among British politicians.

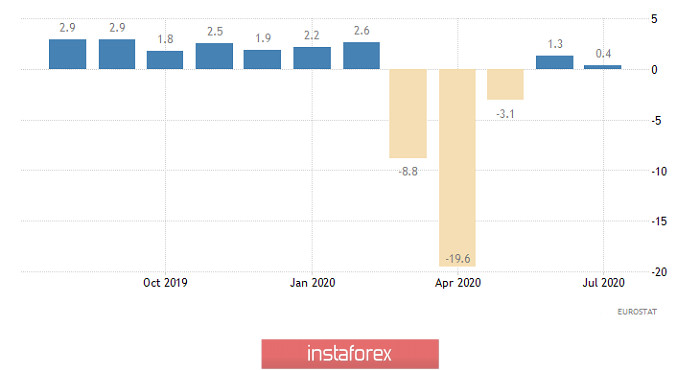

The deflation in Europe is only increasing, the rate of decline in consumer prices in Europe accelerated from -0.2% to -0.3% and this is only according to preliminary estimates. In general, deflation in Europe continues, as it has been going on for the second month in a row. Now, what should the European Central Bank do? Investors clearly believe that there is nothing else but to lower the refinancing rate to negative values. In short, the euro has no reason to grow.

Inflation (Europe):

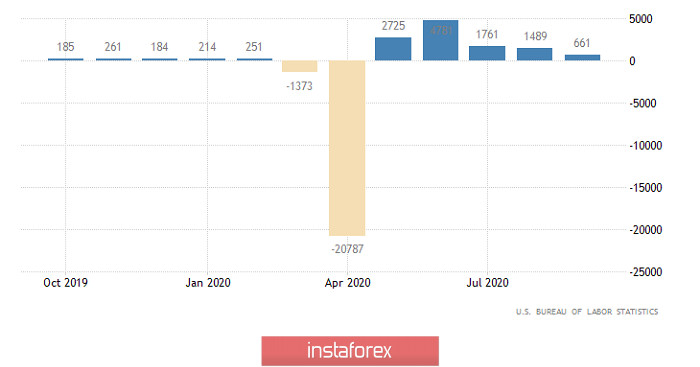

The content of the report of the United States Department of Labor did not also contribute much to the euro's strengthening, rather it finished it off. Here, we can note the number of new jobs – only 661 thousand were created, instead of 915 thousand. Nevertheless, this is quite enough for the recovery of the labor market to continue. Under normal conditions, 200 thousand new jobs per month is quite a lot.

So the unemployment rate, which fell from 8.4% to 7.9%, will continue to decline. In addition, Americans have begun to work harder, as the average work week has increased from 34.6 hours to 34.7 hours. They are paid more for it, since the growth rate of the average hourly wage has accelerated from 4.6% to 4.7%, although this required a downward revision of the previous results. Moreover, D. Trump made an unexpected election move. He cut the number of civil servants by as much as 216 thousand However, the state and its interference in the lives of ordinary citizens in the US are traditionally skeptical. So, from their point of view, the fewer officials, the better.

Non-farm new jobs created (United States):

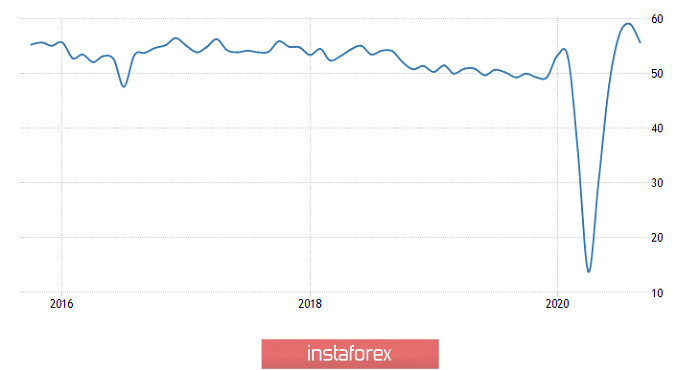

The final data on business activity indices (both composite and in the service sector) will be published today, however, they are unlikely to have a serious impact, since they should coincide with preliminary estimates, which were really disappointing. For example, the UK's index of business activity in the service sector is declining from 58.8 to 55.1, while the composite business activity index went from 59.1 to 55.7.

Composite PMI (UK):

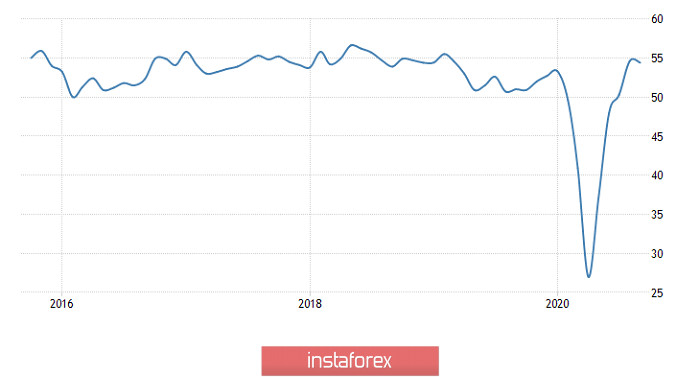

On the other side of England, the service PMI is down from 50.5 to 47.6, while composite PMI is from 51.9 to 50.1. However, all this has already been considered during the publication of preliminary data. In turn, the euro may be pleased by the retail sales – its growth rates should rise from 0.4% to 1.8%. Such an impressive growth in consumer activity highly compensates for the decline in consumer prices. Thus, investors have a reason to buy the Eurocurrency, which will allow it to win back some of its recent losses.

Retail Sales (Europe):

Moreover, the US index of business activity in the service sector should decline from 55.0 to 54.6, and the composite from 54.6 to 54.4. This was shown by the preliminary estimate, although it has already been considered by the market. Nevertheless, the final statement will not clearly please anyone.

Composite PMI (United States):

The single European currency is likely to return to the level of 1.1750.

The pound is likely to remain at the level of 1.2925.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română