Crypto Industry News:

Visa Inc. discussed her crypto strategy and achievements. Visa CEO Al Kelly said: "Many of the current payment trends, including... cryptocurrencies and wallets, are opening up new payment methods. For Visa, they are opportunities. "

Regarding the company's efforts in the crypto space, the director highlighted:

"We also provide ramps for crypto players to create connectivity with fiat economies. There are over 65 crypto platforms and exchanges that have partnered to issue Visa credentials."

Consumers will be able to spend cryptocurrencies at 80 million retailers using Visa cryptocurrency cards. However, CEO Kelly said during the interview that the actual figure is "closer to 100 entities."

Visa's boss also revealed that this quarter, Visa's credentials and crypto wallets had more than $ 2.5bn in payment volume, already 70% of payment volume in the full fiscal year 2021, and crypto card usage reached $ 1bn in the first six months of 2021 .

Technical Market Outlook

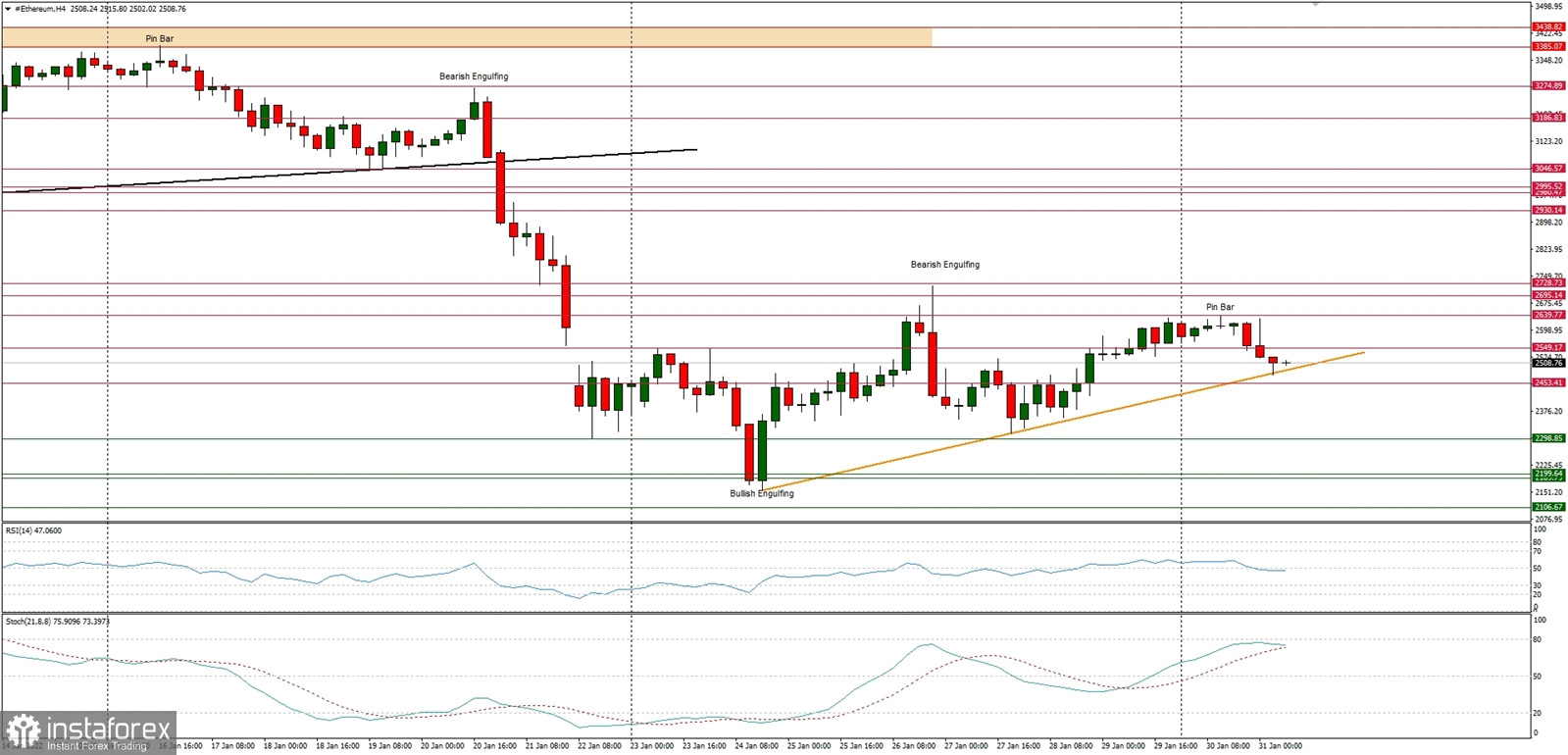

The ETH/USD pair has been seen moving up all the weekend long, but the bulls were unable to break through the technical resistance seen at the level of $2,639. Moreover, the market is still bouncing from the short-term trend line support, so there is a chance for the up move to continue. However, if the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. On the other hand, the nearest technical resistance are $2,728, $2,930 and $3,000. The market conditions are extremely oversold on Daily time frame, so this might help the demand side to bounce higher.

Weekly Pivot Points:

WR3 - $3,405

WR2 - $3,068

WR1 - $2,823

Weekly Pivot - $2,486

WS1 - $2,264

WS2 - $1,931

WS3 - $1,682

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română