Outlook on September 15:

Analytical overview of currency pairs on the H1 scale:

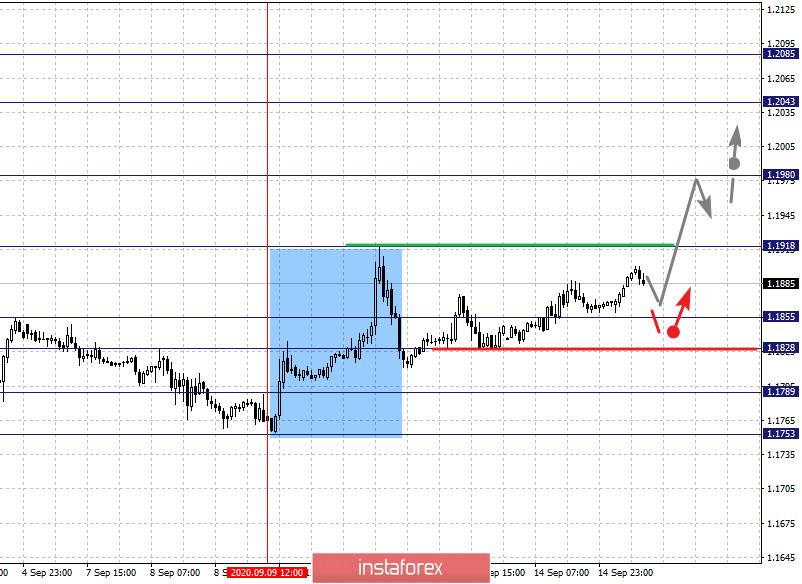

The key levels for the euro/dollar pair on the H1 chart are 1.2085, 1.2043, 1.1980, 1.1918, 1.1855, 1.1828, 1.1789 and 1.1753.We are following the formation of the upward structure from September 9 here. Now, the breakdown of the level 1.1918 should be accompanied by a strong upward movement. The target is 1.1980, and there is consolidation near this level. If the target breaks down, it will lead to a strong upward movement. Here, the target is 1.2043. We consider the level of 1.2085 as a potential value for the top. Upon reaching which, we expect a correction.

A short-term downward movement is possible in the range of 1.1855 - 1.1828. If the last value breaks down, it will lead to a deep correction. The target is 1.1789, which is the key support for the top.

The main trend is the formation of an upward structure from September 9

Trading recommendations:

Buy: 1.1919 Take profit: 1.1980

Buy: 1.1982 Take profit: 1.2041

Sell: 1.1855 Take profit: 1.1828

Sell: 1.1826 Take profit: 1.1790

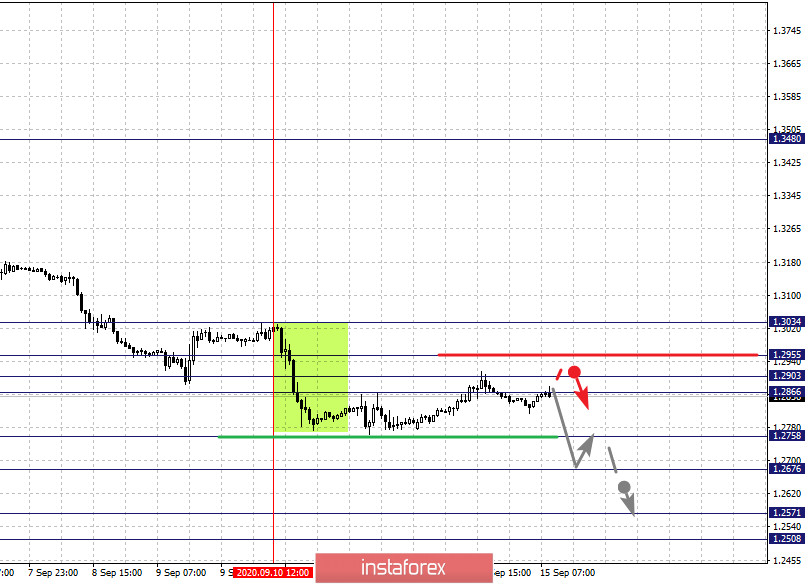

The key levels for the pound/dollar pair are 1.3034, 1.2955, 1.2903, 1.2866, 1.2758, 1.2676, 1.2571 and 1.2508. Here, we are following the local descending structure from September 10th. Here, a short-term downward movement is expected in the range of 1.2758 - 1.2676. If the last value breaks down, it will lead to a strong movement. The target here is 1.2571. For the potential value for the bottom, we consider the level of 1.2508. Upon reaching which, we expect consolidation and an upward pullback.

A short-term upward movement is expected in the range of 1.2866 - 1.2903. If the last value breaks down, it will lead to a deep correction. The target is 1.2955, which is a key support for the bottom and the price passing this level will encourage the development of an upward structure. In this case, the potential target is 1.3034.

The main trend is the local descending structure of September 10

Trading recommendations:

Buy: 1.2903 Take profit: 1.2953

Buy: 1.2957 Take profit: 1.3034

Sell: 1.2758 Take profit: 1.2678

Sell: 1.2674 Take profit: 1.2571

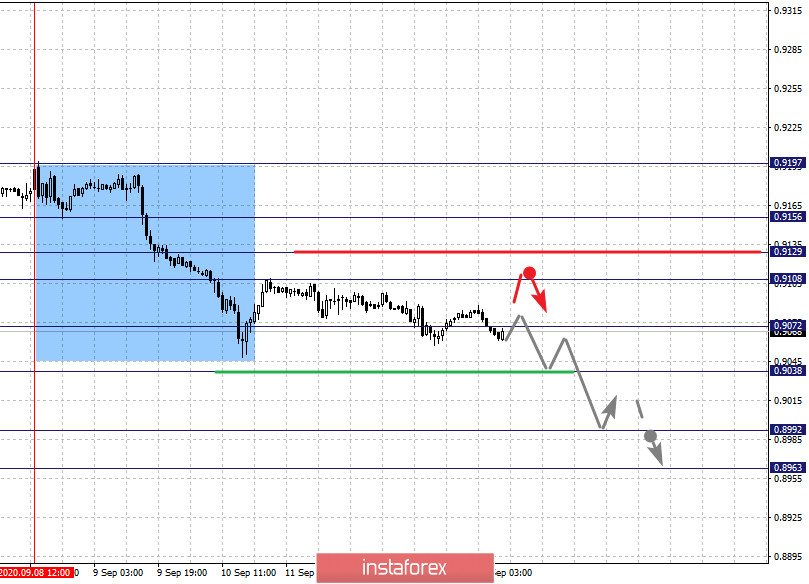

The key levels for the dollar/franc pair are 0.9156, 0.9129, 0.9108, 0.9072, 0.9038, 0.8992 and 0.8963. Here, we are following the medium-term downward trend from September 8th. The decline is expected to continue after the breakdown of the level of 0.9072. In this case, the target is 0.9038. There is consolidation near this level. The breakdown of the level of 0.9038 will lead to a strong downward movement. The target is 0.8992. For the potential value for the bottom, we consider the level of 0.8963. Upon reaching which, we expect a pullback into the correction.

A short-term upward movement is possible in the range of 0.9108 - 0.9129. If the last value breaks down, a deep correction will emerge. Here, the potential target is 0.9156, which is the key support for the downward structure.

The main trend is the medium-term descending structure of September 8

Trading recommendations:

Buy : 0.9108 Take profit: 0.9127

Buy : 0.9131 Take profit: 0.9155

Sell: 0.9070 Take profit: 0.9040

Sell: 0.9036 Take profit: 0.8992

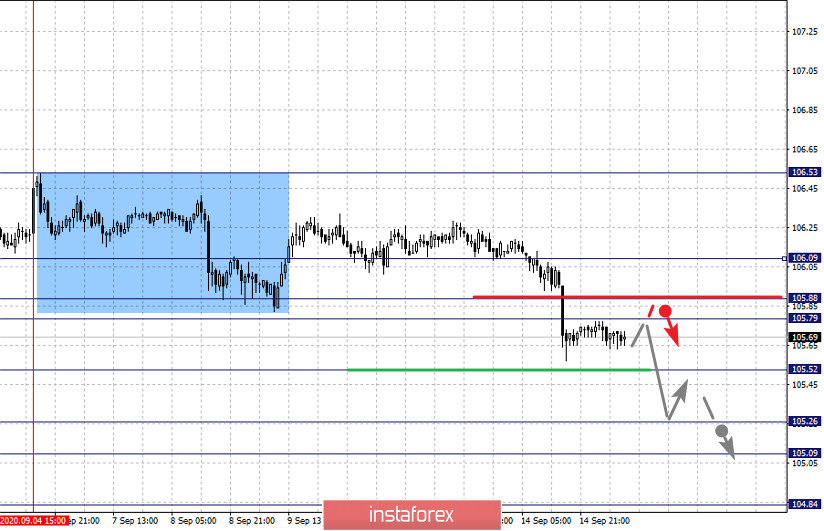

The key levels for the dollar yen are 106.09, 105.88, 105.79, 105.52, 105.26, 105.09 and 104.84. We consider the descending structure of September 4 as the main trend. Here, the downward movement is expected to continue after the breakdown of 105.52. In this case, the target is 105.26. On the other hand, there is a short-term downward movement and consolidation in the range of 105.26 - 105.09. For the potential value for the bottom, we consider the level 104.84. Upon reaching which, we expect a downward pullback.

A short-term upward movement is possible in the range of 105.79 - 105.88. If the last value breaks down, it will lead to a deep correction. Here, the target is 106.09, which is the key support for the downward structure.

The main trend is the descending structure from September 4.

Trading recommendations:

Buy: 105.80 Take profit: 105.88

Buy : 105.90 Take profit: 106.07

Sell: 105.50 Take profit: 105.26

Sell: 105.24 Take profit: 105.09

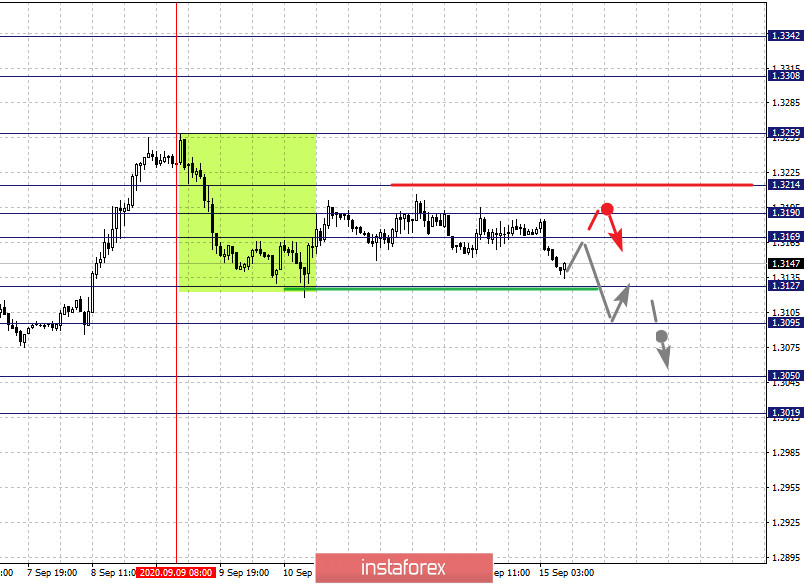

The key levels for the USD/CAD pair are 1.3342, 1.3308, 1.3259, 1.3214, 1.3190, 1.3169, 1.3127, 1.3095, 1.3050 and 1.3019. We are following the development of the upward cycle from September 1. At the moment, the price is in correction and forms a potential for the low from September 9. Meanwhile, a short-term downward movement is expected in the range of 1.3127 - 1.3095. If the last value breaks down, it will lead to a strong downward movement. Here, the target is 1.3050. We consider the level of 1.3019 as a potential value for the bottom; Upon reaching this level, we expect an upward pullback.

Meanwhile, a short-term upward movement is possible in the range of 1.3169 - 1.3190. If the last value breaks down, it will lead to a deep correction. Here, the target is 1.3214, which is a key support for the downward structure from September 9 and its breakdown will lead to the following development of an upward trend. In this case, the first potential target is 1.3259.

The main trend is the upward cycle from September 1, the correction stage

Trading recommendations:

Buy: 1.3190 Take profit: 1.3214

Buy : 1.3216 Take profit: 1.3259

Sell: 1.3127 Take profit: 1.3097

Sell: 1.3093 Take profit: 1.3050

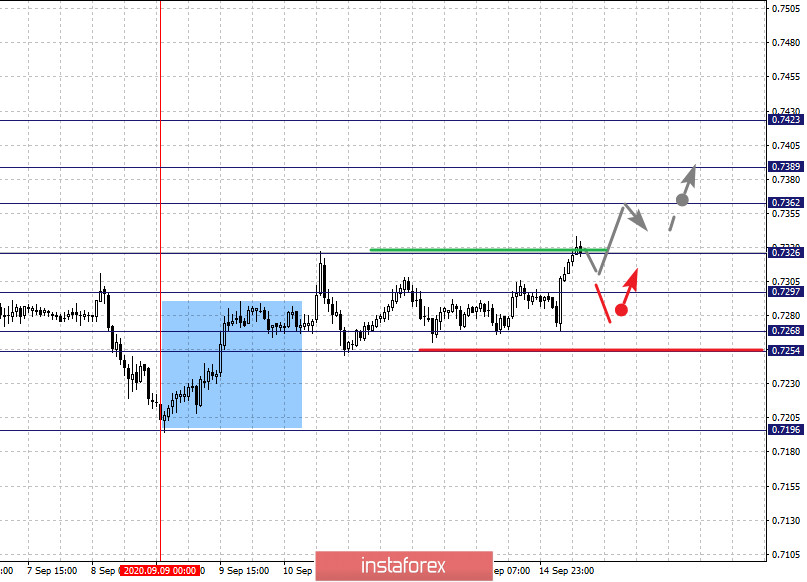

The key levels for the AUD/USD pair are 0.7423, 0.7389, 0.7362, 0.7326, 0.7297, 0.7268, 0.7254 and 0.7196. Here, we are following the upward cycle of September 9th. The growth is expected to continue after the breakdown of the level of 0.7326. In this case, the target is 0.7362. There is a short-term upward movement and consolidation in the range of 0.7362 - 0.7389. On the other hand, we consider the level of 0.7423 as a potential value for the top. Upon reaching which, we expect consolidation and a downward pullback.

Leaving into correction is expected after the breakdown of the level of 0.7297. In this case, the target is 0.7268. The range of 0.7268 - 0.7254 is the key support for the upward structure and the price passing this level will encourage the development of a downward trend. In this case, the potential target is 0.7196.

The main trend is the upward structure from September 9

Trading recommendations:

Buy: 0.7328 Take profit: 0.7360

Buy: 0.7363 Take profit: 0.7387

Sell : 0.7295 Take profit : 0.7268

Sell: 0.7252 Take profit: 0.7200

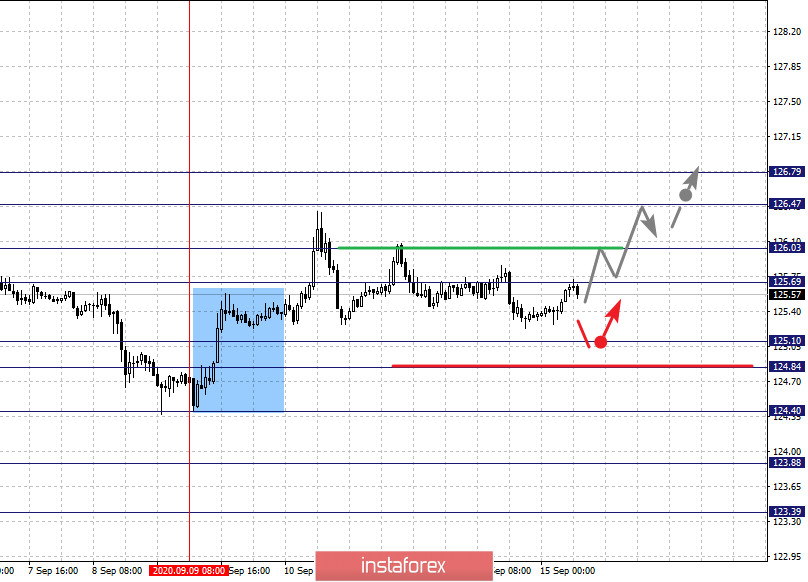

The key levels for the euro/yen pair are 126.79, 126.47, 126.03, 125.69, 125.10, 124.84, 124.40, 123.88 and 123.39. We are following the formation of the upward structure on September 9. Meanwhile, a short-term upward movement is expected in the range of 125.69 - 126.03. If the last value breaks down, it will lead to a strong movement. Here, the target is 126.47. We consider the level of 126.79 as a potential value for the top. Upon reaching which, we expect consolidation and a downward pullback.

A short-term downward movement is expected in the range of 125.10 - 124.84. The breakdown of the last value will be conducive to the following development of a downward trend. In this case, the first target is 124.40. The breakdown of which, in turn, should be accompanied by a strong movement towards the potential target - 123.88.

The main trend is the formation of potential for the top from September 9

Trading recommendations:

Buy: 125.70 Take profit: 126.00

Buy: 126.05 Take profit: 126.47

Sell: 125.10 Take profit: 124.85

Sell: 124.82 Take profit: 124.40

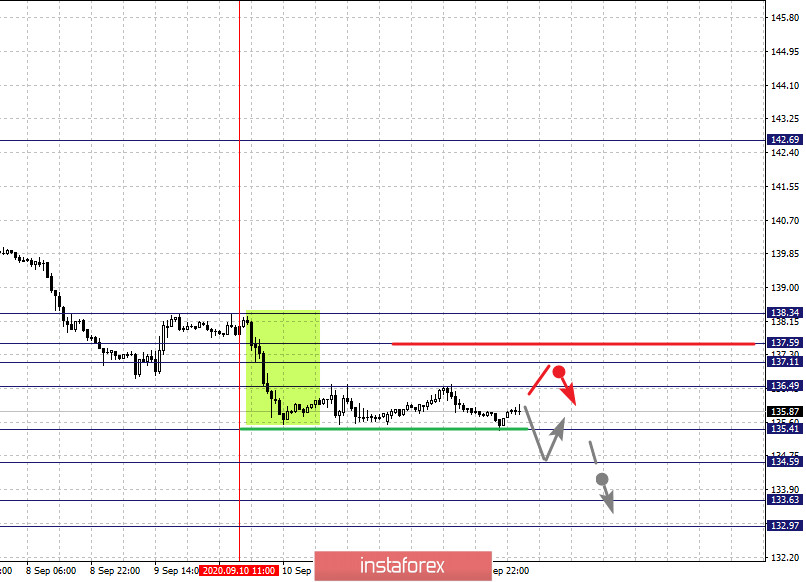

The key levels for the pound/yen pair are 138.34, 137.59, 137.11, 136.49, 135.41, 134.59, 133.63 and 132.97. We are following the local descending structure from September 10 here. Now, a short-term downward movement is expected in the range of 135.41 - 134.59. If the last value breaks down, it will lead to a strong movement. Here, the target is 133.63. For the potential value for the bottom, we consider the level of 132.97. Upon reaching which, we expect consolidation and upward pullback.

A short-term upward movement is expected in the range of 136.49 - 137.11. The range of 137.11 - 137.59 is the key support for the downward structure and the price passing this level will encourage the formation of initial conditions for the top. Here, the potential target is 138.34.

The main trend is the local descending structure of September 10

Trading recommendations:

Buy: 136.50 Take profit: 137.10

Buy: 137.60 Take profit: 138.34

Sell: 135.40 Take profit: 134.60

Sell: 134.55 Take profit: 133.65

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română