Crypto Industry News:

The Fitch rating agency has published a research article about Russia's proposed cryptocurrency ban. While the report agreed with the Central Bank of Russia (CBR) position that the ban would limit the exposure of the financial system to risk, it also warned that such a proposal could "stop the spread of technologies that could improve productivity."

In addition, Fitch commented on Russia's adoption of the central bank's digital currency, the CBDC, saying that "[the digital ruble] should increase the authorities' ability to monitor and manage financial flows that could otherwise be destroyed by an increase in cryptocurrency transactions." The report also explains that the main motive for which the CBR is proposing strict cryptocurrency restrictions may be to restrict competition to the upcoming CBDC.

As in India, Russia's cryptocurrency regulatory environment has been fairly chaotic lately, with policymakers often oscillating between a complete ban on digital currencies and a call for a regulatory framework.

Technical Market Outlook

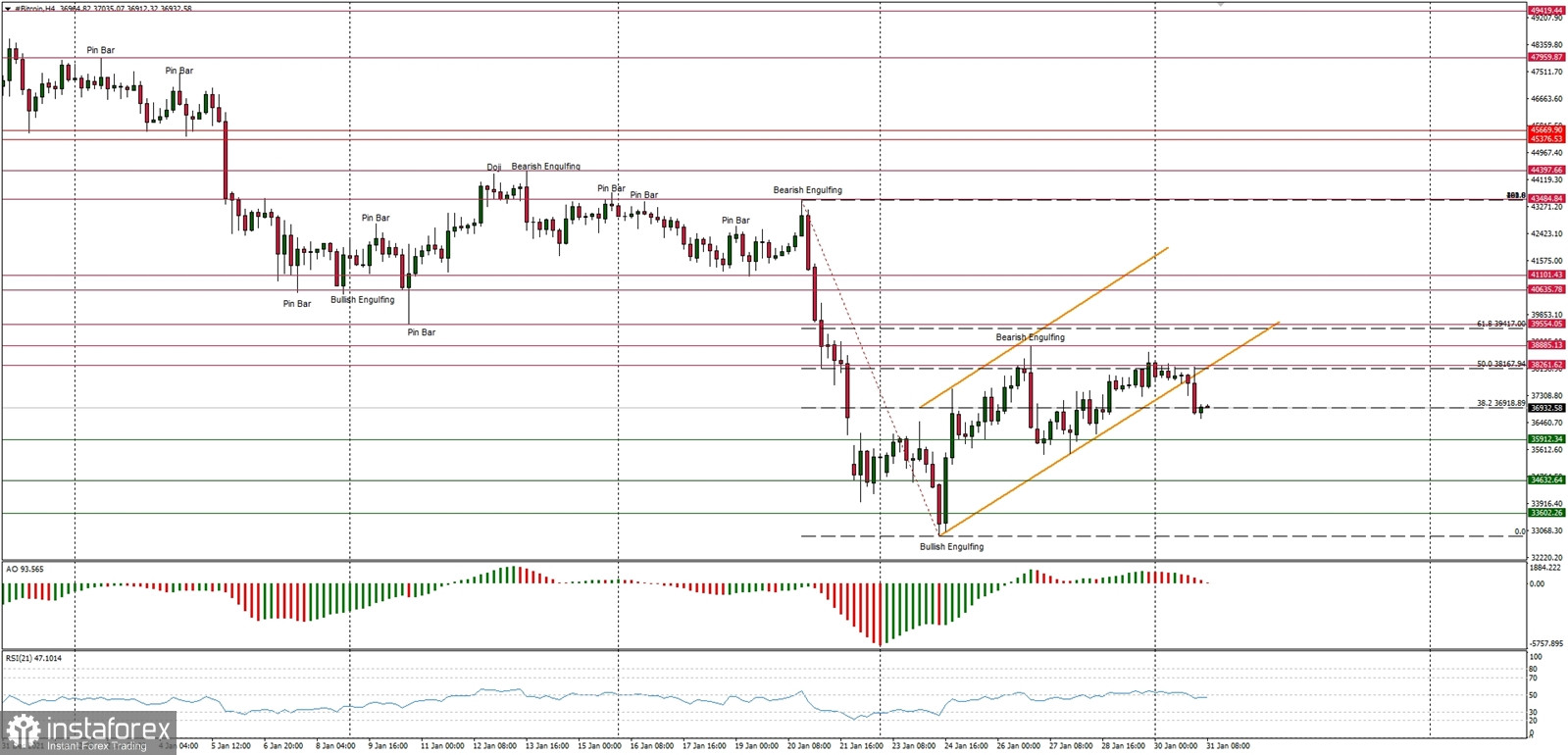

The BTC/USD pair has been rejected form the level of 50% Fibonacci retracement of the last wave down and fell out of the short-term channel as well. The local low was made at the level of $36,710, but the key short-term technical support is seen at $35,912. The market conditions are extremely oversold at daily time-frame chart, but the momentum is still weak and negative. This is not a good situation for bulls as the bears are still in control and might push the price way lower soon. The next technical support is seen at $35,912 and $34,632.

Weekly Pivot Points:

WR3 - $46,518

WR2 - $42,733

WR1 - $40,610

Weekly Pivot - $36,641

WS1 - $34,413

WS2 - $30,618

WS3 - $28,634

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română