On January 24, Bitcoin fell to the low of July 24, 2020 around 32,839.

Since its fall around the zone of 33,000, BTC has managed to recover gaining more than 20%. Currently it is trading at 38,383.

After the Federal Reserve's decision was announced, BTC lost its appeal and investors stopped investing in this risky asset and turned to safe-haven assets.

It is likely that in the coming weeks BTC will come under downward pressure again as the Central Bank promised an increase in interest rates of up to 4 times. The first rate hike is forecast for March.

With an increase in the interest rate, Bitcoin could return to price levels of 30,000, and a break of this psychological level could accelerate the fall to 25,000

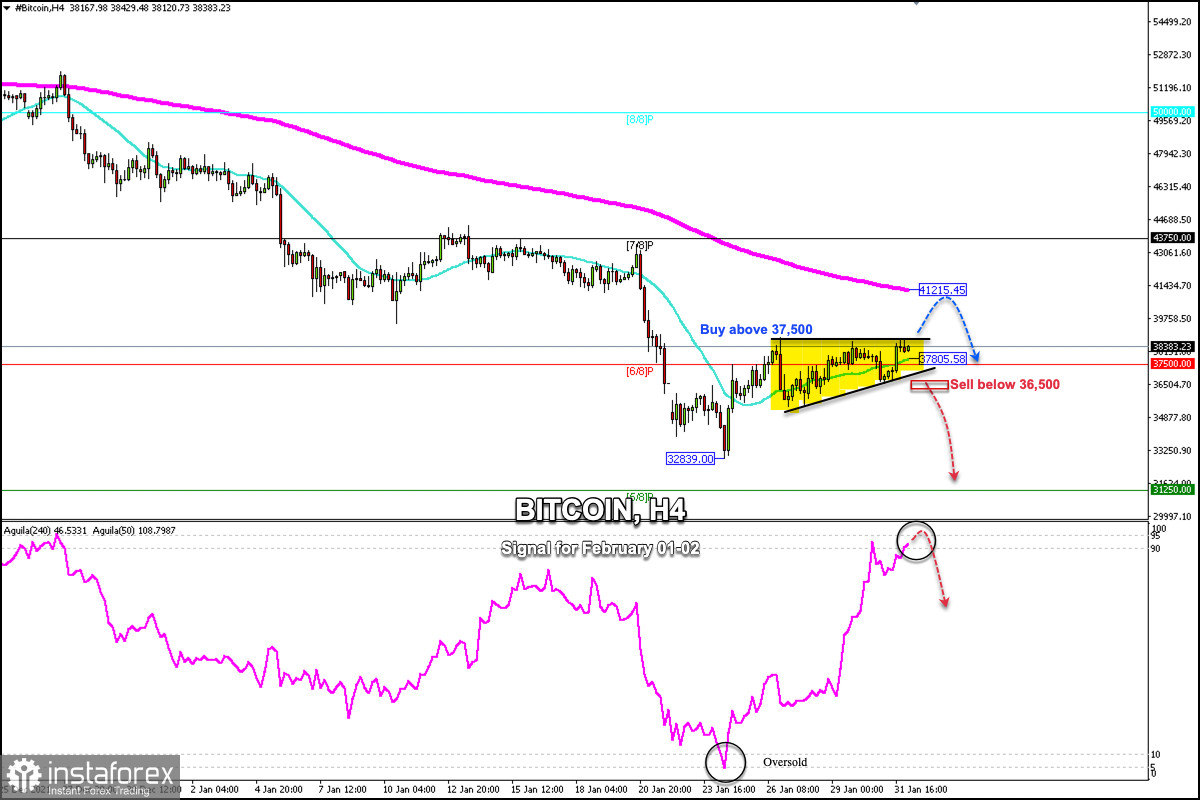

In the short term, according to the 4-hour chart, BTC is showing a positive bias. It is located above the 6/8 Murray and above the 21 SMA. The target of Bitcoin in the short term is to reach the EMA 200 located at 41,215.

As long as BTC remains below the 200 EMA located at 41,215, the overall trend will remain bearish. This recovery that we see these days will be considered a technical correction and BTC could resume its dominant downtrend.

We can see the formation of a bullish wedge. If it breaks below 36,500, it will confirm a new bearish cycle so that the price could reach the support of 5/8 Murray around 31,250.

Our trading plan for the next few hours is to buy above 6/8 Murray around 37,500 with targets at the psychological level of 40,000 and up to the 200 EMA at 41,215.

Support and Resistance Levels for February 1 - 2, 2022

Resistance (3) 41,302

Resistance (2) 40,053

Resistance (1) 39,168

----------------------------

Support (1) 37,500

Support (2) 36,446

Support (3) 34,889

***********************************************************

Scenario

Timeframe H4

Recommendation: buy above

Entry Point 37,500 or above

Take Profit 40,000; 41,215 (200 EMA)

Stop Loss 36,500

Murray Levels 31,250 (5/8) 37,500 (6/8) 43,750 (7/8) 50,000 (8/8)

***************************************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română