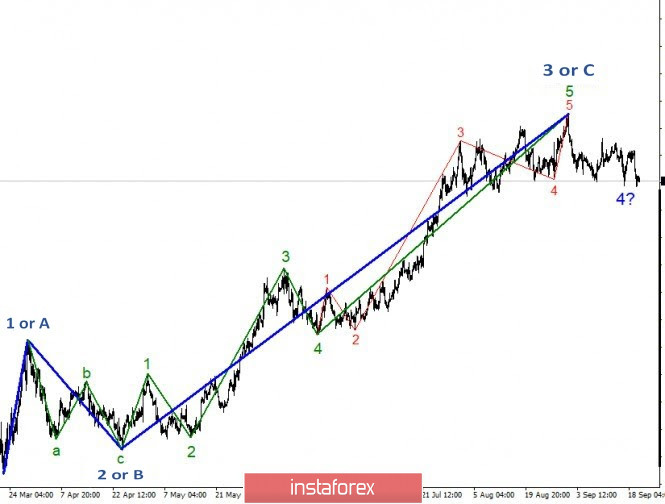

The EUR/USD instrument's wave marking still looks quite globally convincing in everything that concerns the upward section of the trend, which presumably ended with wave 3 on the first of September. After this said day, the problems began. Wave 4 (assumed) first took the form of a three-wave, but yesterday's decline in quotes led the previous low to a breakdown. Therefore, the entire wave that originates after September 1 takes a more complex and ambiguous form.

The smaller-scale wave layout shows that three smaller-scale waves have already been built inside the proposed wave 4, and there is a possibility that a fifth wave is also being built at this time. Thus, the entire wave 4 takes the form of a zigzag and, accordingly, can be more extended. Nevertheless, the instrument's quotes have not yet been able to fall even to the 23.6% Fibonacci level. Therefore, further decline of the instrument is still questionable, and the upward trend section can resume its construction at any time.

The US currency has been in moderate demand in recent days. Another decline in the instrument's quotes began on Monday, and it is still unclear what caused it. Nevertheless, a decline in quotes is allowed form the wave point of view, so it is better to not sound the alarm yet and not to hurtle in making adjustments to the current wave markup. From my perspective, the prospects for the Euro currency still look more attractive, in spite of the fact that the construction of wave 4 is delayed. Yesterday, it became known that Christine Lagarde, the ECB President, is going to conduct a thorough assessment of the PEPP program, which was designed to help the EU economy during the pandemic crisis. In addition, Lagarde said that the exchange rate of the Euro currency has really grown quite strong recently, which may negatively affect the bloc's economy. Lagarde also takes the COVID-2019 pandemic very seriously and requires a thorough analysis of data on its development in the European Union. According to the ECB President, economic growth is uncertain and difficult to predict. "The sustainability of the recovery remains very uncertain, as well as uneven and incomplete. It remains highly dependent on the future evolution of the pandemic and the success of containment policies," Lagarde said. Meanwhile, the Federal Reserve is following the same path. Today, there is going to be a speech by Jerome Powell, who will have to give a report on the funds spent from the 4 trillion allocated by Congress in March, also in the framework of countering the economic crisis. Hence, both of these events can provide crucial information to the markets.

General conclusions and recommendations:

The EUR/USD pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section that begins on September 1. At this time, it is still recommended to sell the instrument with targets located near the calculated levels of 1.1706 and 1.1520, which corresponds to 23.6% and 38.2% Fibonacci, for each MACD signal down. However, it is also possible that wave 4 has already been completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română