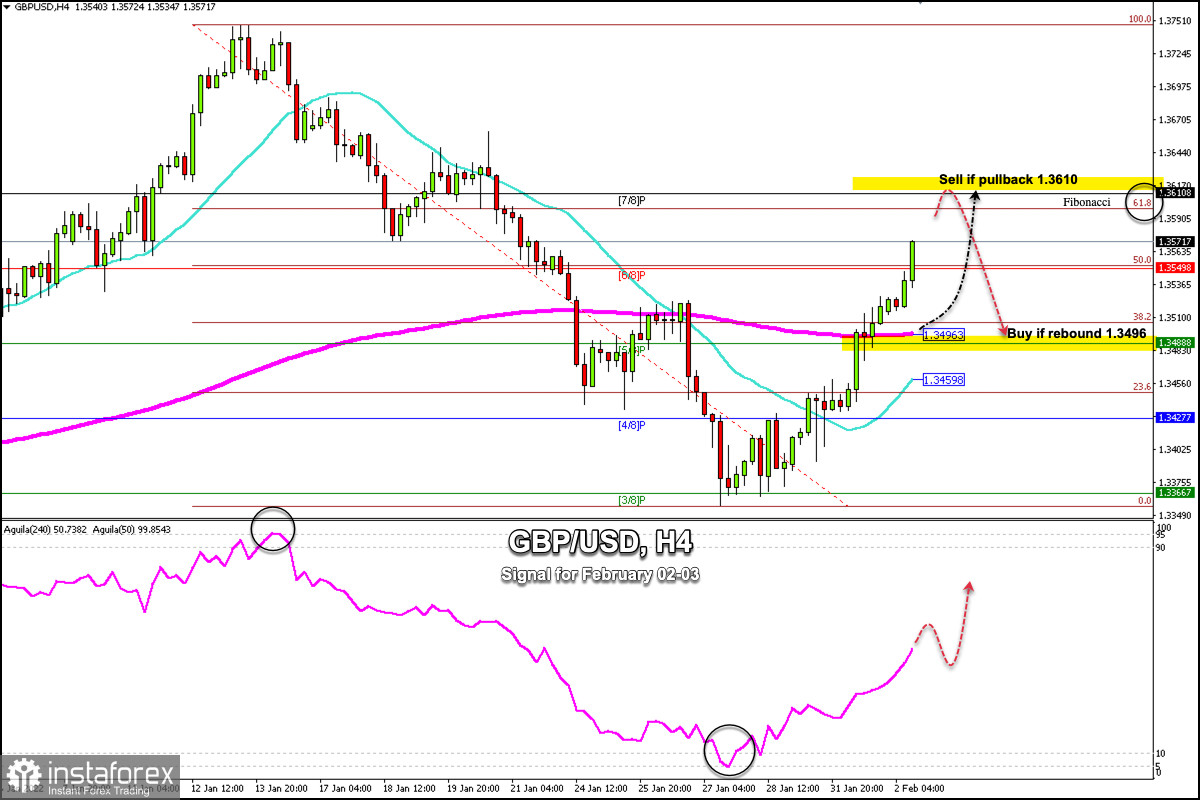

US dollar weakness persists on Wednesday and is helping GBP/USD continue its uptrend. Currently, the pair is trading at 1.3571, prices at time of writing. The pair remains in the high zone, with the bullish tone firm, approaching the level of 61.8% Fibonacci which could be a reversal zone along with 7/8 Murray.

On January 27, the British pound fell to the area of 3/8 Murray around 1.3366. From this level, GBP/USD began a rebound which is now approaching 7/8 Murray and is showing signs of exhaustion.

From a technical viewpoint, the pound turned bullish with the sustained advance above the 23.6% Fibonacci retracement,4/8 Murray and the 21 SMA, all at the same level, which helped the recovery of the pair.

Currently, GBP/USD is trading above the 200 EMA and above the 6/8 Murray. This is a clear sign that the pound could continue its uptrend towards the level 1.3750.

However, the pound should make a technical correction towards the 200 EMA in order to consolidate and gain momentum for another bullish sequence.

The eagle indicator is giving a bullish signal. It is likely that in the next few hours GBP/USD will reach the resistance zone of 1.3610 for a technical correction.

On the other hand, a pullback to the 61.8% Fibonacci (1.3585) or 7/8 Murray located at 1.3610 will be an opportunity to sell with targets at 1.3549 and 1.3488.

Support and Resistance Levels for February 2 - 3, 2022

Resistance (3) 1.3645

Resistance (2) 1.3610

Resistance (1) 1.3586

----------------------------

Support (1) 1.3549

Support (2) 1.3518

Support (3) 1.3488

***********************************************************

Scenario

Timeframe H4

Recommendation: sell below

Entry Point 1.3610 or below 1.3586

Take Profit 1.3549 (6/8), 1.3488 (5/8)

Stop Loss 1.3640

Murray Levels 1.3610 (7/8) 1.3549 (6/8) 1.3488(5/8) 1.3427 (4/8)

***************************************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română