Yesterday was extremely busy and the foreign exchange market was thrown from side to side. Although the single European currency looked relatively stable. The scale of fluctuations in it was much smaller than in the pound. Although, initially the euro's fall was associated with the pound. The market has been set in motion after news that the European Union is launching litigation with Britain over the UK Internal Market Bill, which violates the Brexit deal. This step came as a complete surprise. Moreover, no one has said anything about it at all for the last couple of weeks. EU representatives even stated that they are ready to put this issue aside for the sake of reaching a compromise. The head of the European Commission, Ursula von der Leyen, generally expressed confidence that a trade deal between London and Brussels would be signed. And now the case goes to court. The negotiations fell through. It is clear that the pound immediately plunged down. And the euro as well. The market experienced a shock.

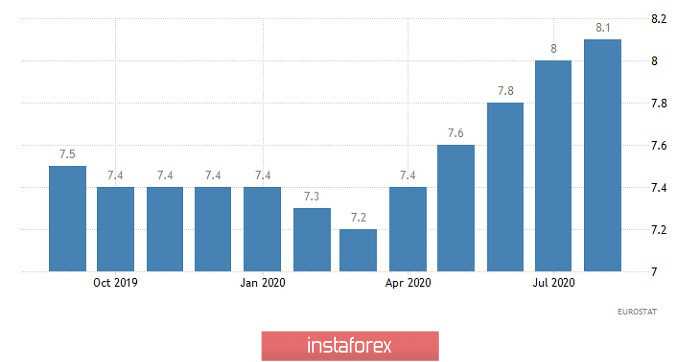

Nevertheless, the euro began to grow after a couple of hours and completely won back the fall. The primary reason was the data on the labor market and producer prices in Europe, which came out better than forecasts. The unemployment rate rose from 8.0% to 8.1%. But they were expecting a rise to 8.2%. Also, the rate of decline in producer prices should have slowed down from -3.1% to -2.6%. In fact, they slowed down to -2.5%. Nevertheless, the data itself is not so upbeat, as it shows a gradual deterioration in the economic situation. However, they are still better than predicted.

Unemployment rate (Europe):

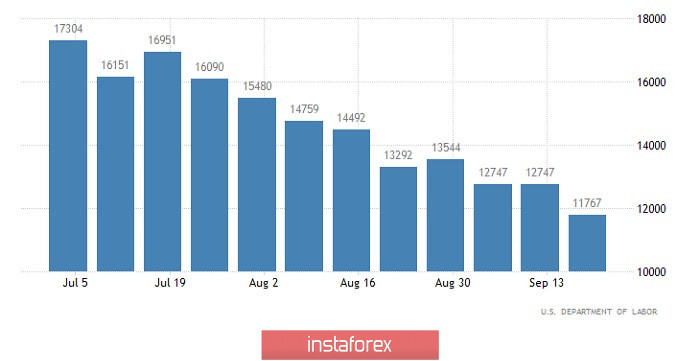

Afterwards, the revision of previous data on applications for unemployment benefits in the United States was released. Naturally, the report was revised towards an increase in the number of applications. However, as soon as the data was published, the euro tumbled with renewed vigor. The number of initial applications for unemployment benefits fell from 873,000 to 837,000. It's all about repeated applications, the number of which decreased from 12,747,000 to 11,767,000. And of course, the data came out much better than forecasts.

Repetitive Unemployment Insurance Claims (United States):

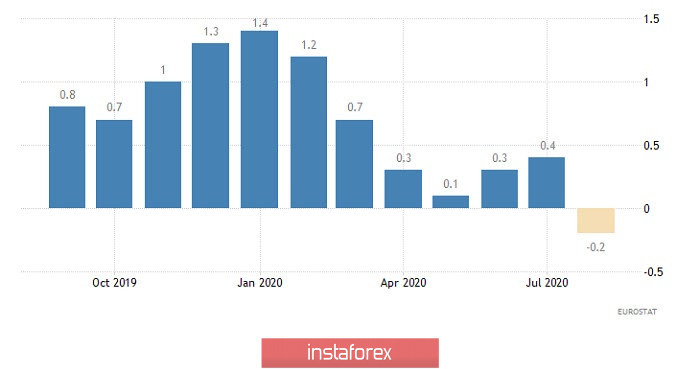

The euro is currently trying to win back some of yesterday's losses. But it looks more like an elementary technical rebound. Most likely, the euro will fall again quite soon. When the preliminary data on inflation in the euro area is released, which should show that the rate of decline in consumer prices accelerated from -0.2% to -0.3%. That is, deflation in Europe is only increasing. And investors do not like such things.

Inflation (Europe):

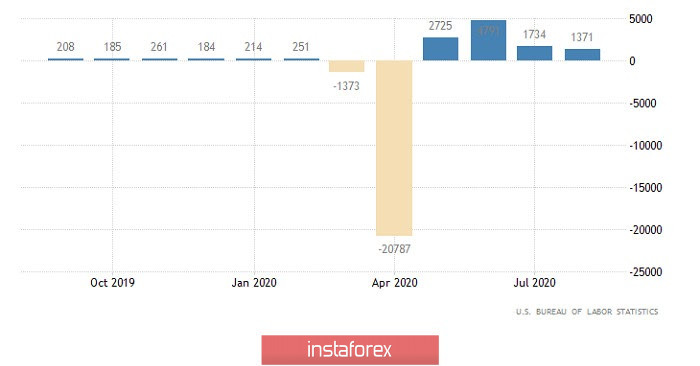

But the content of the US Department of Labor report will undermine the euro's position even more. The unemployment rate is expected to fall from 8.4% to 8.3%. It turns out that the labor market is recovering in the United States, while unemployment is only growing in Europe. In addition, unemployment in the United States should continue to decline, since 915,000 new jobs can be created outside of agriculture. So there will be fewer and fewer unemployed. And this favorably distinguishes the dollar from the euro.

Number of new jobs created outside agriculture (United States):

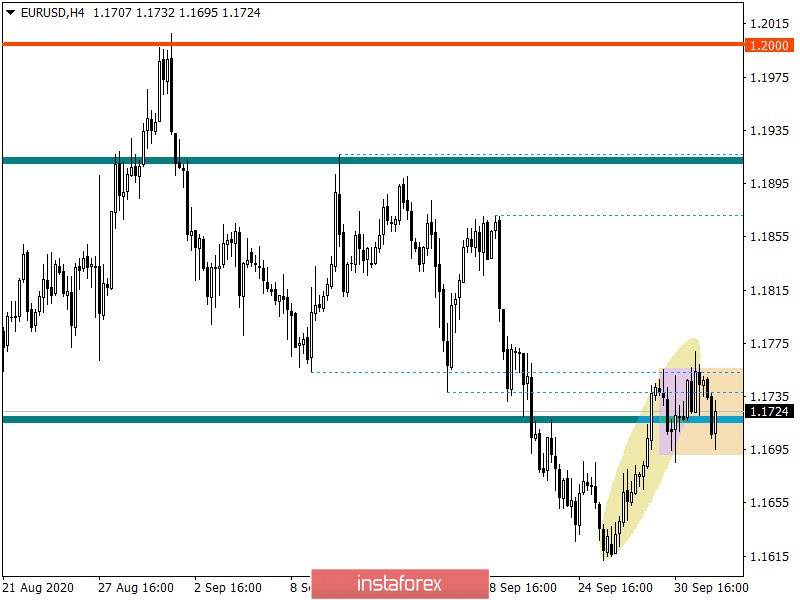

The euro/dollar pair, as before, follows the correction trajectory from the local low of 1.1612, where the 1.1755/1.1770 area is the resistance level. The price consistently rebounding from the area where trading forces interact indicates a possible resumption of the downward interest that was set in the market during the first days of September.

If we proceed from the quote's current location, we can see a fluctuation between the values of 1.1700/1.1755.

A local slowdown is recorded relative to the market dynamics, but we expect a quick acceleration, taking into account the current information and news background.

Considering the trading chart in general terms (daily period), we see the quote returning to the boundaries of the previously passed flat, but taking into account the downward move from September 1, there is still a prospect for a further decline.

We can assume a temporary price fluctuation in the 1.1700/1.1755 range, where there is a high probability of acceleration, which will lead to a breakdown of one or another border. The breakout method will be the best trading tactic, and the points of the highest concentration are 1.1685/1.1775, relative to which it is worth entering the market.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on the minute and hour periods have a variable signal (buy/sell). The daily period, as before, signals a sell, reflecting the scale of the September decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română