The House of Commons suddenly gave support to the pound, although British politicians did everything to bring it down earlier, which took quite a bit. Now, it was only necessary to postpone the second vote on the law on the protection of the UK home market indefinitely. Instead of voting, the parliamentarians fell into the most exciting business – the coordination of punctuation marks. The entire political establishment of the United Kingdom is busy discussing and editing individual points and provisions of the bill proposed by Boris Johnson. This process can take as long as you want, but there is almost no time. Without resolving the situation with this ill-fated bill, the European Union will not continue negotiations on a trade agreement that should regulate relations between London and Brussels after December 31 this year. In view of this, Boris Johnson will clearly make every effort to speed up the process of approving and editing the bill. Moreover, the law itself has only one goal-to force Brussels to soften its position on a number of fundamental issues. Although the very idea of passing such a law that violates already signed agreements, some of which were adopted earlier this year, is categorically not satisfied with the European Union. Thus, delaying the process with all possible approvals gives hope that the final version of the law will not be as extreme as in its original form. It is likely that this will bring the parties back to the negotiating table. Technically, we can say that the pound is now living on this hope.

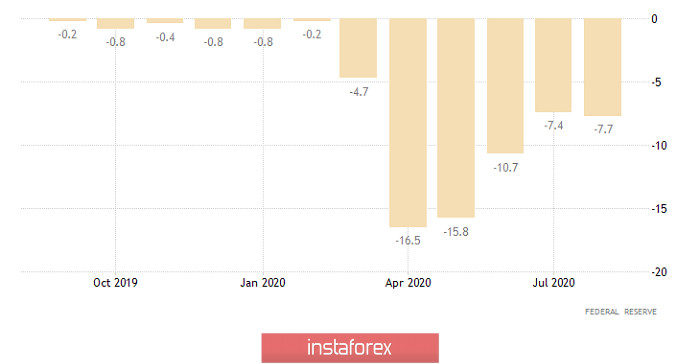

If the pound rose slightly, then the euro declined slightly. This was supported by the final data on inflation in France and Italy. So, in the second economy of the euro area, which is France, inflation fell from 0.8% to 0.2%. In other words, France will also likely slide into deflation. In Italy, and this is the third economy in the euro area, deflation only increased from -0.4% to -0.5%. Therefore, investors are worried about the publication of the final data on inflation in the entire euro area.

Inflation (France):

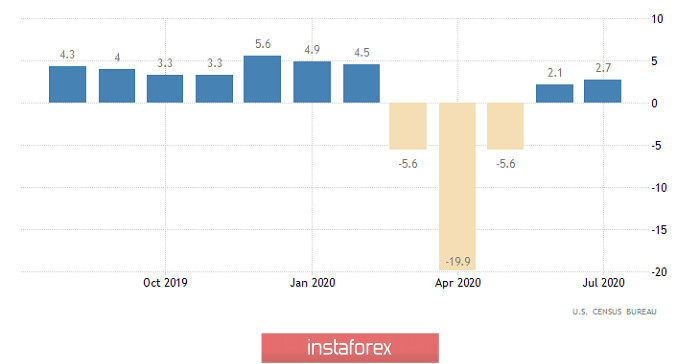

Yesterday, the US statistics hardly caused optimism. Instead of slowing down the decline in industrial production from -7.4% to -6.1%, they accelerated to -7.7%. So the recovery of the US economy is clearly uneven. It is quite common to see the American economy taking a step forward and attempting to take two steps back and such signals are coming more and more often.

Industrial Manufacturing (United States):

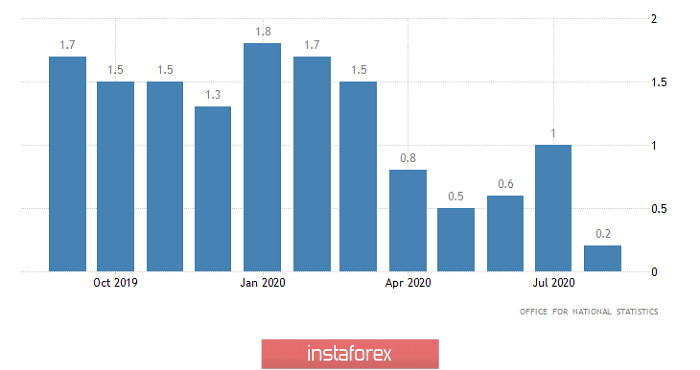

British statistics are not encouraging either. Inflation data released this morning showed a slowdown in consumer price growth from 1.0% to 0.2%. It's funny that this is even better than the forecasts, which predicted a drop in inflation to 0.1%, despite everything bad that is happening. Some even predicted its decline to 0.0%. Nevertheless, this does not nullify the fact that the United Kingdom is confidently moving towards deflation. But the pound practically did not react to this, so the main thing now is the process of discussing and agreeing on the law on the protection of the UK internal market.

Inflation (UK):

Although the main event of the day seems to be the FOMC meeting, US data on retail sales are published before it, which is also considered important. The growth rate of which is expected to slow down from 2.7% to 2.5%. This will completely cancel the entire positive effect of inflation growth. In short, prices have risen, but sales have declined. Consequently, total income remained unchanged. At the same time, sales volume has a much greater impact on the labor market and it is this indicator that affects the number of jobs, while inflation only affects wages. And in the United States, the main issue right now is the level of employment, not how much people get for their work.

Retail Sales (United States):

If we talk about the FOMC meeting itself, then few people are interested in it. It is clear that no decisions will be made and everything will remain as it is.The only interesting event is the next press conference of Jerome Powell. But rather, the speech of the Fed's head will not affect in any way. It is most likely that his speech will be lengthy and simple, but no specifics and no indications of plans for the future. Although duty words will be heard about monitoring the situation and the importance of price stability, his speech will not contain much. However, the recent rise in inflation is encouraging that Jerome Powell may announce the possibility of considering raising interest rates, at least next year. But considering other macroeconomic indicators, especially retail sales, it is almost impossible. There is also speculation that the Fed will announce that interest rates will remain at current levels until 2023. And in this case, the dollar will clearly lose position, but such a development of events is unlikely.

So, the single European currency will definitely be affected by the results of the FOMC meeting and it will stand still until the end of the day. And after the meeting, it will most likely remain around the level of 1.1850. If Jerome Powell announces that interest rates will remain at current levels for several years, then the Euro could rise to 1.1950. But if there are hints of a possible increase in interest rates, we should expect it to fall to 1.1800. After all, it will only be about intentions, not specific actions.

The situation is a little more interesting with the pound, since a lot depends on the process of agreeing on the law on the protection of the UK internal market, which is likely to gradually push the pound towards 1.2925. However, FOMC meeting may also affect it, but only in the case of the implementation of the least likely scenarios. So if it is announced that interest rates will remain at current levels until 2023, then the pound could rise to 1.3000. If investors receive a signal about a possible revision of the Fed's monetary policy, towards tightening, the pound will decline to 1.2800.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română