The euro together with the pound came under very serious pressure, due to one reason — coronavirus. The risk of re-introducing quarantine is increasing more and more every day, since there are all signs of the beginning of the so-called second wave. Moreover, judging by the number of new COVID-19 cases per day, we may have a larger scale than this spring. The UK has the most severe problem, where the authorities have already been forced to sharply raise fines for violating existing anti-epidemic measures, such as not following social distancing, not putting on a mask and doing social gathering. In addition, measures to monitor compliance with existing restrictions are being tightened. The service enterprises have already begun to suffer from this, primarily bars and restaurants. On the continent, the situation is only slightly better. A sharp increase in the number of new cases of infection is observed in Spain and France. At the same time, the Spanish authorities imposed a ban even on movement. But even if it is only for certain regions of the country, this does not make it easier. Given this dynamic, France is next in line to re-introduce strict restrictive measures. All this was instantly reflected in European currencies. After all, the previous quarantine caused such serious economic damage that we can only talk about modest attempts to start recovery at the moment. Businesses, especially small and medium-sized businesses, suffered so much that they survived by some miracle. The business currently simply does not have any funds and resources to survive everything a second time. So the result will inevitably be mass bankruptcies and layoffs. In general, the behavior of investors who are massively getting rid of the Euro and the pound is quite understandable.

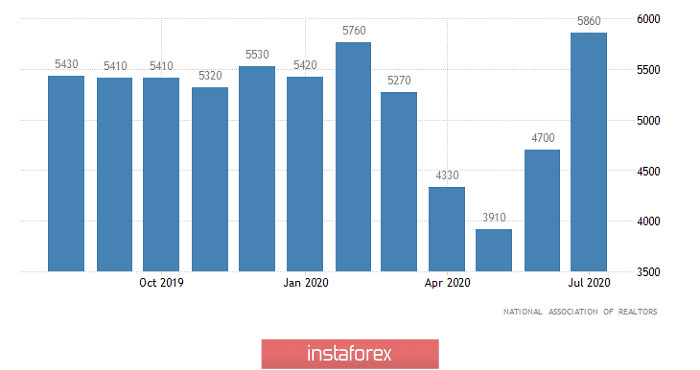

Today, it is very clear that everyone will only look at the information related to the spread of coronavirus in Europe, as well as what additional measures are being introduced by certain countries. Therefore, no one will be interested in any macroeconomic statistics. The only thing that will be published today is the data on home sales in the secondary market of the United States, which should grow by 0.9%. The data itself is not that important, so it could not have had a great effect on the markets in any case. Nevertheless, the growth in sales is a positive moment and fully fits into the general logic of the dollar's strength.

Existing Home Sales (United States):

The EUR/USD pair moved quickly below after a short stagnation, where the level of 1.1755 put pressure on sellers once again. If the pattern associated with the mentioned level is repeated, a pullback in the direction of 1.1810 will occur, but this position will be considered when the price is consolidated above 1.1717. In a different development, a breakdown of the price area is considered with the price moving to the main level of 1.1700.

The GBP/USD pair completed the correctional course with a full-fledged recovery to the pivot point 1.2770, where there was a temporary stop. To keep the downward mood, the quote must consolidate below 1.1770 in a four-hour time frame. Otherwise, there will be a natural price rebound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română