Gold bounced back after registering only false breakdowns below 1,782.67 static support. The yellow metal increased as the US dollar weakened due to the DXY's sell-off. Technically, the XAU/USD was somehow expected to recover after the most recent sell-off. As you already know, gold plunged after the hawkish statement of the FOMC.

As long as the DXY continues to drop, XAU/USD could climb higher. The fundamentals will shape the price movements during the week. Tomorrow, the RBA, Canadian GDP, US ISM Manufacturing PMI, JOLTS Job Openings, as well as the New Zealand Unemployment Rate and Employment Change could really shake the market.

Furthermore, the BoE and ECB announcements on Thursday and the US NFP on Friday are likely to bring sharp movements in gold. That's why you have to be very careful. Also, the yellow metal may try to come back higher as the tensions between Russia and Ukraine are expected to fuel a risk-off sentiment.

XAU/USD temporary rebound?

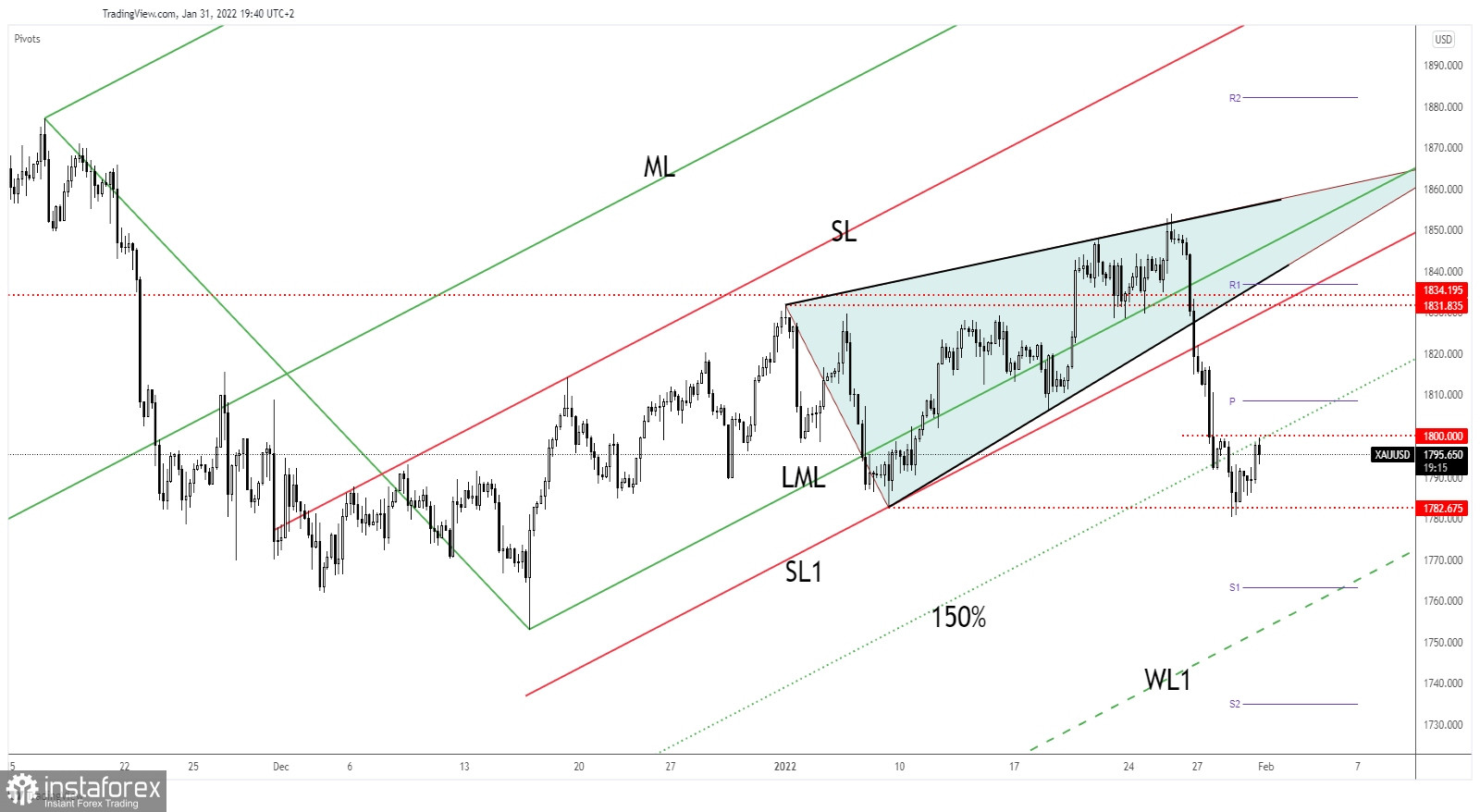

Technically, the price of Gold reached the 150% Fibonacci line which stands as a dynamic resistance (support turned into resistance). At the same time, the 1,800 psychological level represents an upside obstacle.

Staying below the 150% Fibonacci line, XAU/USD could come back down. A new lower low, a valid breakdown below 1,782.67 could confirm more declines towards the Ascending Pitchfork's warning line (WL1).

XAU/USD forecast

In the short term, gold is expected to move sideways. DXY's deeper drop could help XAU/USD to jump higher. Developing a range pattern between 1,782.67 and 1,800 levels could bring us good trading opportunities.

The bearish pressure remains high, the rebound could end anytime as long as it stays below the immediate upside obstacles.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română