Latest COT report (Commitments of Traders). Weekly outlook for GBP/USD

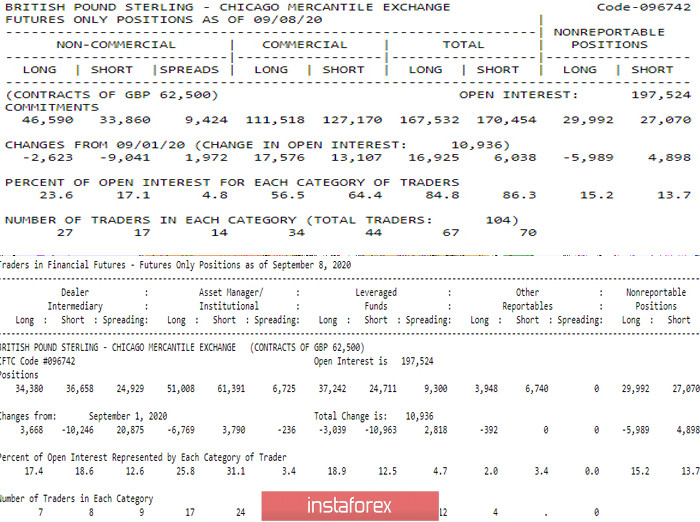

According to the COT report, open interest in the pound rose to 197524 (+10936). The latest report focuses on the sequence of reallocations. So, for example, the net total position of the general report declined (p.p. 2922 (-10887)), but at the same time, there was an active growth in investments (long +16925 - short +6038), the net short position of the Commercial group (p.p. 15652 (-4469)), but a similar result is also provided by active investment with an advantage in the non-dominant direction (long +17576 - short +13107). Meanwhile, the Dealer Intermediary group distinguished itself by having 17.4% of long positions and 18.6% of short positions from the total number of its representatives are in thought and uncertainty and have both long and short positions (12.6%). This is not just a high indicator, it is an order of magnitude higher than in previous reporting periods (0,3 – 1,6 – 1,6 – 2,1 – 2,2 – 12,6).

The main conclusion

Players on the downside received their expected bonus in the form of a large-scale effective reduction. Thus, now may be the time to slow down and take a break for a while.

Technical picture

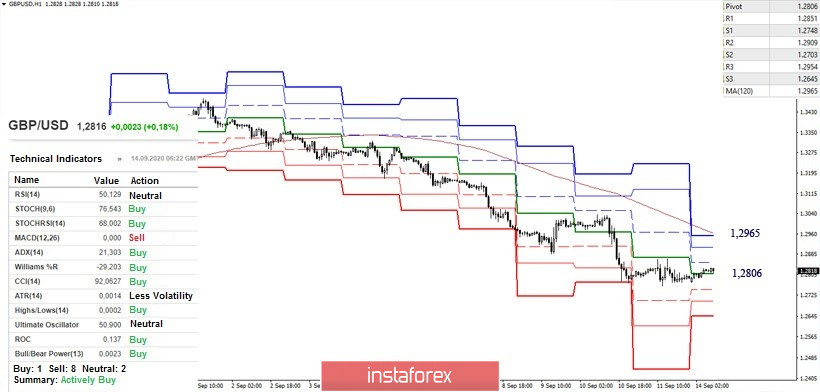

On the chart, you can see that the pair declined into the zone of influence of support levels, which are now joining forces around 1.27 (monthly Fibo Kijun + weekly Fibo Kijun + lower border of the daily cloud). A consolidation below will not only serve to strengthen the bears, opening the way to the already existing benchmarks, but will also form a new one - for example, a downward target for the breakdown of the daily Ichimoku cloud. The strength of the supports can now contribute to decline, consolidation, or even lead to a daily upward correction. Here, the nearest resistances in the current situation are the levels 1.29 (the upper border of the daily cloud) and 1.30 (weekly short-term trend), passed the day before.

In the lower halves, the pair is in the upward correction zone. The upward traders are making efforts to consolidate above the central pivot level (1.2806), besides, the analyzed technical indicators tuned in to their support. The next most important reference point for the development of an upward correction is the weekly long-term trend (1.2965), while nearest resistances can be noted today at 1.2851 (R1) - 1.2909 (R2). The resumption of the downward trend (1.2762) will return the relevance to the supports of the classic pivot levels, which are located today at 1.2748 - 1.2703 - 1.2645.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română