At yesterday's trading, the main currency pair of the Forex market continued its downward trend. The US currency is still supported by the global situation with the spread of COVID-19, as well as statements by Fed officials regarding further stimulation of the world's leading economy.

In European countries, there is a sharp deterioration in the spread of the coronavirus pandemic, where the focus of infection is the Spanish capital of Madrid. The situation is not the best in such countries as the Czech Republic, Greece, Germany, and some others. The Czech Health Minister was forced to resign under the pressure of criticism that he did not cope with the spread of a new type of coronavirus infection. In Germany, for the first time in many decades, a popular beer festival in Munich was canceled. Cinemas, night clubs, and many other places are closed in Greece. The situation is no better in France, where the daily increase in infected people ranges from 1000-1300 people. European society is divided into two camps. Some criticize their governments for failing to deal with COVID-19 and failing to take precautions that they consider ineffective. Others continue to comply with them and hope that this will protect them from infection.

As for the Federal Reserve System (FRS), the head of this department did not say anything new during his speech yesterday. Jerome Powell repeated his lampoon about the significant deterioration of the US economy since the start of the coronavirus pandemic, which has sent the world's leading economy into recession. Nevertheless, the head of the Fed believes that the measures already taken can improve the current uncertain situation.

If you look at today's economic calendar, the main macroeconomic statistics from the Eurozone and the United States will be the publication of the business activity index for the manufacturing and services sectors. You should also pay attention to the speech of a member of the Open Market Committee of the Federal Reserve Mester. More information about these and other events can be found in the economic calendar itself.

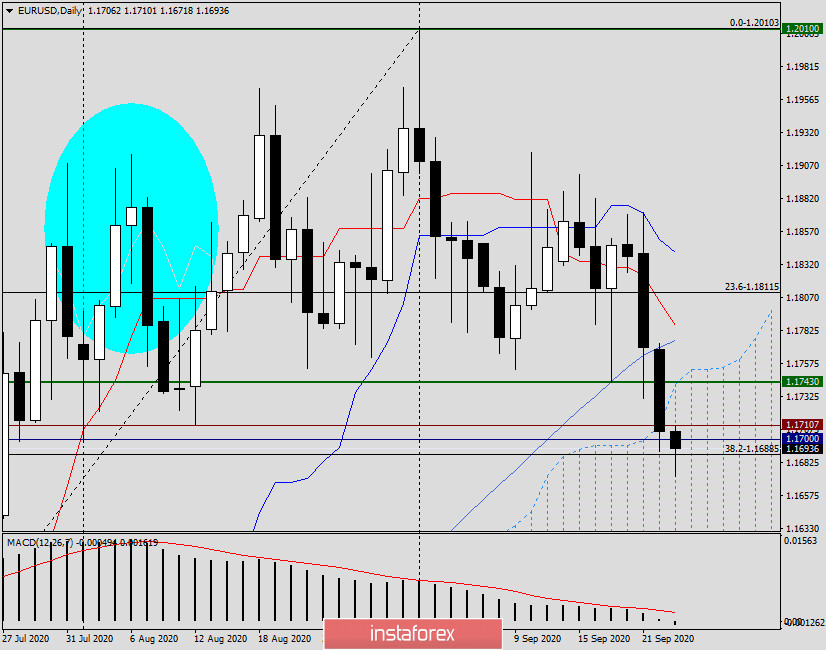

Daily

As a result of the downward trend, the support line of 1.1743 was broken, and trading on September 22 closed at 1.1706. This was to be expected at least by the way the market cautiously probed support at 1.1753 and 1.1743, alternately piercing these levels. Today, at the time of writing, the euro/dollar continues to be under selling pressure and is trading near 1.1686. Thus, there are attempts to break the key support level of 1.1700. If the bears on the pair manage to push through this level and end today's session below it, the first and very important step will be taken to a true breakdown of this important mark. Now it remains to determine the positioning.

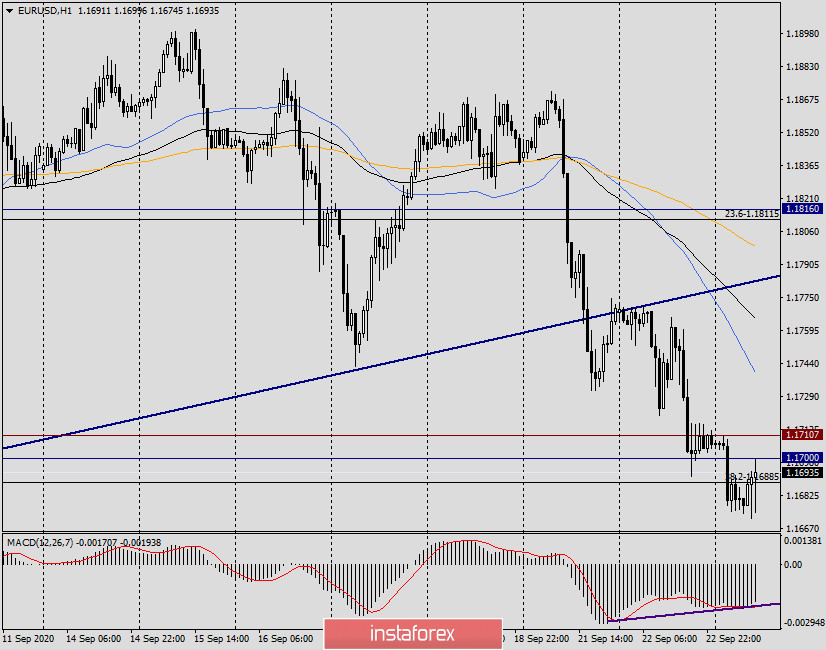

H1

Since the level of 1.1700 is quite important and strong, I do not rule out that the pair may return to it and even try to climb higher, making the expected pullback by many. If this happens, then when you rise to the price zone of 1.1700-1.1740, I recommend looking at sales, especially if bearish candlestick patterns appear in the designated area, which signals the completion of the pullback and the readiness of the quote to continue moving in the south direction. Judging by the bullish divergence of the MACD indicator, the option with a rollback to the selected zone may well be implemented. I suggest that we stop there, since there are no signals for purchases yet, and they are against the current rather obvious downward movement. Further, I consider it inexpedient and technically wrong to sell at the very bottom of the market, and even at the breakout of such an important level as 1.1700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română