Nervousness in the global financial markets caused by a number of negative factors that were broadcast from the USA and Europe contribute to increasing turmoil.

What happened?

The tensions between the EU and the UK over Brexit caused the pound to fall amid growing concern that London will finally leave the EU without any agreements after the end of the transition period by the end of this year. In this case, the EU will be forced to start trade relations based on the WTO rules, which include duties and all kinds of other restrictions and rules. Yesterday's events showed how much the pound is a weak link in this situation. Given the likely change of government in Britain, which the media have already mentioned earlier, we believe that no final agreements between the European Union and London will be reached by the end of the year. This means that the pound will continue to be under pressure and further decline both against the dollar and a single currency.

Yesterday, the ECB announced the results of its two-day meeting on monetary policy. As expected, the regulator left all parameters of monetary policy unchanged, but ECB President, C. Lagarde actually made it clear in her speech that the bank does not care about euro's strengthening. We expect that this approach can be maintained until the end of this year. But in this situation, the euro may still continue to receive general support against the background of some local corrective pullbacks, even despite the start of turmoil in the markets.

Today, the market will focus on the publication of data on consumer inflation in the United States. The CPI is expected to rise by 1.2% in annual terms. But in monthly terms, it is forecasted to decline to 0.3% in August against 0.6% in July. On the other hand, the core CPI should maintain a 1.6% yoy growth rate, but it is expected to fall from 0.6% in July to 0.2% in August.

We believe that if the data turn out to be worse than expected, this could push the dollar to decline, which is likely to be limited if the US stock market continues to decline. At the same time, better indicator values can support the dollar rate, but only locally.

Forecast of the day:

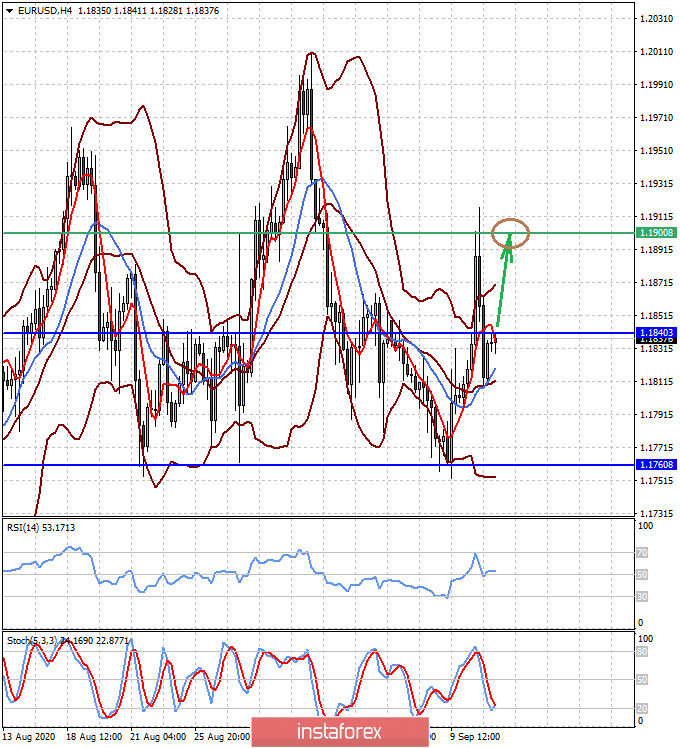

After yesterday's quite volatile trading session amid markets' falling risk appetite, the EUR/USD pair may resume growth, as it has a wide potential for growth following the ECB meeting on monetary policy. Thus, we believe that the pair should be bought after it rises above the level of 1.1840 and continue to further rise to 1.1900.

The GBP/USD pair found support at the level of 1.2800. We expect the decline to continue after a possible upward pullback. Moreover, selling the pair can be considered on the rise, around the level of 1.2855, or on its decline below the level of 1.2800 with local target levels of 1.2650.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română