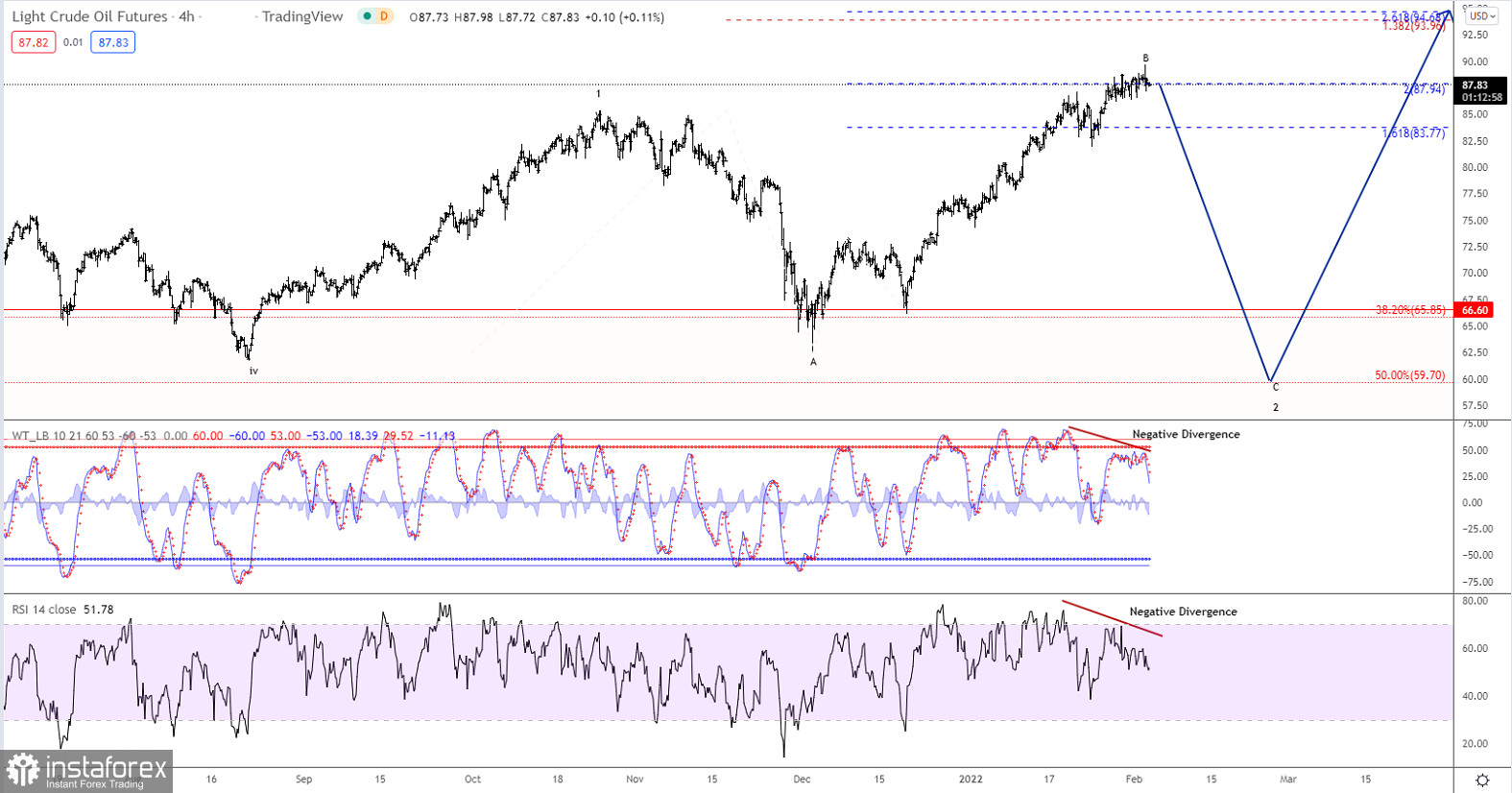

Crude is currently testing the 200% target for the rally from 62.43 to 73.34 at the same time we are seeing a clear negative divergence on both indicators opening for the possibility of a top be nearby and a the possible start of the C-wave lower towards the 50% corrective target near 59.70.

That said we must also accept the possibility of the ongoing B-wave being able to extend its rally closer to the 138.2% target of the length of wave A. This target is near 94 and is a quite common target for an expanded flat correction, which we are in the middle of.

A break below minor support at 86.20 will be the first good warning that the B-wave is complete, while a break below support at 81.90 will confirm the complete B-Wave and that the C-wave lower to 59.70 is in motion.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română