The bears of EUR/USD pair still pushed through the support level of 1.1730 (the upper border of the Kumo cloud, coinciding with the lower line of the Bollinger Bands indicator on the daily chart), followed by testing the area of the 16th figure. From a technical viewpoint, sellers have opened their way to the lower border of the above cloud, that is, to the psychologically important level of 1.1600. On the other hand, looking from the point of view of foundation, we now have all the prerequisites to reach this level, amid the stronger dollar and uncertain positions of the euro. In turn, the PMI data published today put additional pressure on the Euro, indicating the downward prospects for the EUR/USD in the medium-term.

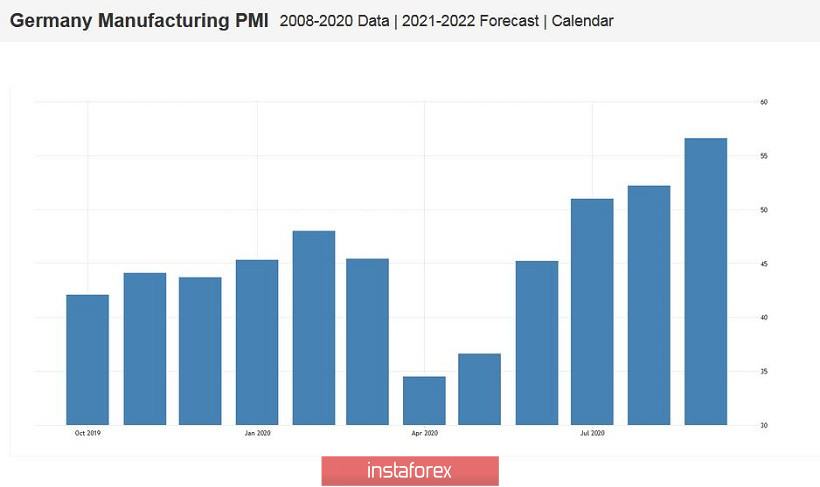

So, PMI indices were published today in Europe, which reflected a certain trend: the manufacturing sector is growing, while the service sector is rapidly declining, finding itself in the "red zone". Moreover, we learned about September's preliminary data, and so, we can draw certain conclusions about the dynamics of larger macroeconomic indicators.

For example, the PMI in the manufacturing sector in France rose slightly and crossed the key 50-point mark again, reaching 50.9 points. Throughout the last June and July, the index reflected an increase in production, but the August result was disappointing. It fell below the key level, reaching 49.8 points, which was contrary to the forecasted growth of 53 points. But the situation in the field of services looks much worse: the indicator slowed to 47.5 points, while it rose to 51.5 points in August.

At the same time, German values showed a similar trend: PMI in manufacturing rose to 56 points (annual high), but in services, it slowed to 49.1 points, with a growth forecast of 55 points.

The pan-European PMI indices followed the course of the above indicators: the indicator grew to 53 points in the manufacturing sector, while it fell to 47.6 points in the service sector. This is the worst result since May this year. The published figures put significant pressure on the single currency, despite the growth of the German manufacturing PMI. In general, the indicators reflected the current situation related to the spread of coronavirus in European countries. Germany, Spain, the Czech Republic, the Balkans and even the Scandinavian countries are tightening quarantine restrictions again, and the service sector is known to be the most vulnerable in this context.

It is also worth recalling that the Euro is under background pressure from the ECB, since Christine Lagarde recently criticized the exchange rate of the currency, saying that euro's high rate negatively affects inflationary processes. Her speech was "dovish" and pessimistic. Therefore, there is no reason for the single currency to recover this time.

Meanwhile, the US currency continues to receive certain "preferences". Initially, it began to be in demand as a protective tool, in view of rising cases of coronavirus in the European Union and Asia. The global economy has been hit again, and the dollar is back in favor. But these are the general prerequisites for the growth of the US currency.

It is also being supported by the recent events in the US. First, US Treasury Secretary Steven Mnuchin, announced at the House Financial Services Committee that the White House continues to work with Congress to pass an economic aid package. However, he assured that the administration "is ready to come to a bipartisan agreement." Thus, the dollar bulls became hopeful again on this issue, and after which the investors became more attracted to the dollar.

In addition, the US House of Representatives approved a bill today to temporarily fund the Federal government until December 11. This document was sent to the Upper House of Congress (which is known to be controlled by the Republicans) ahead of the statutory deadline. Moreover, the leader of the House of Representatives, Nancy Pelosi (representative of the Democratic Party) announced that there are agreements with the Minister of Finance and the Republicans on the expenditure side of the bill. In other words, American politicians avoided the risk of a shutdown before the presidential elections, thereby supporting the dollar. However, it could be completely different, given the strength of political passions in Congress. For example, the confrontation between the White House and the House of Representatives began on December 22 last year and ended only 35 days later. The parties were only able to get out of the political clinch as January started. Trump went down in history as a president under whom the government did not function for a record time. This time, the collapse was avoided – at least, the presidential election will not be held against the background of a shutdown.

Thus, the current fundamental background encourages the EUR/USD pair to consolidate within the 16th figure and test the nearest support level of 1.1660 (the lower line of the Bollinger Bands on the four-hour chart), in order to subsequently decline below the 16th price level. Therefore, the corrective rally in the price (which is driven by the rise in the German manufacturing PMI) can be used to open short positions towards the support levels of 1.1660 and 1.1600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română