Three waves of gold sales (two in August and another in early September) allowed the "bears" to talk about the fact that the precious metal has exhausted its capabilities. They say that Treasury bond yields below current levels are unlikely to go away, the US dollar will stabilize, and ETF stocks will no longer be able to grow as quickly as they did before. Indeed, in January-July, the indicator increased by 899 tons (+31%), which exceeds the 12-month increase for any previous year. Investors invested $ 49.1 billion in ETFs, increasing holdings to a record of $ 239 billion. However, in August, the inability of gold to stay above $ 2000 per ounce significantly cooled the ardor of buyers.

The XAU/USD correction could have continued if not for the Fed's intention to switch to targeting average inflation, which implies long-term retention of the federal funds rate at 0-0. 25%. In this scenario, even if Treasury yields remain at current levels, the acceleration in consumer prices will push real debt market rates down, which is good news for gold. At the same time, due to the Federal Reserve's friendlier attitude to financial markets, the US dollar is not feeling well, which allows fans of the precious metal to keep their hopes for its return above the psychologically important $ 2000 per ounce mark.

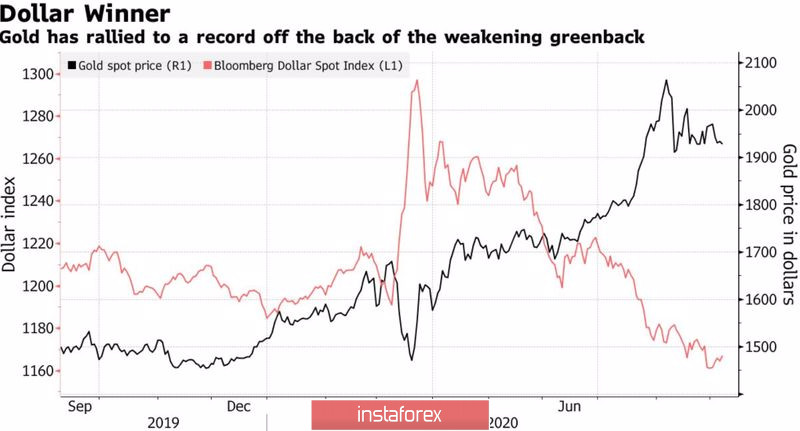

Dynamics of gold and the US dollar

According to BofA Merrill Lynch, gold prices will rise to $ 3000 within 18 months against the background of falling real Treasury yields and the weakening of the US dollar, due to the difficult state of the US economy due to the pandemic. According to the bank's estimates, the share of precious metals in investment portfolios is only 3%, and further growth of the indicator will help restore the upward trend in XAU/USD. In fact, this is not surprising: rates on inflation-protected bonds (TIPS) are negative, meaning that buying this asset, you need to be prepared for losing money. Why, if there are alternatives like stocks and gold?

Thus, the "bulls" for the precious metal still have the powder in their flasks, while its further fate will largely depend on the results of the FOMC meeting on September 15 and 16. According to TD Securities, the Fed should send "dovish" signals in the form of readiness to continue using QE, shifting the timing of rate increases beyond 2023 in forecasts, as well as hints at changing the structure of future bond purchases. As the Treasury increases the issue of long-term securities, the Central Bank should reconsider its approach to the quantitative easing program. In this scenario, gold has a good chance to continue the rally in the direction of $ 2010-2015, so longs formed from the level of $ 1950 per ounce should be held and increased.

On the other hand, if Jerome Powell fails to explain the strategy for targeting average inflation to investors, disappointment and understatement will result in a return to the US dollar. Traders will need to close long positions or move the stop order to the break-even point before the press conference.

Gold, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română