Weak indicators on the real estate market in the United States and a rather restrained reduction in the number of applications for unemployment benefits in the United States - all this led to a weakening of the dollar's position against the Euro and the British pound in the second half of the day. The statements made by the Federal Reserve this Wednesday failed to lead to a breakout of local lows in the EUR/USD trading instrument, which returned demand for risky assets in anticipation for a further medium-term recovery.

As for the technical picture of EUR/USD, at the moment, buyers will persistently try to regain the resistance of 1.1855, the breakthrough of which will provide a direct path for the Euro to local highs in the area of 1.1885 and 1.1920, while maintaining a steady growth of risky assets. However, the further direction of the pair and its campaign for the next test of 1.2000 will depend only on whether the bulls will be able to catch hold of the 19th figure. If the pressure on the Euro returns, and this scenario cannot be ruled out due to a number of fundamental statistics that are waiting for us in the second half of the day, it is best to consider new long positions after the update of the intermediate support of 1.1800. Larger players will be concentrated around the weekly lows of 1.1750.

Returning to yesterday's fundamental statistics, which unfortunately is not pleasurable, it is worth saying that the sharp decline in the number of new housing starts in the United States does not mean that the housing sector has once again slipped into recession. Most likely, the permanent recovery will continue, just at a calmer pace. Based on the indicators, we can expect that the housing sector will continue to perform well, especially given the levels of interest rates and the availability of credit.

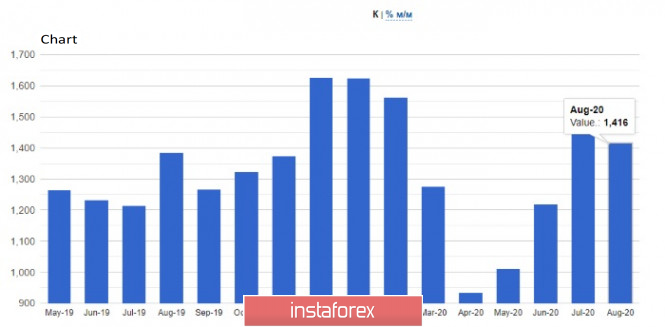

A report from the US Department of Commerce shows that the number of new housing starts in August 2020 fell by 5.1% compared to July and to 1.416 million homes per year. Economists had also expected a decline in the indicator, but only by 3.1% to 1.45 million homes. The Ministry noted that the error of the August indicator may reach 9.6%. Simultaneously, the number of construction permits also decreased, but only by 0.9%, and to 1.470 million against the expected growth of 0.3%, to 1.50 million.

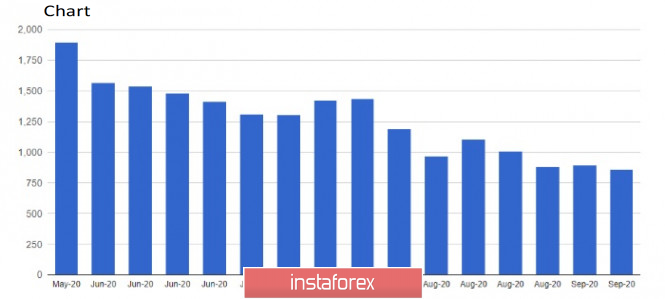

Another important indicator for the US labor market remained almost unchanged yesterday, which is quite expected, since there is not much progress in the US economic recovery in early autumn. According to a report from the US Department of Labor, the number of initial applications for unemployment benefits for the week from September 6 to 12 decreased by 33,000 to 860,000. The main problem for the labor market is the coronavirus pandemic, which may regain momentum again closer to the beginning of winter, which will negatively affect the number of new applications, especially given the fact that the new program of support for the population, which ended on July 31, has not been adopted and there is still no progress on this issue. It seems that the negotiations between Republicans and Democrats have been put on pause and everyone '

Let me remind you that Republicans and Democrats cannot arrive at an agreement that will provide money for PPP programs aimed at paying additional unemployment benefits, as well as for a number of other purposes. Many Americans would not mind continuing to receive additional benefits in the amount of $ 600 per week, but all they have waited for so far is an additional $ 300 weekly, and even then not in all States and on a separate order from American President Donald Trump.

Yesterday, a rather important report was also published on the decline in the growth rate of activity in the area of responsibility of the Federal Reserve Bank of Philadelphia. According to the data, the business activity index fell in September this year to the level of 15.0 points from 17.2 points in August, which fully coincided with the forecasts of economists. However, even a mark of 15 points will allow us to conclude that the activity will continue to recover, even if not at such a rapid pace.

Statements by White House economic adviser Larry Kudlow were ignored by the market, despite the fact that they were mostly positive. Kudlow noted that the United States is experiencing a steady V-shaped economic recovery and can now see its first stage. Surprisingly, Kudlow believes that further recovery does not depend directly on another stimulus package, although, as we may remember, the Fed representatives, along with US Treasury Secretary Steven Mnuchin, hold a very different opinion.

If the pressure on the US dollar continues due to the lack of further stable benchmarks for the pace of economic recovery, then the Euro will also be not so simple. This was once again indicated by yesterday's report on inflation in the Eurozone, which fell below zero in August. The report indicated that the Eurozone CPI index in August 2020 fell by 0.2% compared to the same period of the previous year after rising by 0.4% in July, which fully coincided with economists' forecasts. By the way, the ECB's target inflation rate is set at around 2%. Core inflation also slowed to 0.4%, but this is mostly due to the summer sales problems in tourist countries such as France and Italy. Serious pressure on inflation was also created by a temporary reduction of VAT in Germany, which is a deflationary factor. Although inflation has actually decreased, this does not cause problems for the European regulator. We all remember the recent statements of the President of the European Central Bank, Christine Lagarde, who noted that in the next few months, inflation may decrease significantly, but at the end of the year it will increase. In this regard, the European regulator has no concerns yet, and no one is going to take the necessary measures to revive the growth of consumer prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română