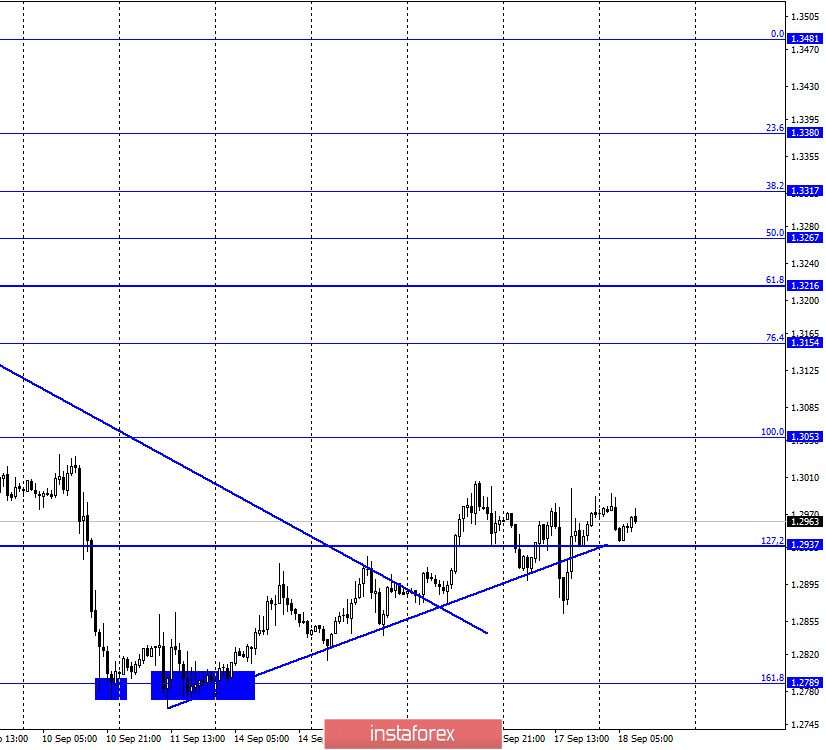

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the British currency and a new consolidation above the corrective level of 127.2% (1.2937), which allows us to expect continued growth in the direction of the next corrective level of 100.0% (1.3053). The upward trend line failed to hold the pair above itself, and the quotes were fixed under it, but not for long. In general, the movement of the British in recent days is very strange. Yesterday, the Bank of England held a meeting, during which it became clear that all the key parameters of monetary policy remained unchanged. Thus, the Bank of England has again taken a wait-and-see position. Thus, representatives of the Bank of England do not deny that they are considering the possible introduction of negative rates if it is necessary to provide the economy with even more incentives. Many experts also believe that by the end of the year, the central bank will increase the quantitative easing program by 50 or 100 billion pounds. Also, do not forget that some EU countries are already experiencing outbreaks of coronavirus, and the UK, which I still consider to be an EU country, is on the same list of countries. Thus, it is quite possible that in a month or two, new restrictive measures will have to be introduced, which will again slow down the economy.

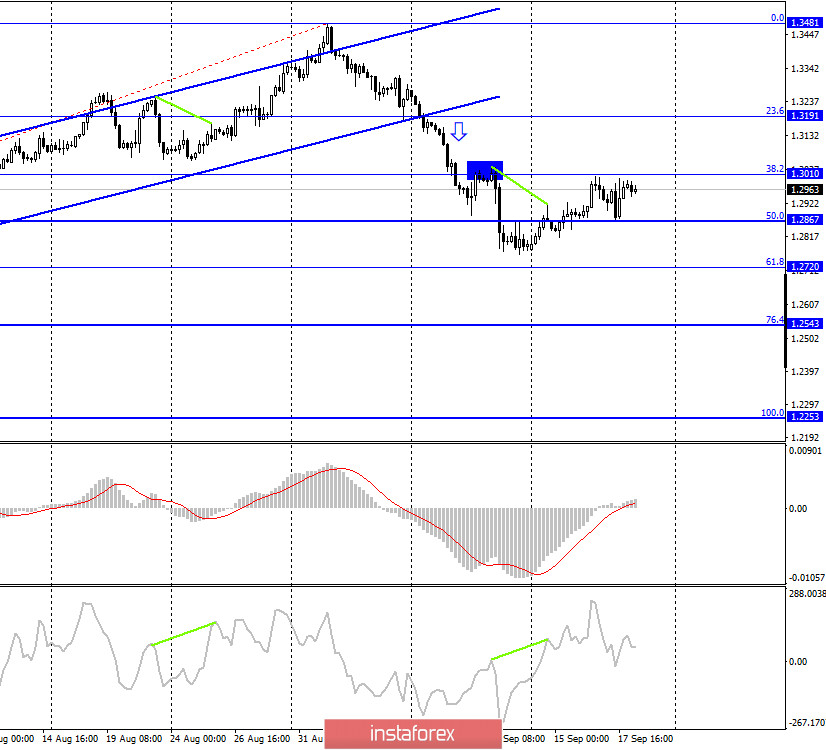

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed an increase to the corrective level of 38.2% (1.3010). The rebound of quotes from this level will work in favor of the US currency and some fall in the direction of the Fibo level of 50.0% (1.2867). Fixing the pair's rate above the Fibo level of 38.2% will work in favor of the corrective level of 23.6% (1.3191). There are no pending divergences in any indicator on September 18.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the Fibo level of 76.4% (1.2776), which now allows traders to expect some growth in the direction of the corrective level of 100.0% (1.3199). Fixing quotes under the Fibo level of 76.4% will work in favor of the US currency and fall in the direction of the corrective level of 61.8% (1.2516).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to the downward trend.

Overview of fundamentals:

On Thursday, nothing was interesting in the UK other than the results of the Bank of England meeting. In the US, the number of secondary claims for benefits fell to 12.628 million.

The economic calendar for the US and the UK:

UK - change in retail sales (06:00 GMT).

On September 18, a report on retail trade was released in the UK, which showed that taking into account fuel sales, the volume increased by 0.8% m/m, and without taking into account - by 0.6% m/m, which is in line with traders' expectations.

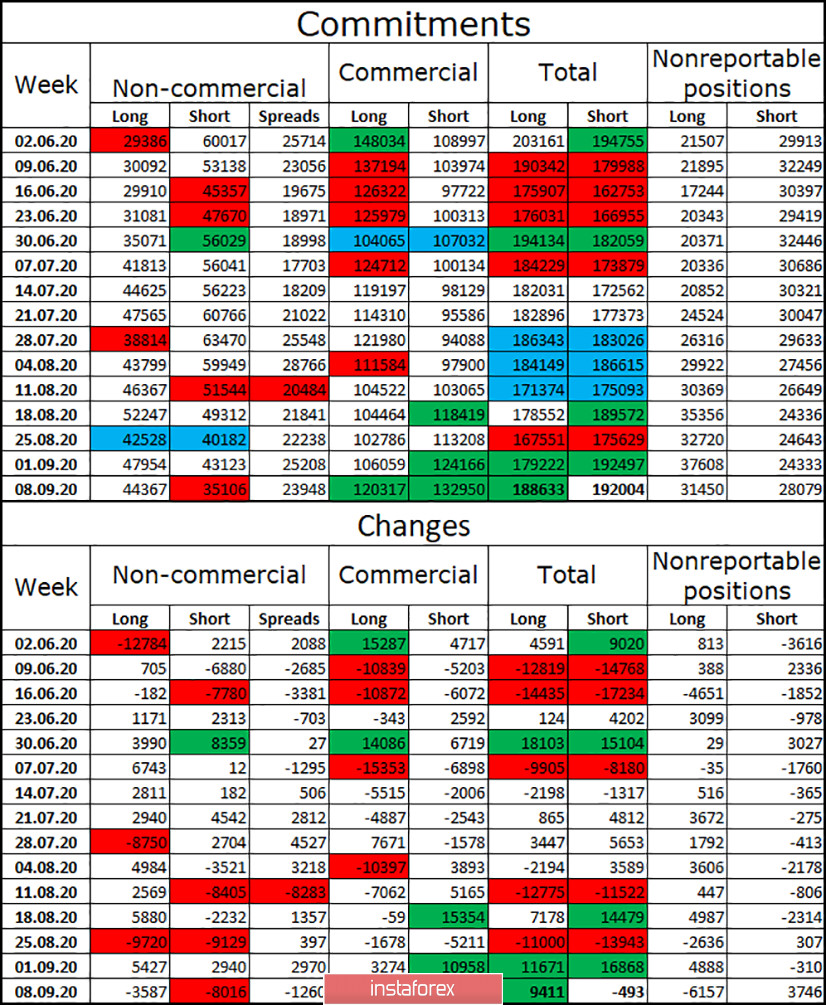

COT (Commitments of Traders) report:

The paradoxical COT report on the pound. You can't say otherwise. According to the latest COT report, major players in the "Non-commercial" group were cutting long contracts, however, they were also cutting short contracts. 8 thousand sales and 3.5 thousand purchases. Thus, it turns out that the British even had to show growth. However, on September 2, it began a severe fall and has now fallen by 700 points. The same applies to the "Commercial" group, which increased long-contracts in the amount of 14 thousand and increased short-contracts in the amount of 9 thousand. Again, it turns out that the British pound should have shown growth in the reporting week. In general, the reported data turned out to be very strange and did not correspond to what was happening in the foreign exchange market.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.2867 if the rebound from the level of 38.2% (1.3010) on the 4-hour chart is completed. I recommend opening purchases of the British dollar if a close is made above the level of 1.3010 on the 4-hour chart, with a target of 1.3191.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română