GBP/USD

Analysis:

An upward wave has been forming on the chart of the British pound since March. Three weeks ago, the middle part of the wave structure (B) was completed. The rising wave that started later has a reversal potential. It is nearing the end of an interim correction.

Forecast:

Today, the price is expected to move in the corridor between the opposite zones. There may be pressure for support in the European session. You can expect a second ascent by the end of the day.

Potential reversal zones

Resistance:

- 1.2950/1.2980

Support:

- 1.2820/1.2790

Recommendations:

Today, the pound can be traded within trading sessions in the market. The boundaries of the probable move are marked by counter zones. Purchases of the tool remains a priority.

EUR/JPY

Analysis:

The pair's chart has been showing a steady downward trend over the past 2 years. Since June 5, at the end of the next correction, a reversal wave model is formed in the direction of the main trend. The structure of the wave shows a clear zigzag. In the last 2 weeks, an intermediate pullback is formed within the last part.

Forecast:

A mostly bearish movement vector is expected today. In the first half of the day, a short-term price rise in the area of the resistance zone is not excluded. If the nearest zone is breached, a decline to the next support is possible today.

Potential reversal zones

Resistance:

- 123.70/124.00

Support:

- 122.80/122.50

- 121.40/121.10

Recommendations:

There are no conditions for the pair's purchases today. At the end of counter-movements, we recommend selling the pair. It is safer to reduce the trading lot.

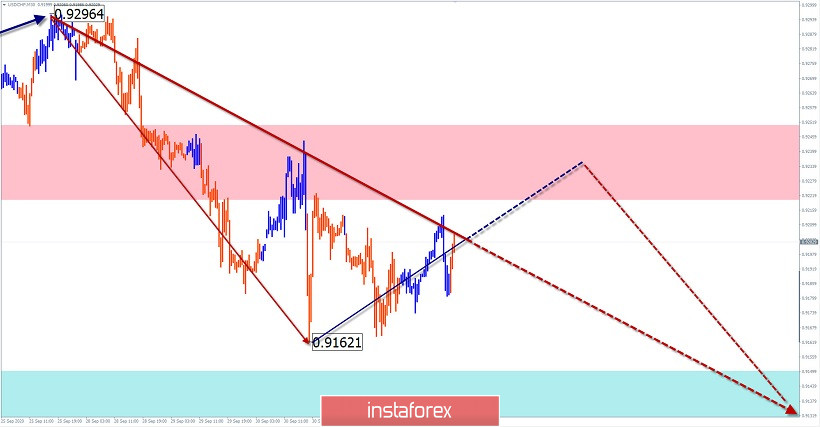

USD/CHF

Analysis:

Since March this year, the Swiss franc chart has been dominated by a bearish trend. Over the past two months, the price has formed a sideways correction. This wave is nearing completion. Since September 25, a reversal pattern has been developing downwards, which may be the beginning of a new wave at the main exchange rate of the pair.

Forecast:

Today, it is expected to move in the price corridor between the nearest zones. In the first half of the day, price growth is likely. A reversal and decline to the support zone can be expected at the end of the day or the beginning of the next trading week.

Potential reversal zones

Resistance:

- 0.9220/0.9250

Support:

- 0.9150/0.9120

Recommendations:

Trading today is only possible within the intraday, with a reduced lot. You should be careful when purchasing. It is more preferable to sell the tool.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română