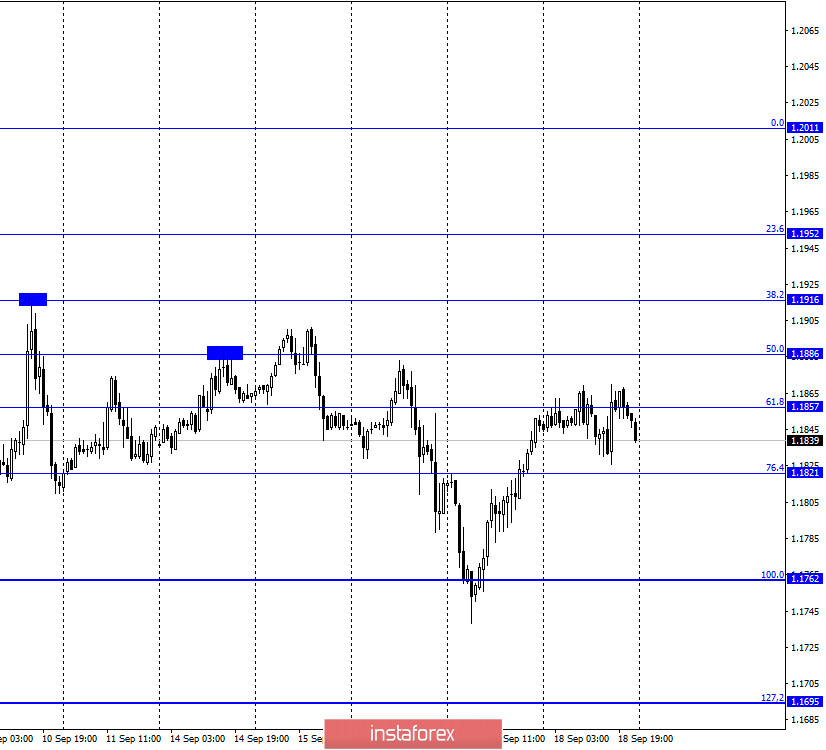

EUR/USD – 1H.

On September 18, the EUR/USD pair tried to continue the growth process, however, it could not confidently close above the corrective level of 61.8% (1.1857). Throughout the day, the pair traded in a narrow range, and the graphical picture did not clear up at all on Friday. The most important thing to understand in the near future is the dynamics of the pair in the coming weeks. Let me remind you that in the past two weeks, the ECB and the Federal Reserve have held alternate meetings. However, as of Monday, September 21, we can't say that these events had a significant impact on traders. Both central banks reported after their meetings that their GDP forecasts for 2020 and 2021 were slightly raised. But at the same time, both central banks also said that monetary policy will remain ultra-soft for a very long time. Both regulators still focus on inflation when adjusting monetary policies. Thus, until inflation in the European Union and America reaches a stable 2%, it makes no sense to expect a rate increase. I would also like to note that the COVID-2019 epidemic continues to be held in three central banks. If it is not possible to defeat the pandemic or prevent a second wave in the near future, the US and EU economies may begin to shrink again. Then the Fed and the ECB will have to adjust again in the direction of easing monetary policy and inject additional trillions of dollars and euros into the economy. Thus, I would say that the dollar and the euro are now in approximately the same position.

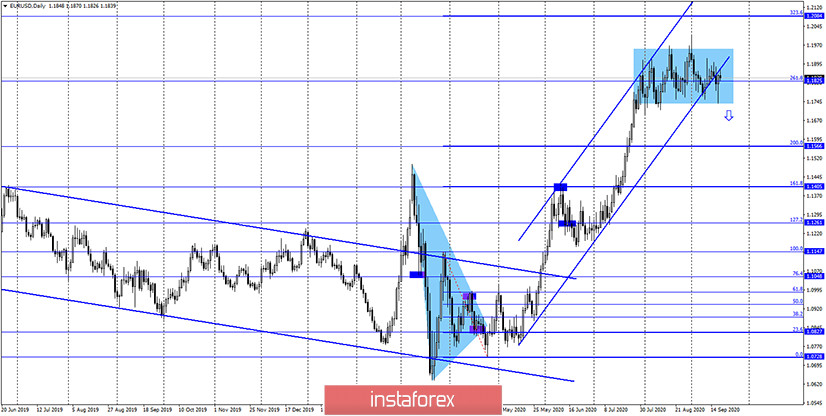

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a reversal in favor of the euro currency near the corrective level of 127.2% (1.1729) and continued the growth process towards the upper border of the side corridor, in which the pair has been trading for several months. Closing the pair's rate above the side corridor will work in favor of continuing growth in the direction of the Fibo level of 161.8% (1.2027). The rebound of quotes from this line will allow us to count on a slight drop in the direction of the corrective level of 127.2%.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the EU currency and fixed above the corrective level of 261.8% (1.1825), which does not mean much, because the quotes continue to remain in the blue rectangle, which perfectly reflects the flat. The pair's quotes are fixed under the upward trend corridor, which slightly increases the probability of continuing the fall. However, the key remains the side corridor.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has completed a consolidation above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 18, the European Union and America did not have a single important report or other events. Thus, the information background was not available on this day.

News calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (12:45 GMT).

US - speech by Jerome Powell (14:00 GMT).

On September 21, the calendars of economic events in America and the European Union contain only speeches by the chairmen of their central banks.

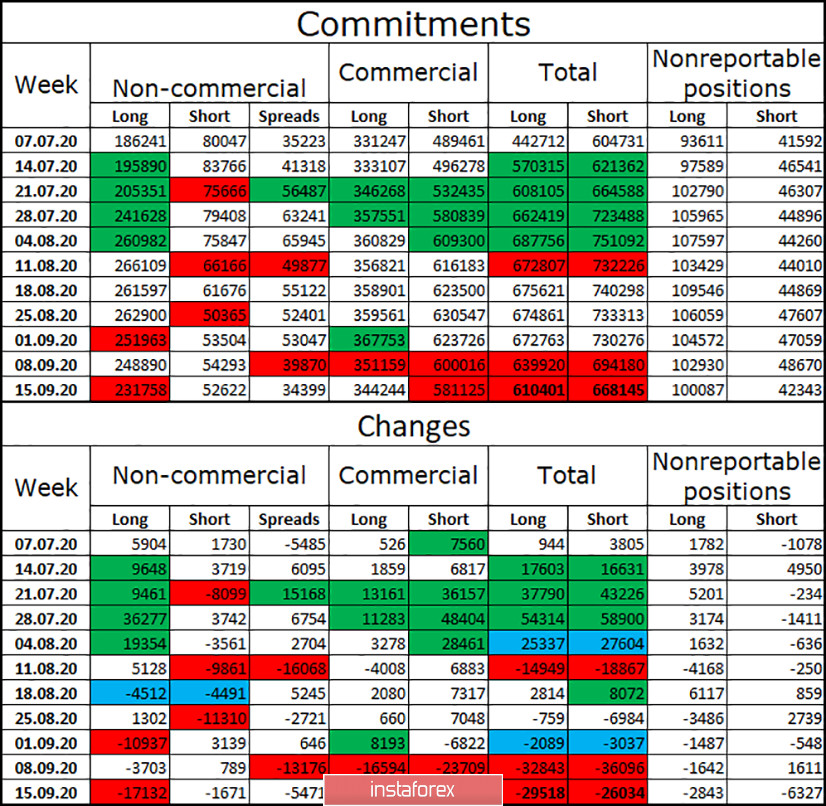

COT (Commitments of Traders) report:

The latest COT report was very interesting. During the reporting week, the "Non-commercial" group got rid of 17,000 long contracts and only 1,700 short ones. Thus, the mood of major speculators began to change to "bearish". The total number of long contracts focused on the hands of speculators is 231,000 against 52,000 short contracts. Thus, the advantage is still with the bulls, however, it is beginning to decrease. Over the past three weeks, the "Non-commercial" group has closed almost 30,000 long contracts, which significantly increases the probability of a fall in the European currency in the near future. However, the number of short contracts has also decreased in the last two months - from 80,000 to 50,000. Thus, the euro may start the process of falling, however, it is unlikely to be strong.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1762, if the rebound is made from the upper line of the side corridor on the 4-hour chart (from the level of 61.8% - 1.1857 on the hourly chart, the rebound is already made). I recommend buying the pair if it closes above the side corridor on the 4-hour chart with a target of 1.2027.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română