To open long positions on EUR/USD, you need:

The pair remained in a sideways channel last Friday, considering that a weak data on European inflation was released, which fell more than economists expected, and that we also received a rather extraordinary data on the US labor market, where the unemployment rate fell and the number of employees grew much less than expected. Traders chose to not build up large positions in either direction. As a result, it was not possible to wait for convenient entry points to the market, but maybe it was for the better.

Before we talk about today's prospects for the pair's movement, let's look at the situation in the futures market, which tells us that traders are being more cautious and selective against the backdrop of the approaching US elections. The Commitment of Traders (COT) report for September 29 recorded a reduction in both long and short positions, which led to a decrease in the delta. Apparently, the lack of guidelines and a surge in the incidence of coronavirus in Europe discouraged major players from building up long positions in the euro, but no one is in a hurry to buy the US dollar either because of the upcoming presidential elections in the United States. Thus, long non-commercial positions decreased from 247,049 to 241,967, while short non-commercial positions decreased from 56,227 to 53,851. The total non-commercial net position also decreased to 188,116, against 190,822 a week earlier. which implies that new players are taking a wait-and-see approach, however, bullish sentiments for the euro remain rather high in the medium term. The more the euro falls against the US dollar, the more attractive it is for new investors.

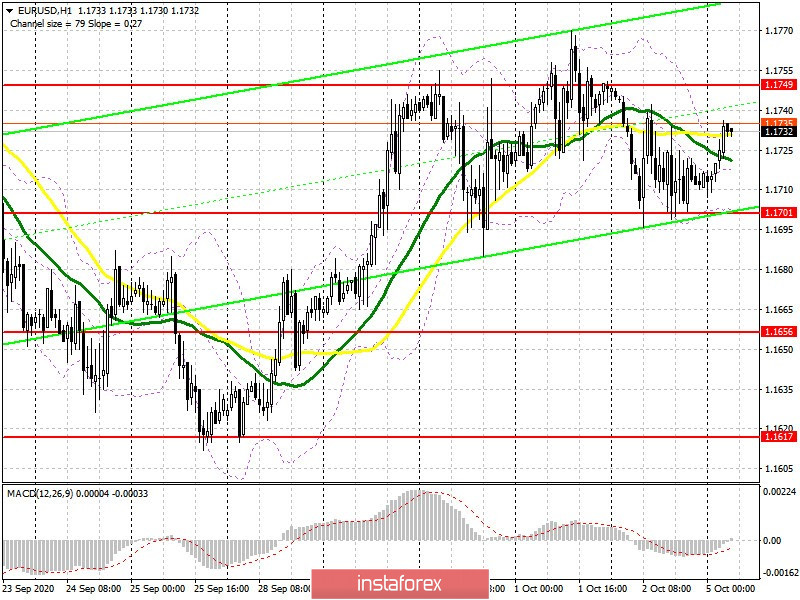

As for the current situation on the market, buyers need to go beyond resistance at 1.1749 today, consolidating on it will open a direct path for EUR/USD to rise to the highs of 1.1796 and 1.1833, which is where I recommend taking profits. But you can only achieve these levels if the data on the service sector of the eurozone and the composite index turn out to be better than economists' forecasts. And this is unlikely. Therefore, in case EUR/USD falls in the first half of the day, I recommend not to rush into buy positions, but to wait until a false breakout forms in the support area of 1.1701, or to open long positions on a rebound from a larger low of 1.1656, based on a correction of 20-30 points within the day.

To open short positions on EUR/USD. you need:

All the bears need is a false breakout in the 1.1749 resistance area, which they defended at the end of last week. In this scenario, together with weak fundamental data for the eurozone countries, we can expect renewed pressure on the euro in order to update the low around 1.1701. Consolidating or settling below this level forms a new entry point for short positions, and the 1.1656 area will be the succeeding target, which is where I recommend taking profits. In case bears are not active in the 1.1749 area, it is best not to rush to sell, but to wait until the larger resistance at 1.1796 has been updated, from where you can sell the euro immediately on a rebound, based on a correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates market uncertainty.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the lower border of the indicator around 1.1700 will increase pressure on the euro. A breakout of the upper border of the indicator in the 1.1730 area will lead to a sharper rise in the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română