On September 14-18, the EUR/USD currency pair did not show a pronounced directional movement. Therefore, the weekly session closed almost in the same place as it opened. Despite the important events that took place over the past five days, the market has not found a driver for a clear direction for the main currency pair. The Fed's decision on the main interest rate, which fully coincided with the expectations of market participants, as well as updated economic forecasts and a press conference by Fed Chairman Jerome Powell, gave the US currency some support. However, it was relatively short-lived, and soon the single European currency began to recover its position against the US dollar.

This week, we expect a portion of macroeconomic statistics from the Eurozone and the United States, which will be mentioned directly on the day of the news release. Today, the main events for the EUR/USD currency pair will be speeches by the President of the European Central Bank (ECB) Christine Lagarde, which will be held at 13:45 (London time). This will be followed by a speech by Fed Chairman Jerome Powell at 15:00 London time. It is not yet known what the heads of the world's leading central banks will say and whether the market will be able to find a reason for directed price movements, however, there is no doubt that these events are very significant in themselves.

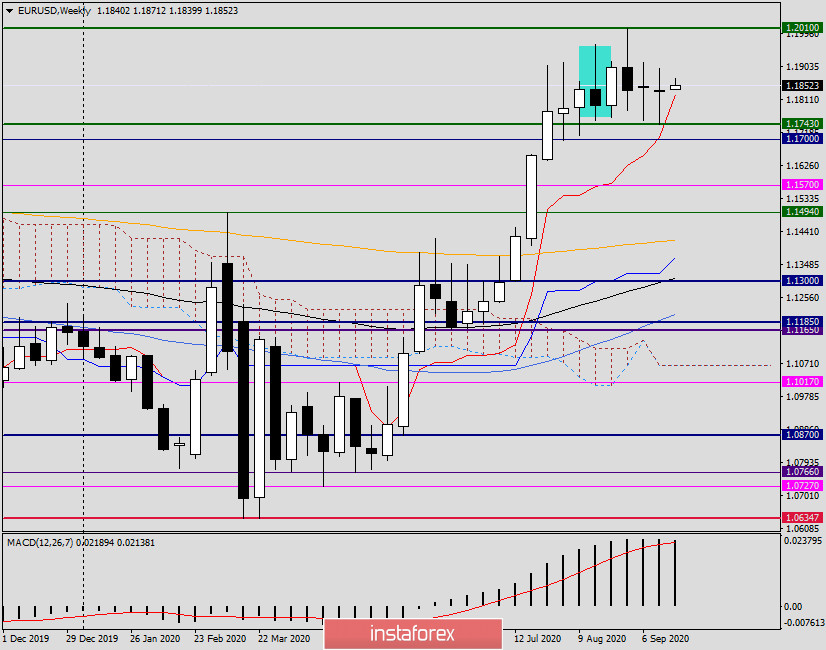

Weekly

It's time to move on to the technical picture for the euro/dollar currency pair, and, as usual, on Mondays, we start considering the corresponding timeframe. As already noted, the pair could not determine the direction, therefore, the last weekly candle has quite long shadows and there is actually no body. As a rule, such candles indicate that the market does not know which way to move, or is waiting for some important news, after which it intends to do so.

The technical picture on the weekly chart has not undergone any significant changes. The only thing worth paying attention to is an unsuccessful attempt to break through the lower limit of the current range of 1.1753. As a result, the price range in which the main currency pair is traded has slightly expanded and now stands at 1.2010-1.1743. As before, I believe that a true exit from this range can determine the further direction of EUR/USD, and in the medium term. Current trading on the euro/dollar takes place with a slight strengthening of the exchange rate, but to determine the actual and technically sound points for entering the market, it is worth turning to smaller time intervals.

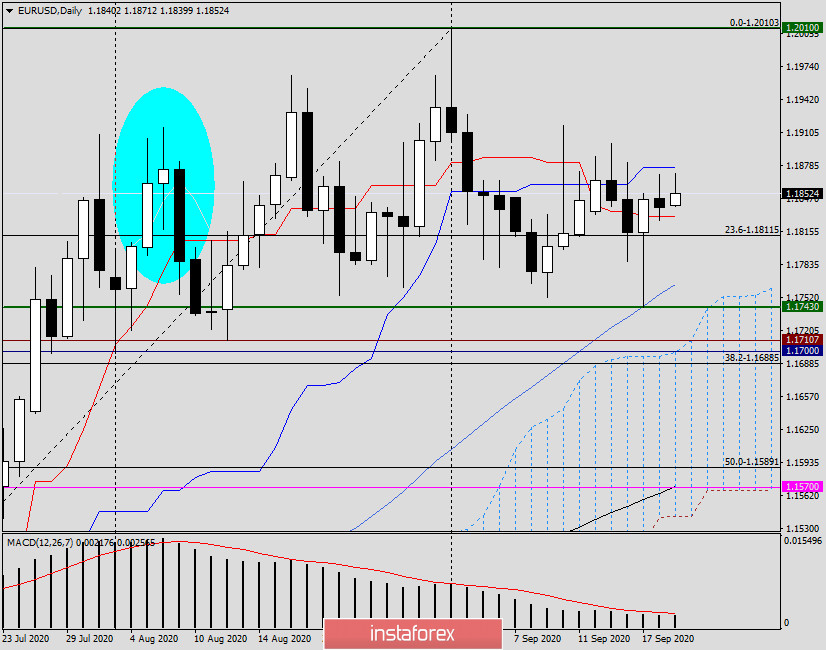

Daily

As can be seen on the daily chart, the pair is trading between the Tenkan and Kijun lines of the Ichimoku indicator, which represent support and resistance, respectively. At the very least, we can assume that a consolidation above Kijun will open the way to 1.1900, 1.1915, 1.1960, and possibly, to the key resistance zone of 1.2000-1.2010. At the same time, a true breakdown of 1.2010 will finally convince you of the further bullish direction of the instrument. If the euro/dollar is fixed under the Tenkan, the next target will be the important level of 1.1800, the true breakdown of which will most likely target the exchange rate to meet the 50 simple moving average, which passes at 1.1765 and then to retest the key support level of 1.1743.

Today, there are still opportunities for both purchases and sales for trading ideas. I recommend considering purchases after declines in the area of 1.1800-1.1770. Sales, in my opinion, remain relevant when trying to break above the price zone of 1.1900-1.1915. Since the situation for EUR/USD is far from unambiguous, it is better to see confirmation signals on lower timeframes with both positioning options and only then enter the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română