GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair quotes have consolidated under the corrective level of 161.8% (1.2789) and continue the process of falling towards the next Fibo level of 200.0% (1.2625). The downward trend corridor characterizes the current mood of traders as "bearish", and so far traders have not managed to close above the corridor. In recent days, the information background from the UK has subsided a little. At least the background that concerned the controversial law, as well as the Brexit negotiations. But these two topics were immediately replaced by the topic of a new coronavirus outbreak in Britain. The country has already reached spring levels of morbidity. For example, on September 22, almost 5 thousand cases of infection were recorded in Britain. Thus, the fall in the British dollar's quotes can be continued based on this factor. It also became known that the UK Parliament will vote on the new bill no earlier than December. London and Brussels will likely try to hold several more rounds of negotiations on a trade deal in the near future. Moreover, if they also fail, then after the EU summit in mid-October, it will already be known exactly whether a deal will take place between the parties or not.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair fell to the corrective level of 61.8% (1.2720). Closing the pair's rate below this level will work in favor of continuing the fall towards the next corrective level of 76.4% (1.2543). The downward trend corridor supports bear traders on the 4-hour chart as well. Closing the pair's rate above it will allow you to count on a reversal in favor of the British currency and some growth. The emerging divergence in the MACD indicator increases the probability of a reversal in the near future.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a consolidation under the corrective level of 76.4% (1.2776). Now traders can expect a further drop in quotes in the direction of the corrective level of 61.8% (1.2516).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

On Tuesday, the UK also released indices of business activity in the services and manufacturing sectors, which were slightly worse than traders' expectations. Thus, the Briton could continue to fall due to these reports.

News calendar for the US and UK:

Great Britain - Bank of England Governor Andrew Bailey will deliver a speech (14:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (14:00 GMT).

US - Treasury Secretary Steven Mnuchin will deliver a speech (14:00 GMT).

On September 24, Steven Mnuchin, Jerome Powell, and Andrew Bailey will speak. Thus, the information background for the pair today can be very strong.

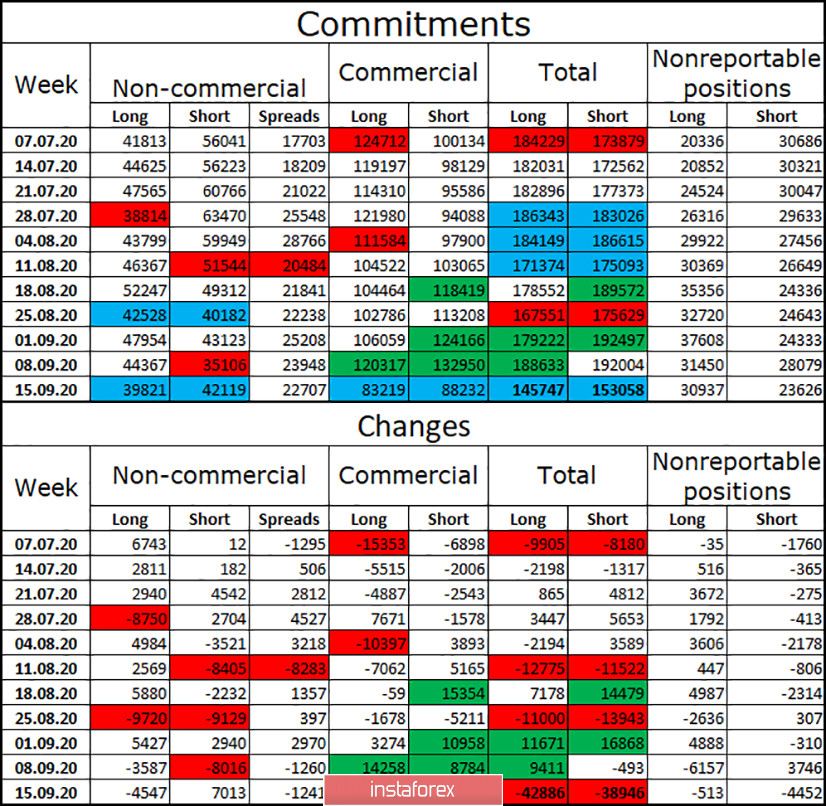

COT (Commitments of Traders) report:

The latest COT report on the British pound, released last Friday, was much more logical than the previous one. This time, the report showed that the "Non-commercial" group reduced the number of long contracts on its hands by 4,547 units and opened 7,013 short contracts. Thus, the mood of the most important group (the group of professional speculators) became more "bearish" during the reporting week. Given that the British pound has fallen by 700 points since September 1, this behavior of the "Non-commercial" group is logical. The "Commercial" group (hedgers) managed to close about 80 thousand contracts during the reporting week, in equal shares of short and long. For comparison, 80 thousand contracts are more than the total number of contracts currently in the hands of speculators. Thus, the attractiveness of the British in the eyes of major traders begins to decline quite strongly.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.2625, as the close was made at the level of 161.8% (1.2789) on the hourly chart. I do not recommend opening purchases of the British currency until the quotes are fixed above the downward trend corridor on the hourly chart or before they are fixed on the downward trend corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română