Yesterday, investors continued to assess the results of the Fed meeting on monetary policy, which led to the continuation of decline in global stock markets and a local increase in the US dollar, although it was not universal and only limited.

So what is the reason for this seemingly inappropriate behavior of investors?

It is obvious the Fed and its chief tried to do everything possible to convince the markets that the ultra-soft monetary rate will remain for a significant period of time. But the regulator's slightly better assessment of the state of the economy, the labor market, and, most importantly, inflation for this year and for the following years has stirred up markets and led investors to believe that targeting measures and everything related to it may lead to an increase in inflationary pressure sooner than expected.

So, earlier, the markets believed that the recovery of the economy and the labor market would be slower, but the Fed's forecasts have changed everything, and there are now growing expectations that the bank may begin the cycle of raising interest rates in the near future. This, in fact, was the main reason that caused a stir in the global financial markets.

It can be recalled that this week's economic statistics from both the labor market and industrial production turned out to be worse than expected, which led to a decline in demand for risky assets and an appreciation of the US currency. Today, the attention of the market will focus on the publication of important US economic data from the University of Michigan. The numbers of the consumer expectations and sentiment indices will attract attention. According to the forecast, the consumer expectations index should fall in September from 68.5 points to 67.8 points, and on the contrary, the consumer sentiment index will add from 74.1 points to 75.0 points in September.

If we analyze the possible reaction of the markets in general and the currency market in particular, we note that if the data from the University of Michigan turn out to be predictable, then this may become the basis for the resumption of negative dynamics in the US stock market and a limited rise in the dollar rate.

Forecast of the day:

The EUR/USD pair remains in a wide side range of 1.1750-1.1915. The pair passed the level of 1.1860, which may serve as a basis on the background of Germany's positive data on manufacturing inflation to continue to rise to 1.1915.

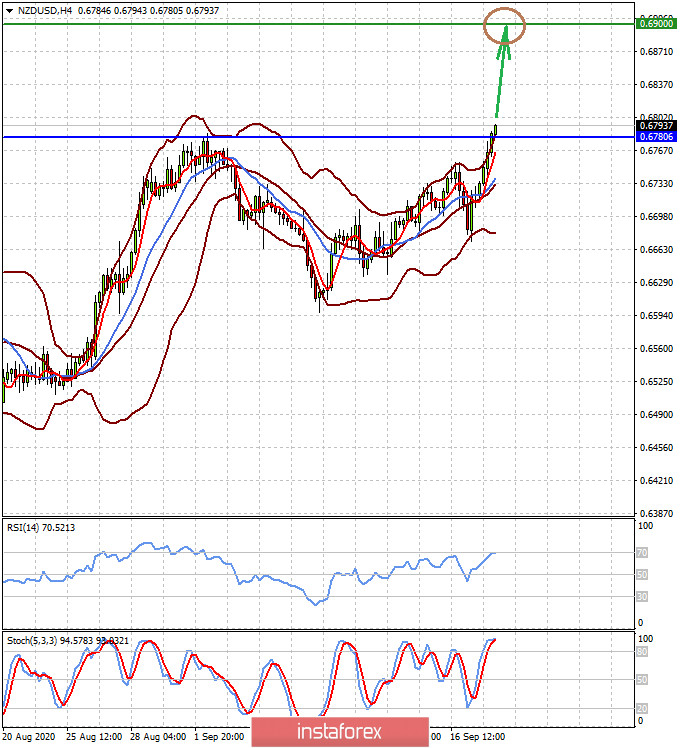

The NZD/USD pair continues to rise on the wave of better New Zealand GDP data released yesterday. A price consolidation above the level of 0.6780 will be the basis for growth to continue to 0.6900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română