To open long positions on EURUSD, you need:

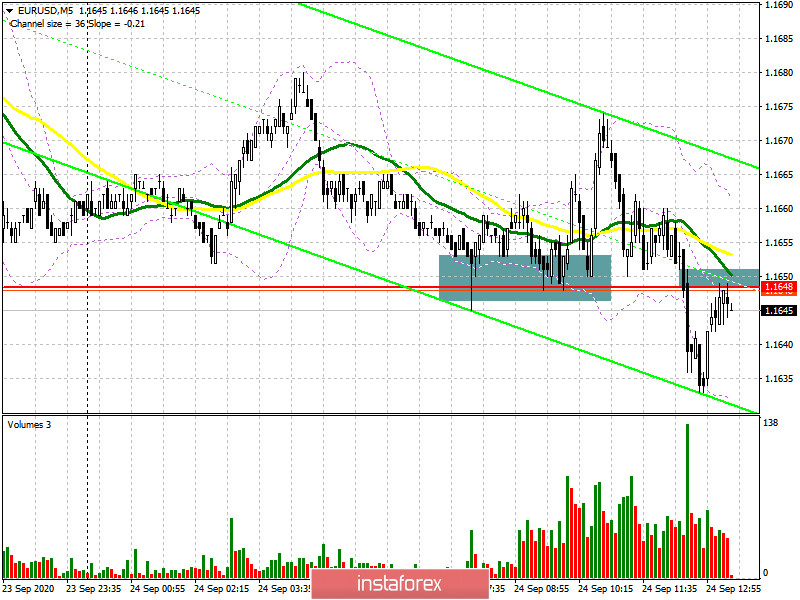

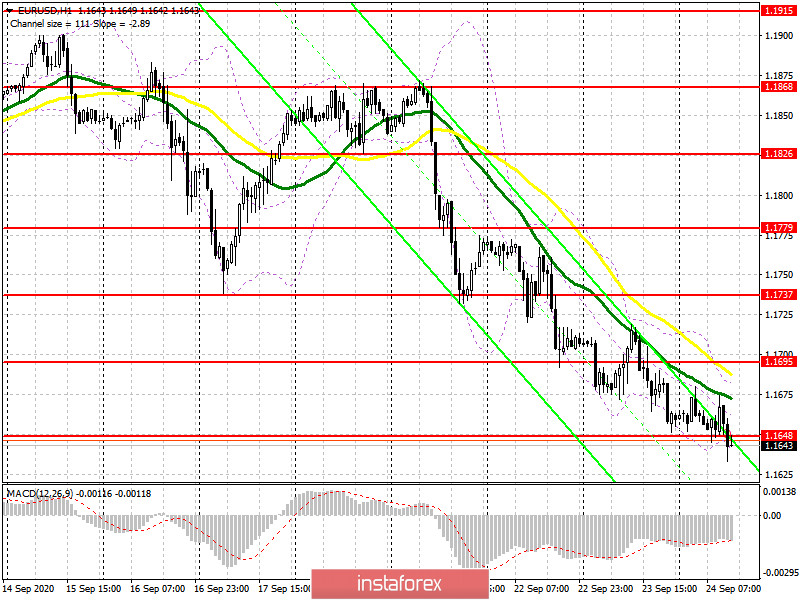

The active struggle for the level of 1.1648 continues, as the morning data on confidence in the German business community could be interpreted in two ways. On the one hand, growth has continued, but on the other hand, the rate is slowing down, which is a more significant point of this indicator. That is why the bulls failed to continue the upward correction for the euro in the first half of the day. On the 5-minute chart, the bulls make the formation of a false breakout at the level of 1.1648 and then do not let the pair below this range, forming a signal to buy the euro. However, we did not see a movement of more than 20 points, and as the pair fell back to the support of 1.1648, the enthusiasm of buyers also fell. At the moment, the level of 1.1648 is missed, and the main task of the bulls for the second half of the day will be to return this range. Only growth above 1.1648 and a reverse test of this area from top to bottom forms a new entry point for long positions to restore EUR/USD to the first resistance level of 1.1695 where the 50-day moving average feels great. We can talk about a larger growth of the euro only after fixing above the level of 1.1695 with the main goal of updating the maximum of 1.1737, where I recommend fixing the profits. If the pressure on EUR/USD persists in the second half of the day, it is better not to take any risks, but wait for the pair to fall to the support area of 1.1585 and open long positions from there immediately for a rebound in the expectation of correction of 30-40 points within the day.

To open short positions on EURUSD, you need to:

Sellers keep the market under their control and have already managed to return the pair to the level of 1.1648, testing it from the bottom up. Updating this area on the reverse side is a signal to open short positions in the euro, the main goal of which is the area of 1.1585, where I recommend fixing the profits since this level is not as simple as it seems. In the scenario of EUR/USD growth back at 1.1648 in the second half of the day, it is better to get out of short positions and focus on the resistance of 1.1695. However, I recommend selling from it only if a false breakout is formed, which will again return pressure on the euro and lead to a repeated return to the area of the week's low of 1.1648. In the scenario of the euro's growth in the first half of the day above the resistance of 1.1695, where the moving averages play on the side of the bears, it is best to postpone sales until the update of the larger resistance of 1.1737 and open short positions from there immediately on the rebound in the expectation of a downward correction of 20-30 points by the end of the day.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates continued pressure on the euro and the formation of a bear market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

Only a break of the lower limit of the indicator in the area of 1.1640 will lead to a larger decline in the euro. A break of the upper limit in the area of 1.1680 may strengthen the upward correction for the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română