The EUR/USD pair rallied today. At the moment of writing, it was traded at 1.1217 level far above 1.1121 Friday's low. The price turned to the upside as the Dollar Index plunged. DXY's correction was natural after its amazing growth.

Today, the Eurozone data came in mixed. The German Prelim CPI rose by 0.4% versus 0.2% drop expected, while the Prelim Flash GDP registered a 0.3% compared to 0.4% expected.

On the other hand, the US Chicago PMI jumped from 63.1 to 65.2 points though specialists expected a potential drop to 61.7.

EUR/USD throwback

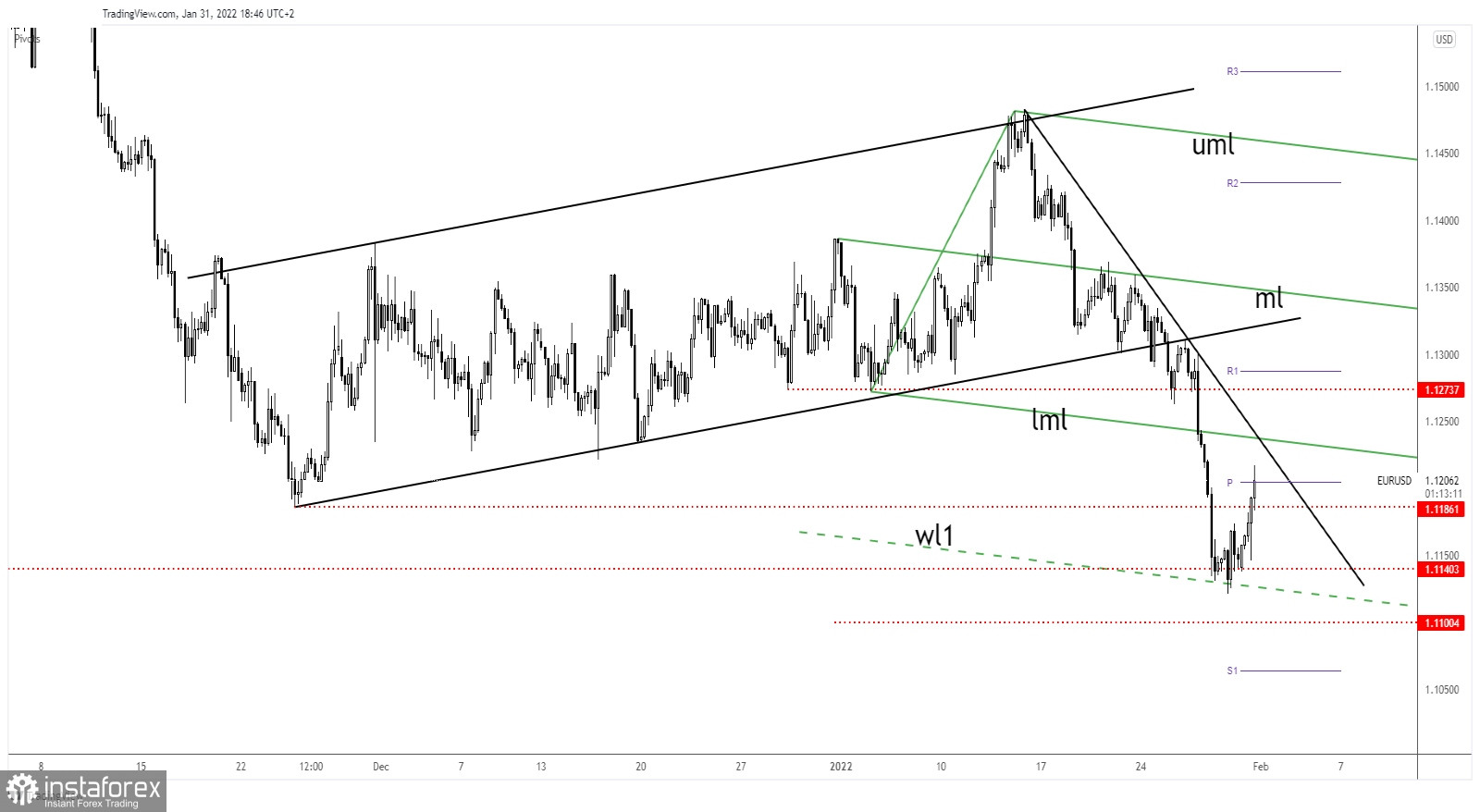

Technically, EUR/USD found support on the first warning line (wl1) of the Descending Pitchfork. After that, it was traded right above the weekly pivot point (1.1204) and was about to reach the downtrend line.

The lower median line (lml) stands as a potential resistance as well. Actually, the rate could be attracted by the confluence area formed at the intersection between the lower median line (lml) with the downtrend line.

If the rate stays under the downtrend line, it can be only a temporary rebound. After the last sell-off, a temporary rebound was natural and expected.

EUR/USD outlook

False breakouts above the downtrend line and above the lower median line (lml) could bring new selling opportunities as EUR/USD could come back down. Technically, the rebound could help the sellers to catch a new bearish momentum.

Making a valid breakout above the immediate upside obstacles, through the confluence area, EUR/USD could confirm further growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română