Crypto Industry News:

Led by bioethicists at Baylor College of Medicine, the researchers noted that NFT could be altered to be used for the healthcare industry. As a result, they can give patients more control over their personal health information by identifying who has access to it and tracking how it is shared.

Kristin Kostick-Quenet of Baylor College stated:

"NFTs can be used to democratize health data and help individuals regain control and be more involved in decisions about who can see and use their health information."

Another author of the article added:

"Using NFT for health data is the perfect option between a huge market that is evolving and the popularity of cryptocurrencies. There are also many ethical, legal and social implications to consider."

Even though the NFTs are raising the bar as potential opportunities to transform the world of health data, researchers said challenges such as intellectual property rights disputes and vulnerabilities must be tackled.

NFTs are among the top digital resources considering their Google searches surpassed cryptocurrency and Ethereum searches, according to Google Trends. With non-exchangeable tokens offering real value based on their unique blockchain-based features, their adoption continues to grow.

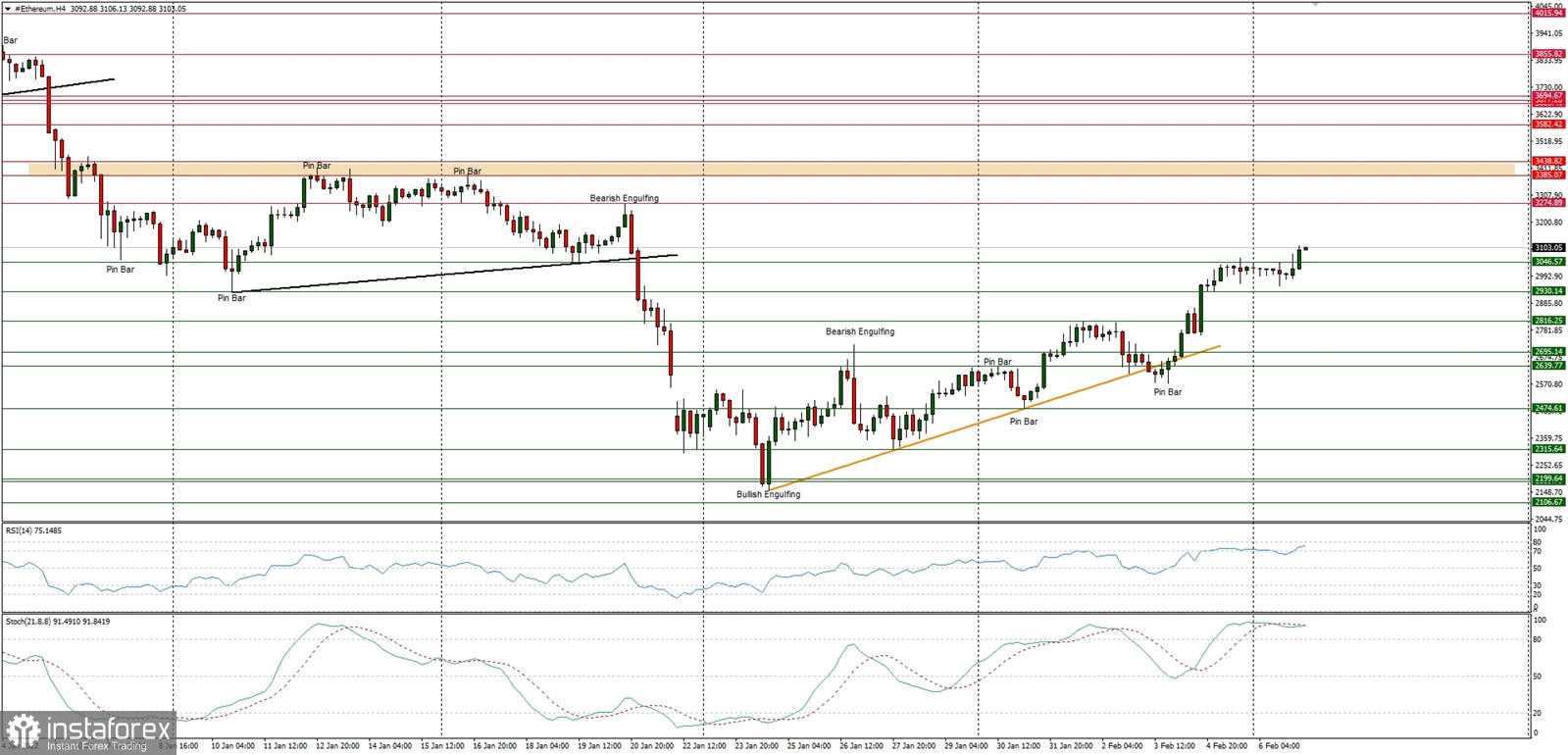

Technical Market Outlook

The ETH/USD pair has made a new local high above the $3,000 level at $3,110 as the up move continues all the weekend. The next target for bulls is seen at the level of $3,279, but the game changing level is located between $3,385 - $3,438. The bulls are in control of the market on the lower time frames as the momentum is strong and positive on the daily time frame chart and the market is bouncing from the extremely oversold conditions. The nearest technical support is seen at $3,046 and $2,930.

Weekly Pivot Points:

WR3 - $3,873

WR2 - $3,464

WR1 - $3,288

Weekly Pivot - $2,862

WS1 - $2,704

WS2 - $2,297

WS3 - $2,119

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română