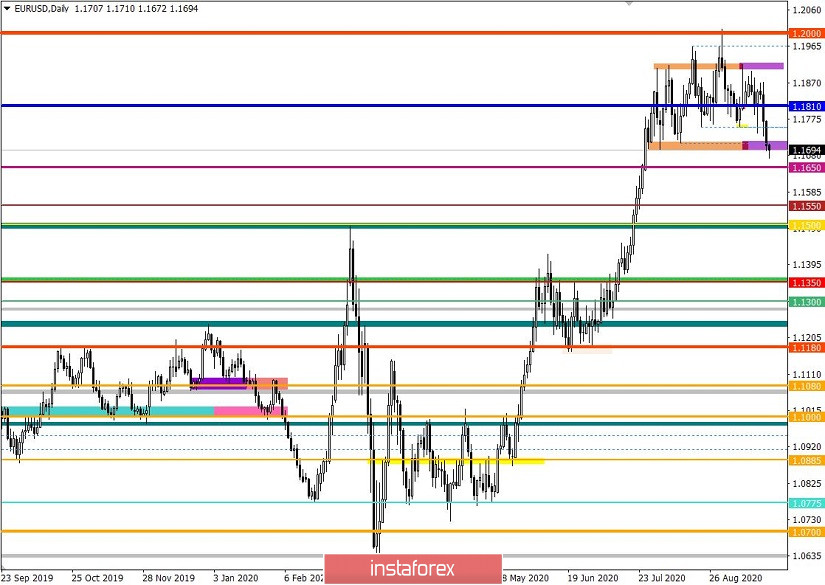

The quotes consolidated below the level of 1.1680, renewing the local low in EUR / USD. This indicates that there may be an impending drastic change in the medium-term upward trend, provided that market participants continue to work with short positions.

Thus, it is now clear that the earlier flat market constitutes a slowdown in the medium-term trend, and the recent breakout in the lower limit is a signal for numerous sell positions in the market.

Given these indications, the prospects of a decline is now high, and if the assumption about the change of direction coincides, then the euro will most likely go down to the area of 1.1000 / 1.1350.

So, if we look at the M15 chart, we will see that the market has a bearish sentiment all day yesterday, as a result of which the quotes reached a price level of 1.1700. Afterwards, it moved even lower in the chart, updating the local low in EUR / USD.

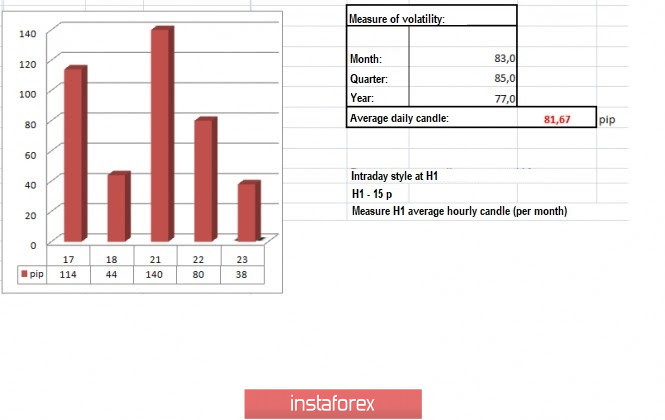

[The highest spike in short positions occurred between 14:30 and 16:00]

In terms of daily dynamics, the indicator recorded a value equal to the average level, however, if we take into account the hourly activity, we can safely say that there is a high coefficient of speculative transactions in the market.

This is because as discussed in the previous review , traders are counting for a further drop after a consolidation below 1.1700.

As for the daily chart, the movement of the quotes is clearly downwards, and within it, the seven-week side channel is the pivot point for the trend change.

With regards to news, one important report was the data on home sales in the US secondary market, which increased by 2.4%, well above the forecast of just 0.9%.

Such high statistics was very positive for the US economy, however, the main impetus for the dollar's growth was the rising COVID-19 incidence rate in many countries.

Many states have already re-introduced quarantine measures, ergo, investors are afraid of another economic collapse, especially since a widespread lockdown or quarantine is very detrimental to the global economy.

In this regard, Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell said that the current aid programs in the United States help a confident economic recovery, however, there is a need for additional funds.

"The recovery is progressing at a strong pace because the administration and the Congress worked together on a bipartisan basis to deliver the largest economic aid package in American history. The Fed also played an important role in the recovery, introducing 13 unique lending mechanisms," Steven Mnuchin said.

Jerome Powell agreed and said that full recovery is likely to come only when people are confident that it is safe to return to a wide range of activities. Hence, the future depends on the eradication or control of the coronavirus, as well as on the political actions taken at all levels of the government.

Today, reports on euro area and United States PMI are published, which revealed that:

EU 09:00 - Manufacturing PMI (September)

Previous: 51.7

Forecast: 51.9

Actual: 53.7

EU 09:00 - Index of business activity in the services sector (September)

Previous: 50.5

Forecast: 50.5

Actual: 47.6

US 14:45 - Index of business activity in the manufacturing sector (September)

Previous: 53.1

Forecast: 53.1

US 14:45 - Index of business activity in the services sector (September)

Previous: 52.0

Forecast: 54.1

Further development

As we can see on the trading chart, the quotes fluctuated within price levels 1.1670 / 1.1710, which can be considered as a stage of consolidation at new levels. The renewal of local low can mean an upcoming strong decline in the EUR / USD pair, due to which a consolidation below 1.1670 will drop the quote to 1.1650, and then to 1.1550-1.1500.

In the case of a slowdown, movement may stretch from 1.1670 / 1.1710 to 1.1670 / 1.1760.

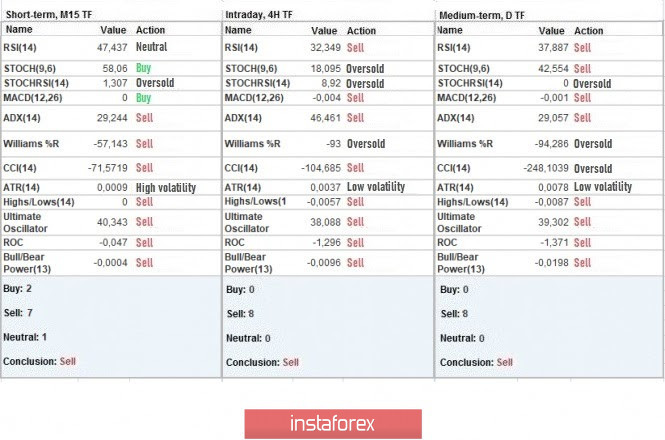

Indicator analysis

All time frames (TF) are signaling SELL due to the recent renewal of the local low in EUR / USD.

Weekly volatility / Volatility measurement: Month; Quarter; Year

Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year.

(The dynamics for today is calculated, all while taking into account the time this article is published)

Volatility is at 38 points, which is 53% below the average value.

It is assumed that if the quote remains trading below the sideways channel, short positions will arise, which will create high activity in the market.

Key levels

Resistance zones: 1.1910 **; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825.

Support Zones: 1.1700; 1.1650 *; 1,1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***.

* Periodic level

** Range level

*** Psychological level

Also check trading recommendations for the GBP / USD pair here , or brief trading recommendations for the EUR / USD and GBP / USD pairs here .

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română