The US dollar rose sharply yesterday during the European and American trading sessions, so as a result, the quotes of the USD / JPY pair consolidated higher in the charts, after breaking out of the two-month highs.

Ergo, long positions will be very profitable today, and you may set them in accordance to this strategy below:

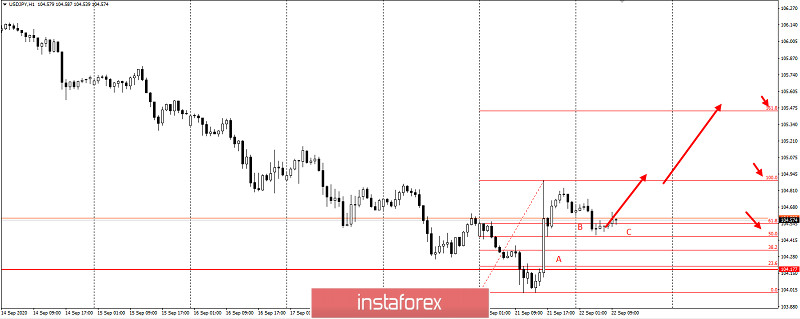

Since an ABC pattern has formed in the daily chart, we can use the Elliott Wave analysis to locate subsequent points where we can place our next positions in trading.

Thus, the bullish impulse of yesterday's American session will be considered as wave "A", and our next targets will be 104.9, which is the high of the previous daily range, and 105.5, 161.8% Fibonacci extension from the current prices.

The main target will be the monthly level of 107.

However, forget this strategy if the quotes break out of yesterday's low.

This follows the framework of the classic Price Action and Stop Hunting strategies.

Of course, we would still need to control the risks to avoid reducing or losing profit.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română