Crypto Industry News:

The US Securities and Exchange Commission has rejected the application of the ETF managing the assets of the Fidelity Wise Origin Bitcoin Trust.

As per today's filing, the SEC has rejected a proposed Cboe BZX Exchange rule change to list and trade Fidelity's Wise Origin Bitcoin Trust stock. The regulator stated that any change to the rules in favor of the approval of an ETF would not be aimed at preventing "fraudulent and manipulative acts and practices" nor would it necessarily "protect investors and the public interest".

The SEC extended its window of deliberation to approve or decline the offer in July and November following Fidelity's original submission in March 2021 - but published in the Federal Register on June 1. The SEC added that BZX has "failed to comply with its obligations under the Stock Exchange Act and the Commission's Rules of Procedure to demonstrate that its proposal complies with the requirements of the Stock Exchange Act Section."

"When listing derivative securities products on an exchange, a joint surveillance agreement must be entered into with the underlying asset trading markets in order for the exchange to obtain the information necessary to detect, investigate and prevent market fraud and manipulation, as well as violations of exchange rules and applicable federal laws, securities laws and regulations" - states the SEC.

While the SEC has yet to approve ETFs with direct exposure to Bitcoin, the regulator has given the green light to BTC-related investment vehicles - for the first time in October 2021.

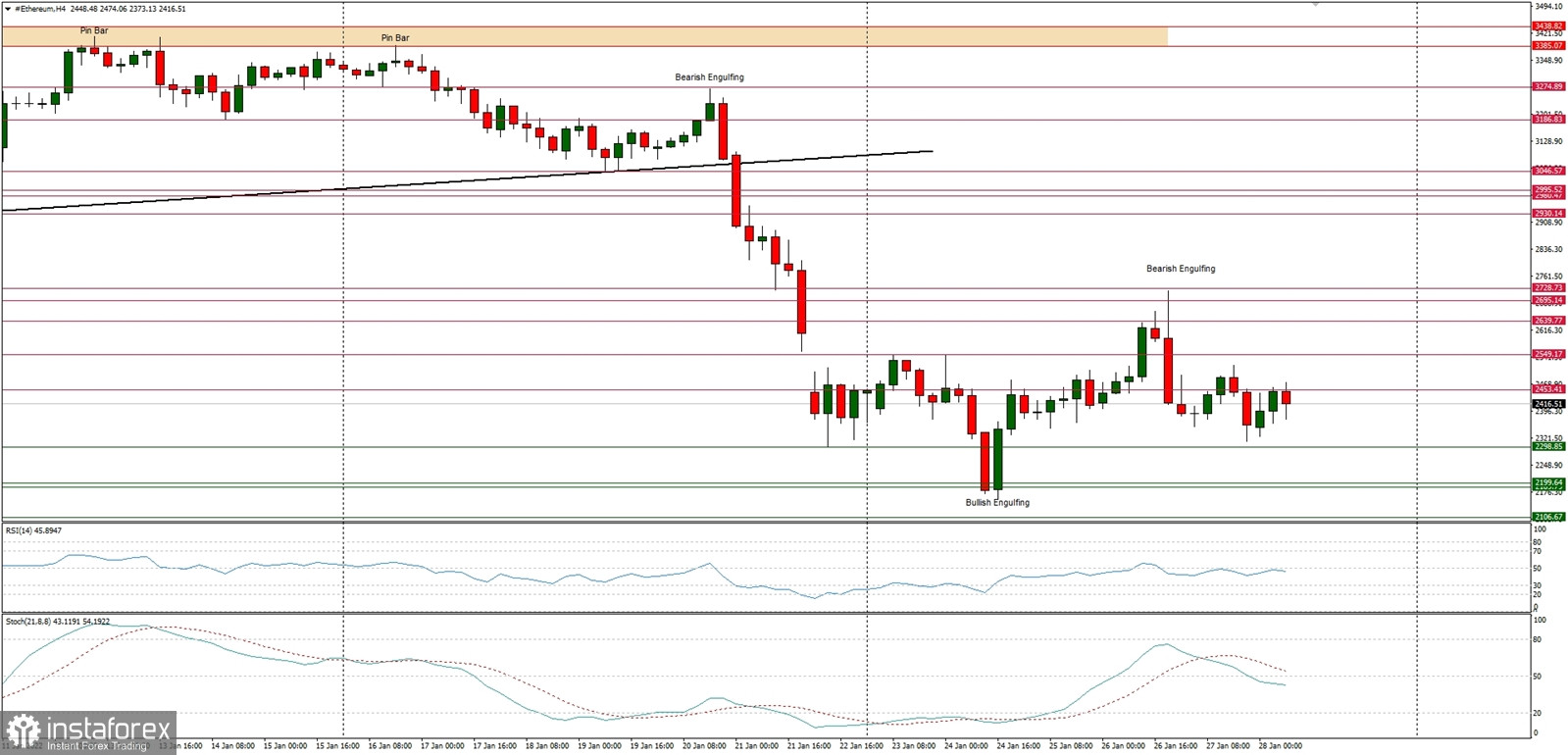

Technical Market Outlook

The ETH/USD bulls failed to bounce higher than $2,728 and the Bearish Engulfing candlestick pattern was made around this level. The volatility has decreased as the market is range bounded after the local low at the level of $2,313 was made. If the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. On the other hand, the nearest technical resistance are $2,728, $2,930 and $3,000. The market conditions are extremely oversold on Daily time frame, so this might help the demand side to bounce higher.

Weekly Pivot Points:

WR3 - $3,996

WR2 - $3,638

WR1 - $2,926

Weekly Pivot - $2,584

WS1 - $1,819

WS2 - $1,512

WS3 - $812

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română