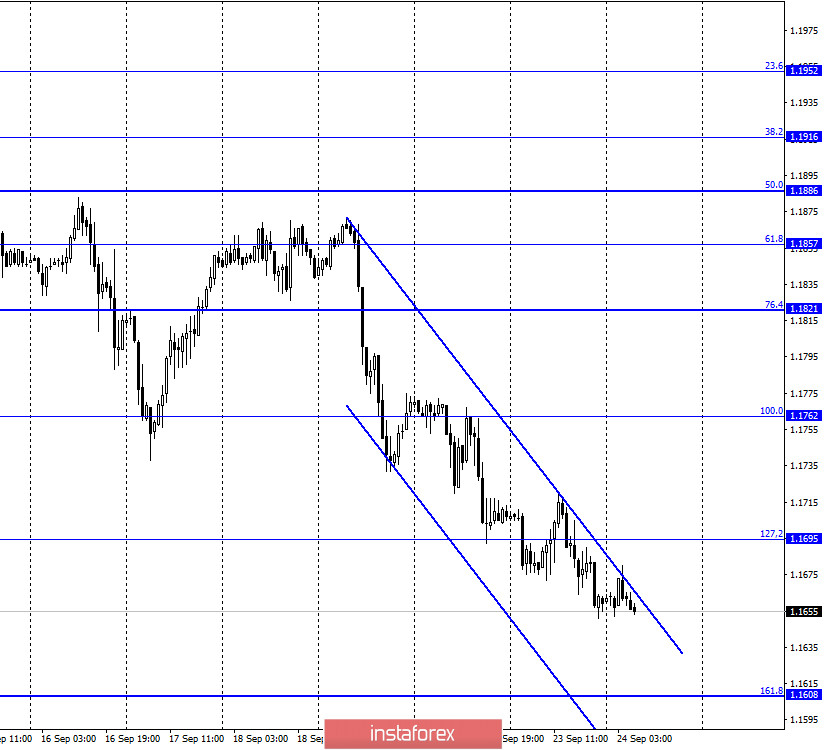

EUR/USD – 1H.

On September 23, the EUR/USD pair continued to fall within the downward trend corridor. Thus, the pair's fall may continue in the direction of the corrective level of 161.8% (1.1608). Closing the pair's rate above the trend corridor will work in favor of the European currency and start growing in the direction of the corrective level of 127.2% (1.1695). The entire current week is fully focused on the speeches of Fed Chairman Powell and Treasury Secretary Mnuchin in various committees of the US Congress. The first performances have already taken place and it is quite difficult to characterize them from a positive or negative side. Rather, the heads of their departments outlined the current state of affairs to Congress. Both said that the economic recovery lies entirely in the fight against the coronavirus, and the US economy requires an additional monetary stimulus to continue the recovery. Both Powell and Mnuchin noted the recovery's high growth rate, however, they also acknowledged that a return to pre-crisis levels is still a long way off. "We still have 11 million people out of 22 million who were laid off in March and April. There is still a lot of work to be done, but the process will go faster if the government works together," said Jerome Powell. The US dollar shows growth and does not pay attention to the rhetoric of Powell and Mnuchin. Or traders simply interpret it as neutral.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair were fixed under the side corridor. Thus, the process of falling can be continued in the direction of the next corrective level of 100.0% (1.1496). The pair's quotes broke out of the side corridor after two months of staying in it. Today, the divergence is not observed in any indicator.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the US dollar, fixing under the corrective level of 261.8% (1.1825). Thus, now the chances of continuing the fall in the direction of the Fibo level of 200.0% (1.1566) have significantly increased.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 23, the European Union and America released indices of business activity in the services and manufacturing sectors. Indices for the services sector in Germany and the EU were significantly worse than expected, and for the manufacturing sector - much better. In America, both areas showed a decent result.

News calendar for the United States and the European Union:

US - Number of primary and secondary applications for unemployment benefits (12:30 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (14:00 GMT).

US - Treasury Secretary Steven Mnuchin will deliver a speech (14:00 GMT).

On September 24, the calendar of economic events of the European Union does not contain important reports and speeches. All the most interesting things will happen again in the US.

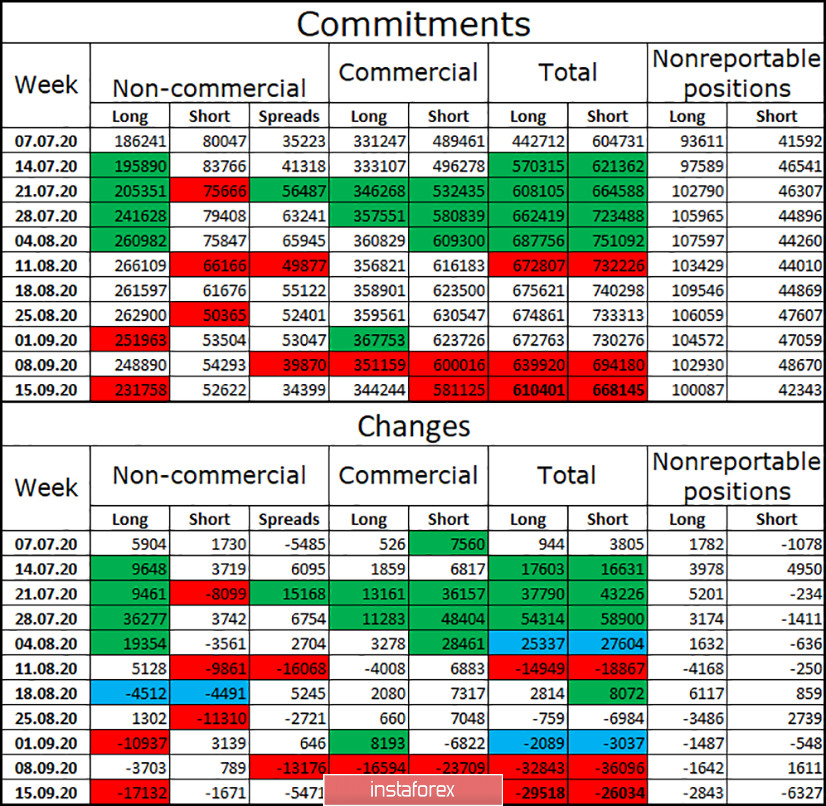

COT (Commitments of Traders) report:

The latest COT report was very interesting. During the reporting week, the "Non-commercial" group got rid of 17 thousand long contracts and only 1.7 thousand short ones. Thus, the mood of major speculators began to change to "bearish". The total number of long contracts focused on the hands of speculators is 231 thousand - against 52 thousand short contracts. Thus, the advantage is still with the bulls, however, it is beginning to decrease. Over the past three weeks, the "Non-commercial" group has closed almost 30 thousand long contracts, which significantly increases the probability of a fall in the European currency in the near future. However, the number of short contracts has also decreased in the last two months - from 80 thousand to 50 thousand. Thus, the euro may start the process of falling, however, it is unlikely to be strong.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1608, as it was closed under the side corridor on the 4-hour chart. I recommend buying the pair if it closes above the descending corridor on the hourly chart with a target of 1.1695.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română