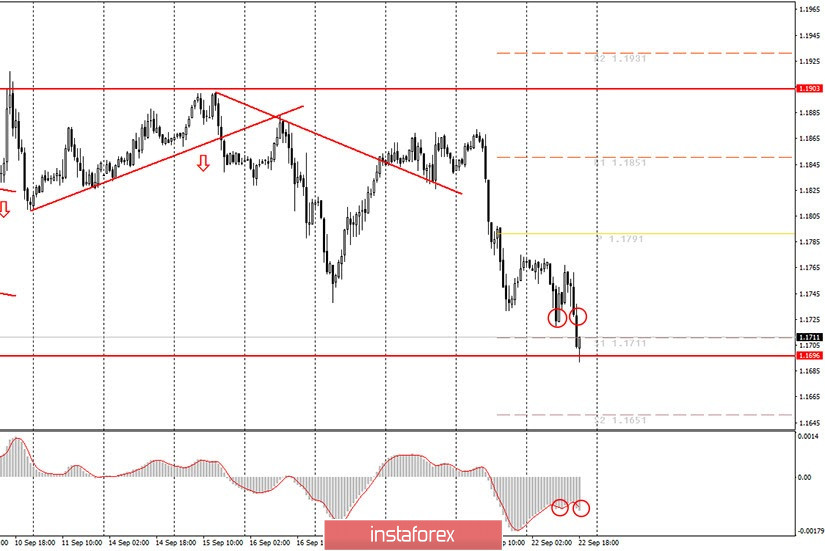

Hourly chart of the EUR/USD pair

Instead of a normal correction, the EUR/USD pair continued to move down on Tuesday, September 22, and by the end of the day it reached the lower boundary of the horizontal channel at 1.1700-1.1900. The price has reached the extreme lower point of the horizontal channel, below which it will be possible to count on the resumption of the downward movement. True, it has not yet been possible to overcome this line. Thus, it is quite possible that a rebound will follow, the euro/dollar pair will start a new round of upward movement, and therefore, the relevance of the horizontal channel will be preserved. We mentioned in our morning review that it is more convenient to consider buying the pair in the lower area of the horizontal channel. However, we have already pointed out more than once that no trend lines or channels within the 1.17-1.19 range have appeared in recent days, so any signals from the MACD are weak and unconfirmed. Today the price turned down very quickly, and the MACD indicator, due to the fact that it wasn't near the 0 mark, failed to react to the completion of the upward movement in time. We generally advise novice traders to not consider selling the currency pair today. And, as you can see, this was very difficult to implement, since both sell signals from the MACD appeared very late, again because the indicator did not have time to discharge enough and return to the zero mark. Therefore, it was extremely difficult to trade today.

The fundamental background was quite interesting on Tuesday, as Federal Reserve Chairman Jerome Powell made a speech in the US Congress, and the text of his speech was publicized much earlier than the speech itself. Powell attaches great importance to the coronavirus pandemic, the government's fight against it, and he connects the prospects of the American economy with its outcome. In other words, Powell believes that the US economy will not be able to fully recover without defeating the epidemic. In addition, Powell called on the US Congress to approve a new stimulus package, in other words, new cash injections into the economy, which Democrats and Republicans are still fighting over.

Powell will deliver another speech in the US Congress on Wednesday, September 23, but this time in front of a different committee. Powell speaks to Congress twice a year, so we can confidently say that both texts of his speech are the same. Thus, there is no point in expecting any new information tomorrow. Today markets have barely noticed his speech. Most likely it will be the same tomorrow. In addition, the European Union and America will release business activity indices in the manufacturing and services sectors, which may affect the movement of the euro/dollar pair only if they go below 50.0 (below this mark it is believed that a decline has begun in one area or another ). Judging by experts forecasts, no field in any country will go below 50.0.

Possible scenarios for September 23:

1) Novice traders are still not recommended to place buy positions at this time, since there isn't a single signal. Although, it is more convenient to consider buy orders from the lower area of the 1.17-1.19 horizontal channel. Especially after the pair fell by around 170 points and reached the lower channel line. Thus, at a minimum, to open buy positions for the pair, you need to wait for the price to rebound from the 1.1700 level. And even in this case, you are still advised not to forget about the Stop Loss level.

2) Selling does not seem appropriate at all at this time, since the pair has already gone down 170 points and is currently trading near the lower border of the horizontal channel. Therefore, novice traders are recommended either to wait for the price to settle below the horizontal channel and, accordingly, for a new downward trend to appear, or you can wait for quotes to return to the upper area of the channel, from where you can again trade for a fall.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română