US dollar's first reaction to the news about Donald Trump's coronavirus diagnosis was positive. This is where the defensive asset factor came into play. The American currency rose moderately against its major rivals. Only the Japanese yen and the Swiss franc resisted the dollar's growth as their status of safe have assets is stronger than the one of the US dollar.

But when the markets get over the first shock, what their reaction will be? At the moment, the uncertainty around the presidential elections has increased. Trump appears to have contracted the virus from its senior aide Hope Hicks. Friday news reminded that the country is still in the midst of a crisis. Markets are now focusing on the spread of the coronavirus and its impact on the economy. Over the past day, more than 43,000 new cases of infection have been confirmed in the US, and over 850 people have died.

The head of the White House along with the First Lady are now in quarantine. This stops Donald Trump from participating in the planned pre-election events. So, market players have already made their bets. Analysts think that Trump's disease could further weaken his position as a presidential candidate and contribute to the victory of his main opponent Joe Biden. Some market participants are almost sure that a representative from the Democratic Party will become the next US president.

Historically, the US dollar has a tendency to change its trend dramatically when a new president from another party enters the White House.

For example, during the first presidential term of Republican Ronald Reagan, greenback showed a multi-year steep rise thanks to the victory of Fed Chairman Paul Volcker over inflation. A similar situation was observed during the presidency of Bill Clinton, the representative from the Democrats. The US dollar has seriously advanced amid the improvements in the labor market and the reduction of national debt.

When Republican George W. Bush took office, budget deficit deepened, causing the US currency to depreciate. Under Obama, the dollar hit the bottom, but then rose again and has been consolidating ever since.

As for the current possible change of the leader, the following scenario is expected. If Donald Trump loses to Joe Biden, Democrats will win a majority in both houses of Congress. Thus, budget spending in the United States will expand together with the budget deficit, and the US dollar will collapse.

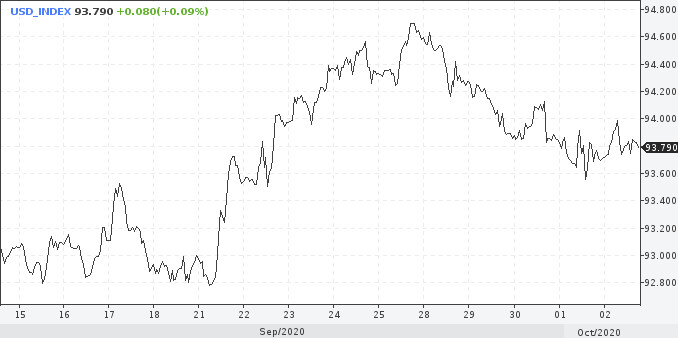

In the meantime, the greenback stays cautious and does not make any serious movements. On Friday, US dollar posted some minor gains while trading between the two important levels. The breakdown of one of them will indicate future prospects of the US currency. If the dollar settles above 94 points, this should help it resume the uptrend. On the other hand, the breakthrough below the mark of 93.75 will indicate the continuation of the downtrend.

At the moment, the markets are driven by the coronavirus news, while the existing positive factors are largely ignored. Thus, markets have downplayed the news about the approval of a $2.2 trillion stimulus package. This Friday, key data on the US labor market was published. This could slightly adjust the dollar's trajectory, depending on investors' expectations. According to the report, the number of new jobs in non-agricultural sectors increased by 877 thousand, while it was projected to rise by 850 thousand. What is more, the US unemployment rate in September fell to 7.9% from 8.4% in August. Markets had expected unemployment to be at 8.2%.

At the moment, investors are closely watching the health condition of the US President. If coronavirus symptoms are mild, Trump will soon be ready to get back to the election race. Besides, if there are no serious consequences for his health, Trump will be able to make bold statements. For instance, he might claim that even elderly people like him can avoid serious complications. So, the criticism of his opponents against his coronavirus policies would have no ground in this case.

If Trumps' disease has a more severe form, like that of British Prime Minister Boris Johnson, everything will get more complicated. The president's energy will decrease and his ambitious plans will be put on halt. Besides, Trump's critics will gain support, and doubting voters might take the side of Joe Biden.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română