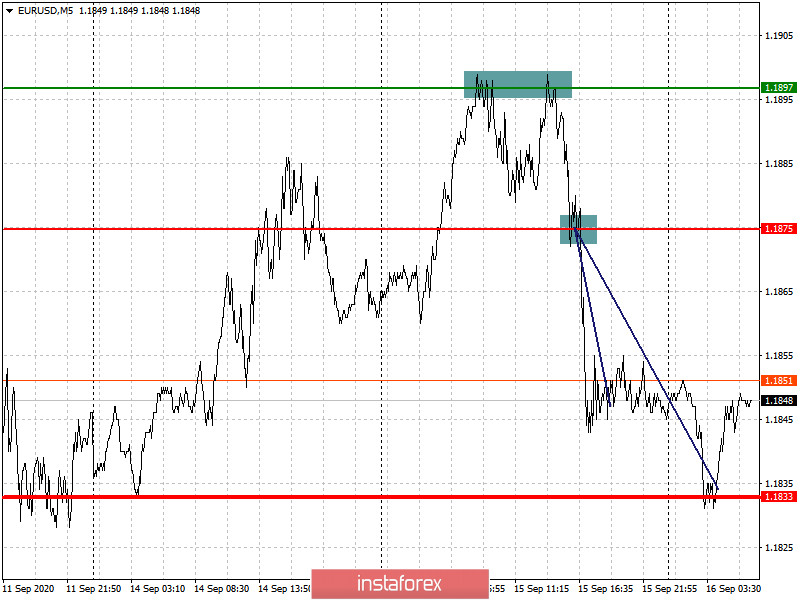

Trading recommendations for EUR / USD on September 16

Analysis of transactions

Bulls failed to raise the rate of euro from 1.1897, as a result of which price reversed and moved down quite decently from 1.1875. The movement was more than 30 points and gave good profit to short positions in the market.

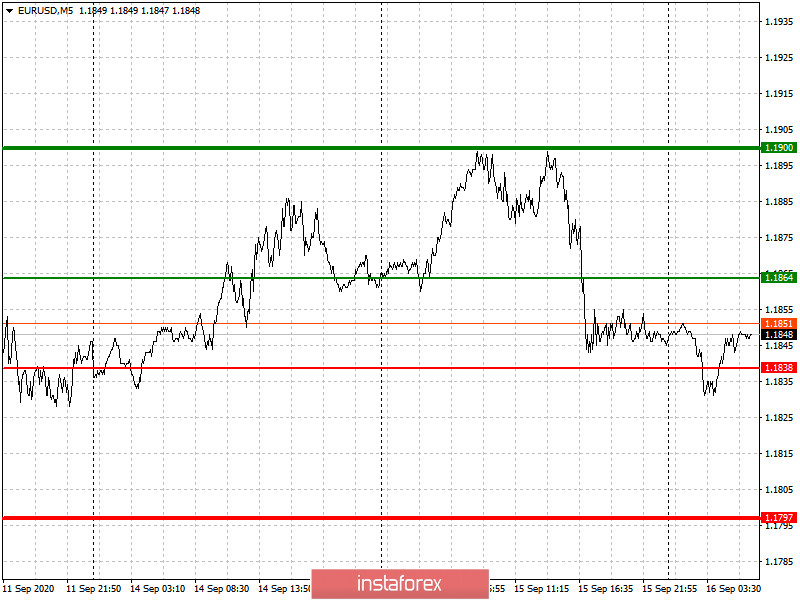

A good deal of important statistics are due for release today, among which is data on the foreign trade balance of the euro area. However, the most significant event is the upcoming US Fed meeting, during which the regulator will announce its decision on interest rates. In such a case, it is best not to trade haphazardly, so wait instead for the final decisions before opening any position in the market. To those willing to take risks, you may follow the strategy below:

- Set long positions from 1.1864 (green line on the chart), and take profit around the level of 1.1900. Any effect of good indicators in the euro zone will be short-lived due to the Fed meeting.

- Sell shorts from 1.1838 (red line on the chart) to 1.1797. A decline will take place on the grounds of strong economic forecasts by the Federal Reserve.

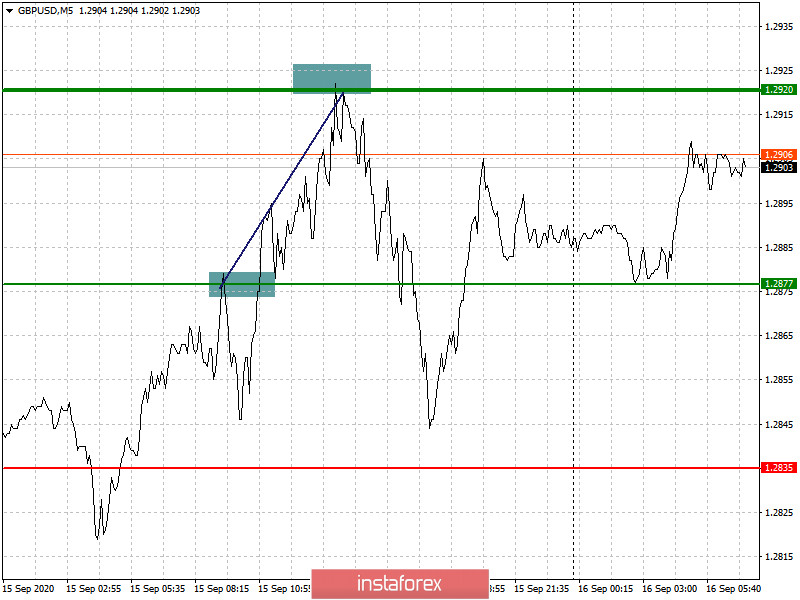

Trading recommendations for GBP / USD on September 16

Analysis of transactions

The pound saw quite large movements from 1.2877, which gave long positions decent profit of more than 40 points.

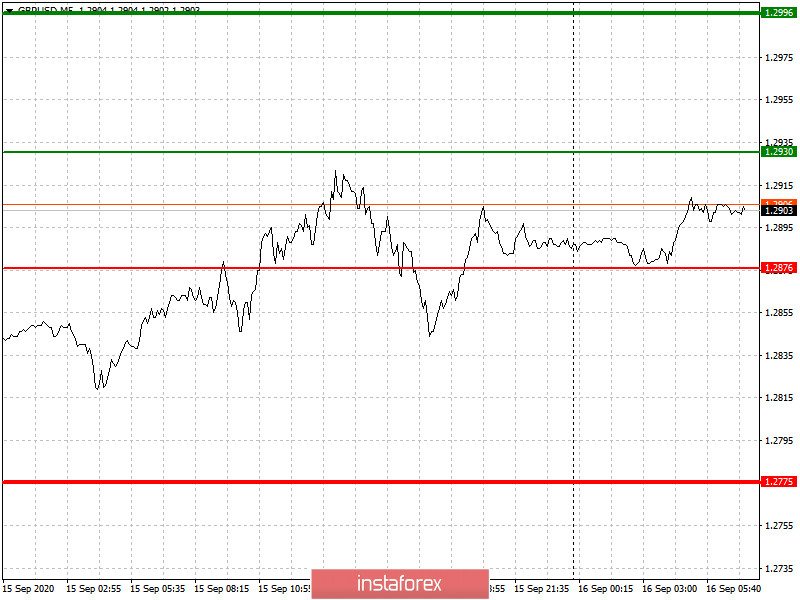

Latest report on UK inflation is scheduled to come out today, the data of which, if turns out better than the forecasts, will result in a new wave of growth in the pound. But if the indicators disappoint, it is better to take a closer look at short positions, especially before the Fed meeting.

- Open long positions from 1.2930 (green line on the chart), and take profit at the level of 1.2996 (thicker green line on the chart). However, GBP/USD will only rise if data on inflation comes out better than forecasts.

- Set short positions from 1.2876 (red line on the chart) to 1.2775, as it is best to sell the pound and trade along the trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română